Reassessing First Industrial Realty Trust (FR) Valuation After Land & Buildings’ Activist Campaign

First Industrial Realty Trust (FR) is back in the spotlight after activist investor Land and Buildings went public with criticism of the REIT’s valuation, urging asset sales and even a strategic alternatives review.

See our latest analysis for First Industrial Realty Trust.

The activist noise is landing on a stock that already had the wind at its back, with a roughly 18 percent year to date share price return and a 5 year total shareholder return north of 60 percent, suggesting momentum is building as investors reassess the risk reward around logistics real estate.

If this activism has you rethinking where the next opportunity might come from, it could be worth exploring fast growing stocks with high insider ownership for more ideas beyond industrial REITs.

With shares now hovering near analyst targets but activists insisting on a sizable discount to net asset value, is First Industrial still quietly undervalued, or is the market already baking in the next leg of growth?

Most Popular Narrative: 2.2% Undervalued

With First Industrial Realty Trust last closing at $58.19 against a narrative fair value of $59.50, the valuation hinges on a finely balanced growth and multiple story.

The analysts have a consensus price target of $56.333 for First Industrial Realty Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $64.0, and the most bearish reporting a price target of $52.0.

Want to see how modest revenue growth, slimmer margins and a richer future earnings multiple could still add up to upside? The narrative spells out the full math.

Result: Fair Value of $59.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained double digit rent growth or persistently tight supply could keep occupancy and cash flows stronger than modeled, which would challenge the cautious fair value case.

Find out about the key risks to this First Industrial Realty Trust narrative.

Another Angle on Valuation

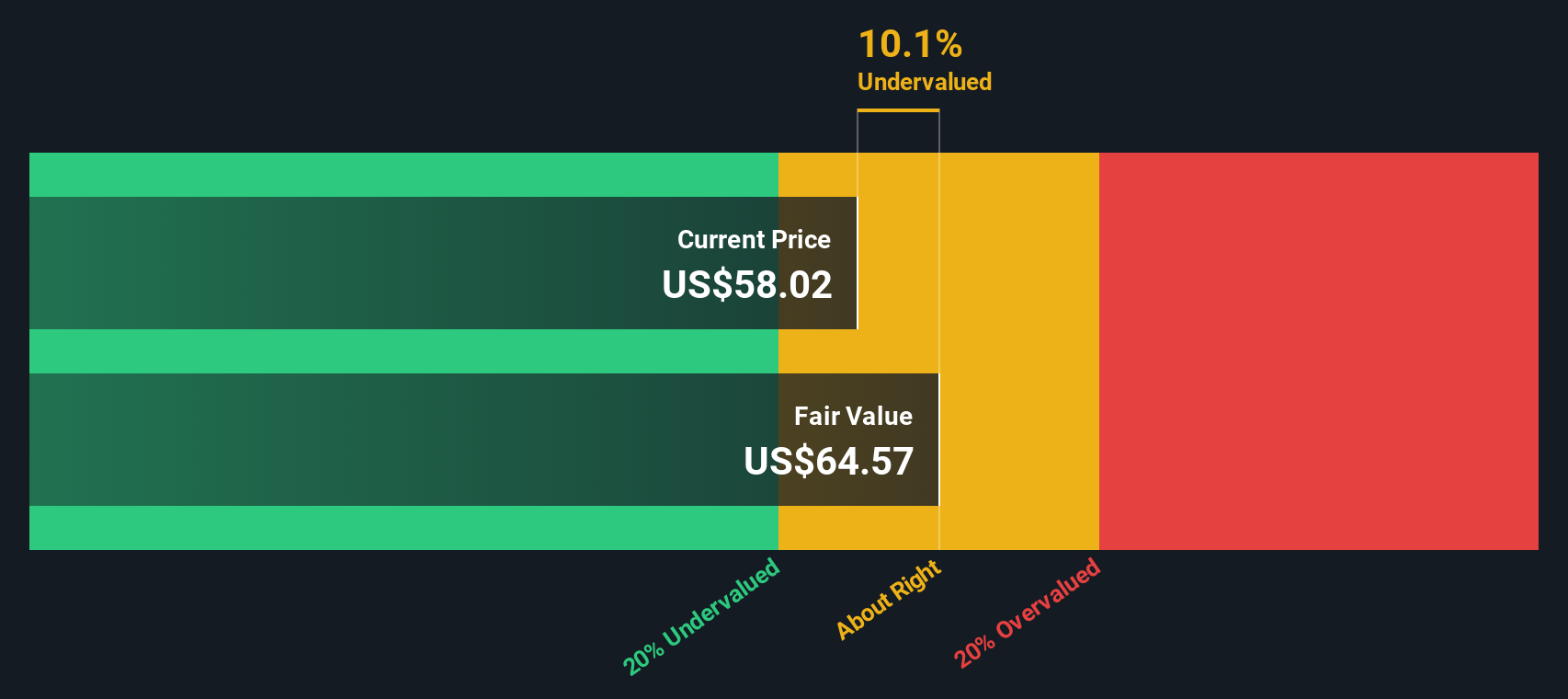

While the narrative fair value suggests only a 2.2 percent upside, the SWS DCF model is more optimistic, putting fair value at about $64.58, roughly 10 percent above the current $58.19 share price. Is the market underestimating long term cash flows, or is the model too generous?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own First Industrial Realty Trust Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom narrative in minutes: Do it your way.

A great starting point for your First Industrial Realty Trust research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one promising REIT when the market is full of opportunities. Use the Simply Wall Street Screener to pinpoint your next smart move today.

- Capture potential breakout names by scanning these 3612 penny stocks with strong financials that pair tiny market caps with financial profiles and momentum.

- Position yourself for the next wave of innovation by targeting these 26 AI penny stocks where intelligent automation and data advantages may enhance long term growth.

- Focus on these 13 dividend stocks with yields > 3% that combine attractive yields with payout ratios and cash generation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報