TSX Penny Stocks To Watch In December 2025

The Canadian market has shown resilience, with equities reaching new highs following dovish signals from the Bank of Canada and supportive measures by the Federal Reserve. In this context, penny stocks—though a term from past eras—remain relevant for investors seeking affordable entry points into potentially high-growth companies. These smaller or newer firms can offer significant opportunities when they demonstrate financial strength, and we'll explore three such stocks that stand out in today's market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.16 | CA$54.6M | ✅ 3 ⚠️ 3 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.11 | CA$21.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.46 | CA$261.8M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.27 | CA$128.01M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.415 | CA$3.47M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.335 | CA$50.32M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.29 | CA$858.23M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.08 | CA$156.23M | ✅ 2 ⚠️ 1 View Analysis > |

| Caldwell Partners International (TSX:CWL) | CA$1.04 | CA$31.52M | ✅ 1 ⚠️ 4 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.02 | CA$191.15M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 390 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

GoldMining (TSX:GOLD)

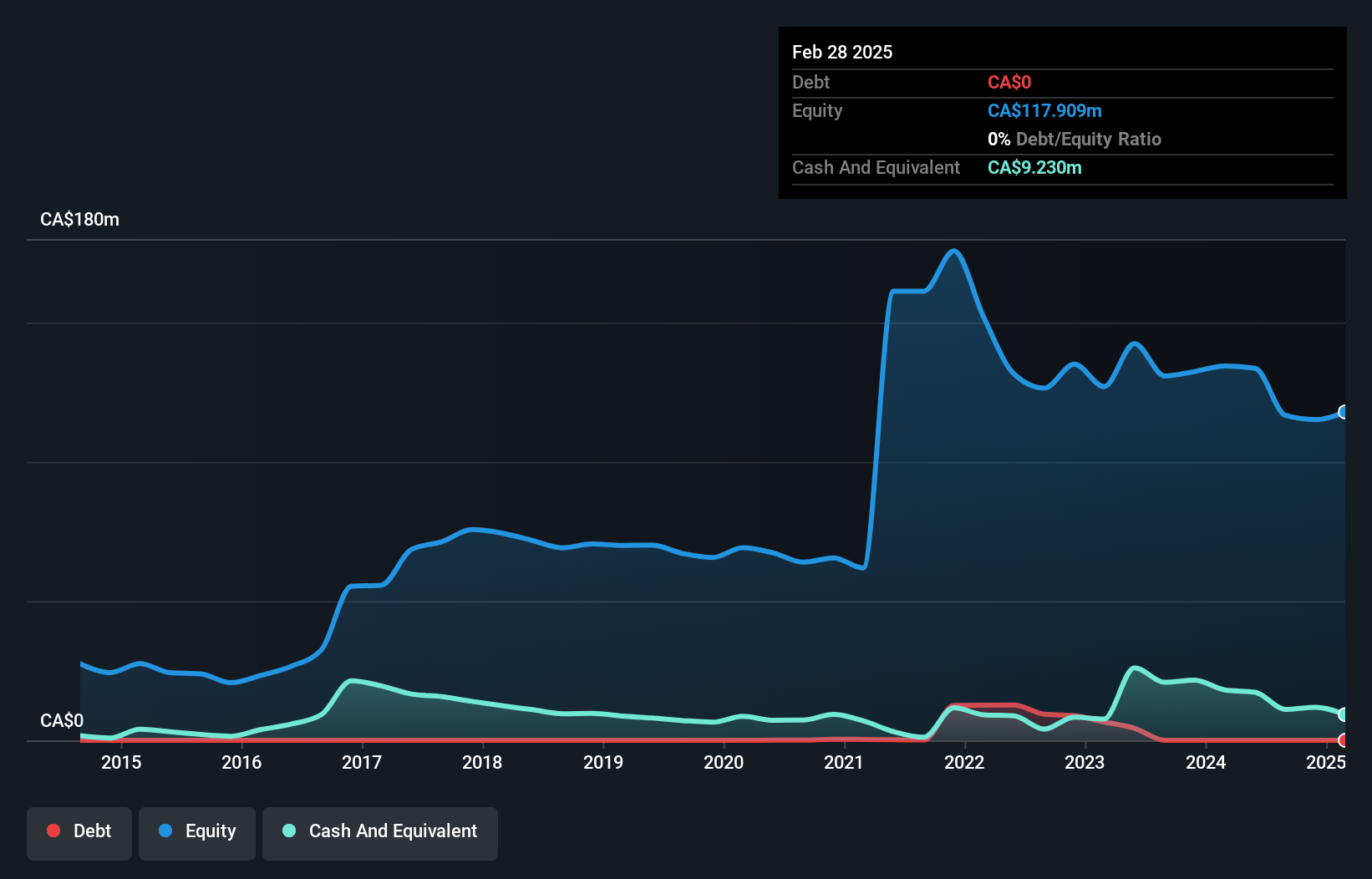

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoldMining Inc. is a mineral exploration company focused on acquiring, exploring, and developing gold and copper assets in the Americas, with a market cap of CA$400.68 million.

Operations: GoldMining Inc. does not report any revenue segments.

Market Cap: CA$400.68M

GoldMining Inc., with a market cap of CA$400.68 million, remains pre-revenue and debt-free, focusing on gold and copper exploration in the Americas. Despite stable weekly volatility, the company faces challenges with negative return on equity and increased losses over five years. Recent strategic moves include raising US$17.76 million through follow-on equity offerings to bolster its cash runway beyond four months. The renewal of exploration claims in Brazil's Colider Project highlights potential growth avenues, while ongoing drilling programs at SJ Jorge Project indicate promising new gold discoveries that could enhance future prospects despite current financial constraints.

- Jump into the full analysis health report here for a deeper understanding of GoldMining.

- Examine GoldMining's earnings growth report to understand how analysts expect it to perform.

Golconda Gold (TSXV:GG)

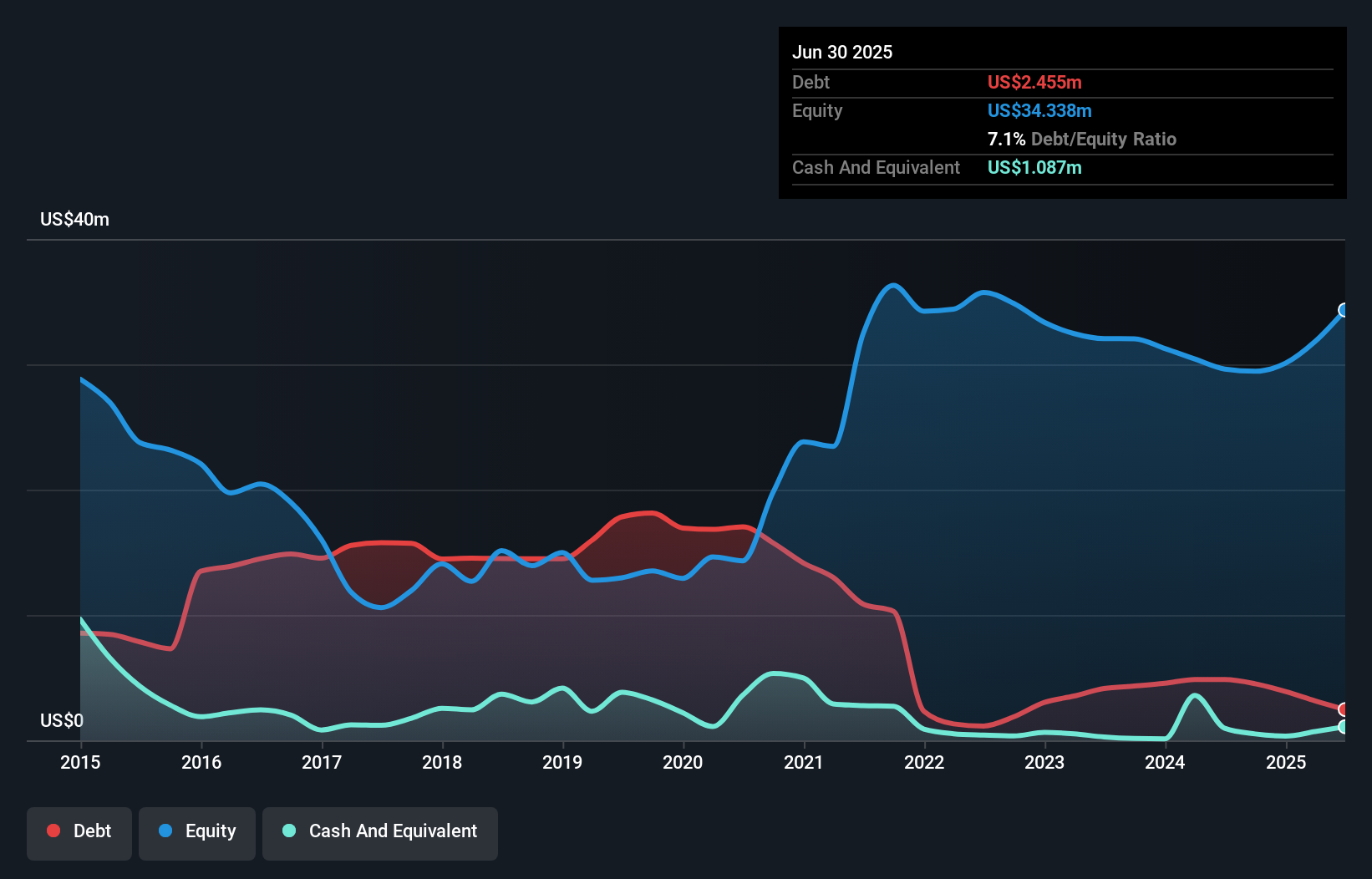

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Golconda Gold Ltd. explores, develops, and operates gold mining properties in Canada, the United States, and South Africa with a market cap of CA$146.37 million.

Operations: The company's revenue is derived from the exploration, development, and operation of gold mining properties, amounting to $27.49 million.

Market Cap: CA$146.37M

Golconda Gold Ltd. has recently achieved profitability, reporting a net income of US$2.79 million for the third quarter of 2025, a significant turnaround from a loss in the previous year. The company’s revenue for the same period was US$8.95 million, more than doubling from last year’s figures, indicating strong sales growth. Despite experiencing some insider selling over the past three months and having short-term assets that do not cover liabilities, Golconda maintains robust financial health with its debt well covered by operating cash flow and interest payments comfortably managed by EBIT at 8.2 times coverage.

- Click to explore a detailed breakdown of our findings in Golconda Gold's financial health report.

- Evaluate Golconda Gold's historical performance by accessing our past performance report.

Silver One Resources (TSXV:SVE)

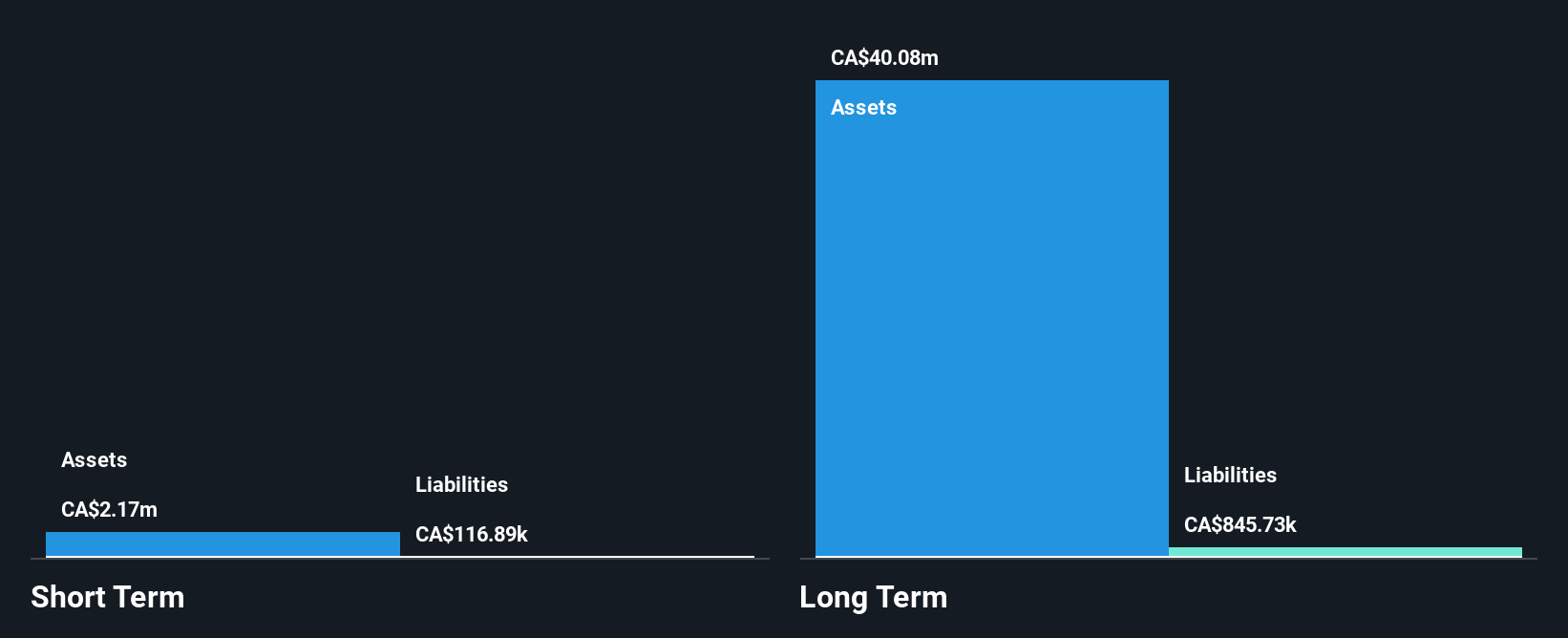

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Silver One Resources Inc. focuses on the acquisition, exploration, and development of mineral properties in the United States with a market cap of CA$142.41 million.

Operations: Silver One Resources Inc. currently does not report any revenue segments.

Market Cap: CA$142.41M

Silver One Resources Inc. is a pre-revenue company focused on advancing its Candelaria project in Nevada and exploring the Phoenix Silver project in Arizona. Recent updates highlight the company's progress towards a Pre-Feasibility Study at Candelaria, with significant silver resources identified and further drilling planned to enhance resource classification. Despite being unprofitable, Silver One has reduced losses by 5.6% annually over five years and maintains financial stability with no debt and sufficient cash runway for over a year. The seasoned management team continues to drive exploration efforts amidst challenging weather conditions affecting fieldwork timelines.

- Dive into the specifics of Silver One Resources here with our thorough balance sheet health report.

- Explore historical data to track Silver One Resources' performance over time in our past results report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 390 TSX Penny Stocks here.

- Interested In Other Possibilities? We've found 13 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報