AvePoint Leads These 3 High Growth Stocks Backed By Insiders

As the United States market grapples with volatility, particularly in the tech sector due to AI bubble concerns, investors are increasingly seeking stability through high insider ownership in growth companies. In this environment, stocks like AvePoint stand out as they offer a unique blend of growth potential and insider confidence, which can be appealing amidst broader market uncertainties.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.2% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 29.2% | 114.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Karman Holdings (KRMN) | 17.3% | 78.5% |

| Credo Technology Group Holding (CRDO) | 10.4% | 30.7% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.7% | 29.0% |

| AppLovin (APP) | 27.4% | 27.1% |

Here's a peek at a few of the choices from the screener.

AvePoint (AVPT)

Simply Wall St Growth Rating: ★★★★☆☆

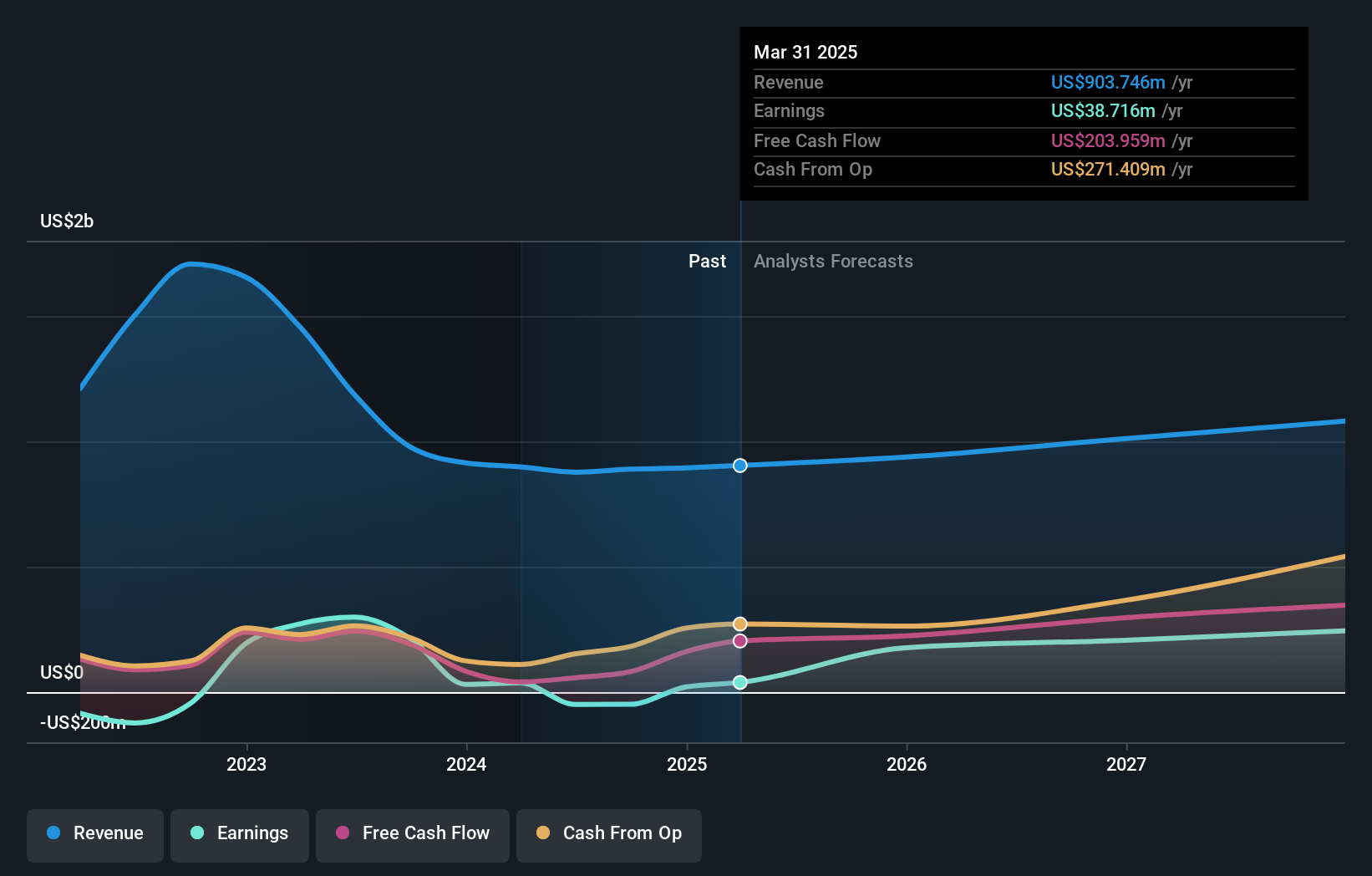

Overview: AvePoint, Inc. offers a cloud-native data management software platform across various regions including North America, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of approximately $2.99 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated $394 million.

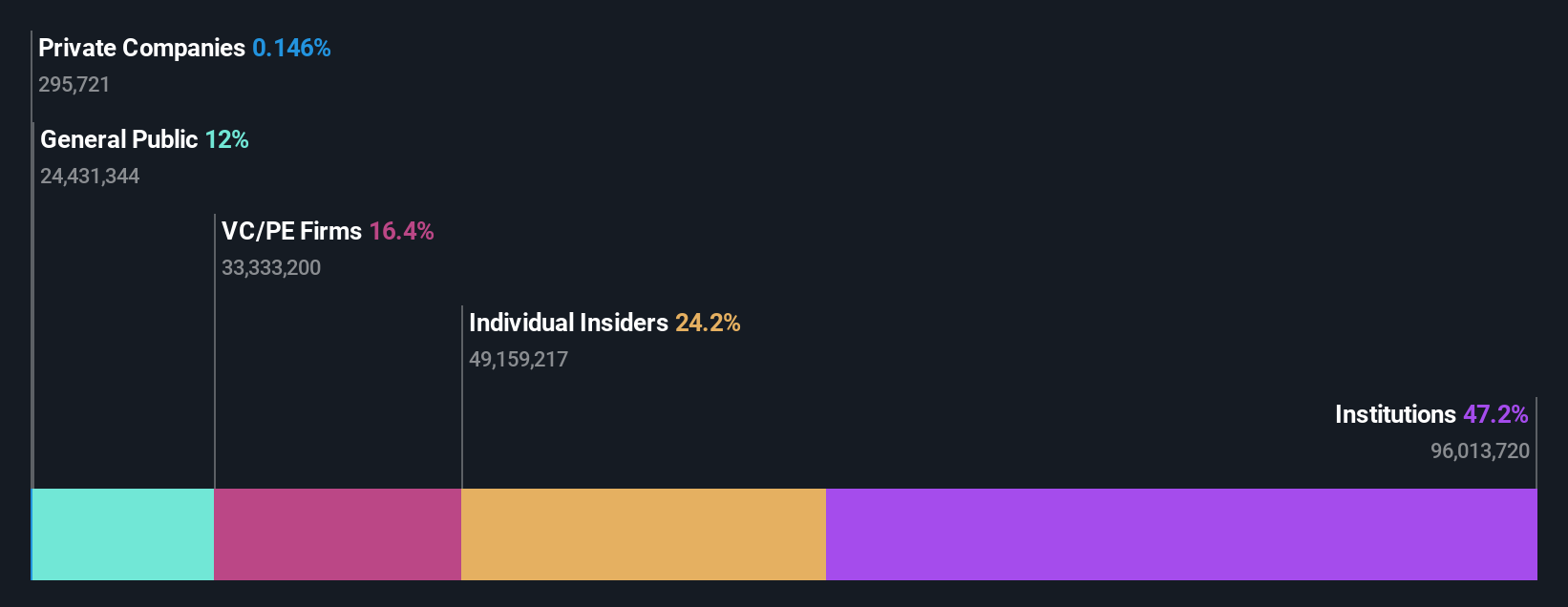

Insider Ownership: 27.6%

AvePoint's growth trajectory is underscored by its recent profitability and significant projected earnings growth of over 70% annually. Despite substantial insider selling recently, the company trades below estimated fair value and has not diluted shares over the past year. Recent product launches, including AgentPulse for AI governance, enhance its competitive edge in addressing rising AI-related security risks. AvePoint's strategic partnerships and raised revenue guidance further solidify its position in a rapidly evolving market landscape.

- Unlock comprehensive insights into our analysis of AvePoint stock in this growth report.

- The valuation report we've compiled suggests that AvePoint's current price could be inflated.

CarGurus (CARG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CarGurus, Inc. operates an online automotive platform for buying and selling vehicles both in the United States and internationally, with a market cap of approximately $3.67 billion.

Operations: The company's revenue primarily comes from its U.S. Marketplace segment, generating $801.72 million, followed by the Digital Wholesale segment with $50.35 million.

Insider Ownership: 13.9%

CarGurus' growth outlook is supported by its recent profitability and expected annual earnings growth of 22.4%, outpacing the US market. Despite slower revenue growth projections, the launch of PriceVantage enhances its competitive position by leveraging substantial consumer demand data for pricing optimization. The company trades significantly below estimated fair value, with no substantial insider buying recently but more shares bought than sold over three months, indicating potential confidence in future performance.

- Click here to discover the nuances of CarGurus with our detailed analytical future growth report.

- The analysis detailed in our CarGurus valuation report hints at an inflated share price compared to its estimated value.

Warby Parker (WRBY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Warby Parker Inc. operates in the United States and Canada, offering eyewear products, with a market cap of approximately $3.35 billion.

Operations: The company's revenue primarily comes from its Holistic Vision Care segment, generating $850.58 million.

Insider Ownership: 15.8%

Warby Parker's growth trajectory is underscored by its recent profitability and projected annual earnings growth of 48.7%, surpassing the US market average. Despite a volatile share price, revenue is expected to grow faster than the market at 15.1%. The company reported Q3 sales of US$221.68 million, with net income turning positive at US$5.87 million from a loss last year. No significant insider trading activity was noted in recent months, indicating stability in insider sentiment.

- Dive into the specifics of Warby Parker here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Warby Parker's share price might be too optimistic.

Seize The Opportunity

- Click through to start exploring the rest of the 201 Fast Growing US Companies With High Insider Ownership now.

- Interested In Other Possibilities? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報