European Market's Hidden Gems: Acerinox Among 3 Stocks Estimated Below Fair Value

In recent weeks, the European market has experienced mixed performances across major indices, with Germany's DAX showing gains while France's CAC 40 and the UK's FTSE 100 faced slight declines. Amidst this fluctuating landscape and potential rate hikes by the European Central Bank, investors are increasingly on the lookout for stocks that may be trading below their intrinsic value, offering opportunities for those seeking to capitalize on undervalued assets in a complex economic environment.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimot (WSE:UNT) | PLN131.20 | PLN257.60 | 49.1% |

| Straumann Holding (SWX:STMN) | CHF95.28 | CHF187.83 | 49.3% |

| Sanoma Oyj (HLSE:SANOMA) | €9.19 | €18.35 | 49.9% |

| PVA TePla (XTRA:TPE) | €22.40 | €44.04 | 49.1% |

| Kitron (OB:KIT) | NOK68.00 | NOK134.76 | 49.5% |

| Inission (OM:INISS B) | SEK48.20 | SEK96.19 | 49.9% |

| Gentili Mosconi (BIT:GM) | €3.33 | €6.52 | 48.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.395 | €0.78 | 49.2% |

| Digital Workforce Services Oyj (HLSE:DWF) | €2.56 | €5.07 | 49.5% |

| Allcore (BIT:CORE) | €1.355 | €2.66 | 49% |

Here's a peek at a few of the choices from the screener.

Acerinox (BME:ACX)

Overview: Acerinox, S.A. is a company that manufactures, processes, and markets stainless steel products across various regions including Spain, the United States, Africa, Asia, and Europe with a market cap of approximately €2.99 billion.

Operations: The company's revenue is primarily derived from its Stainless Steel Business, which accounts for €4.17 billion, and High Performance Alloys, contributing €1.67 billion.

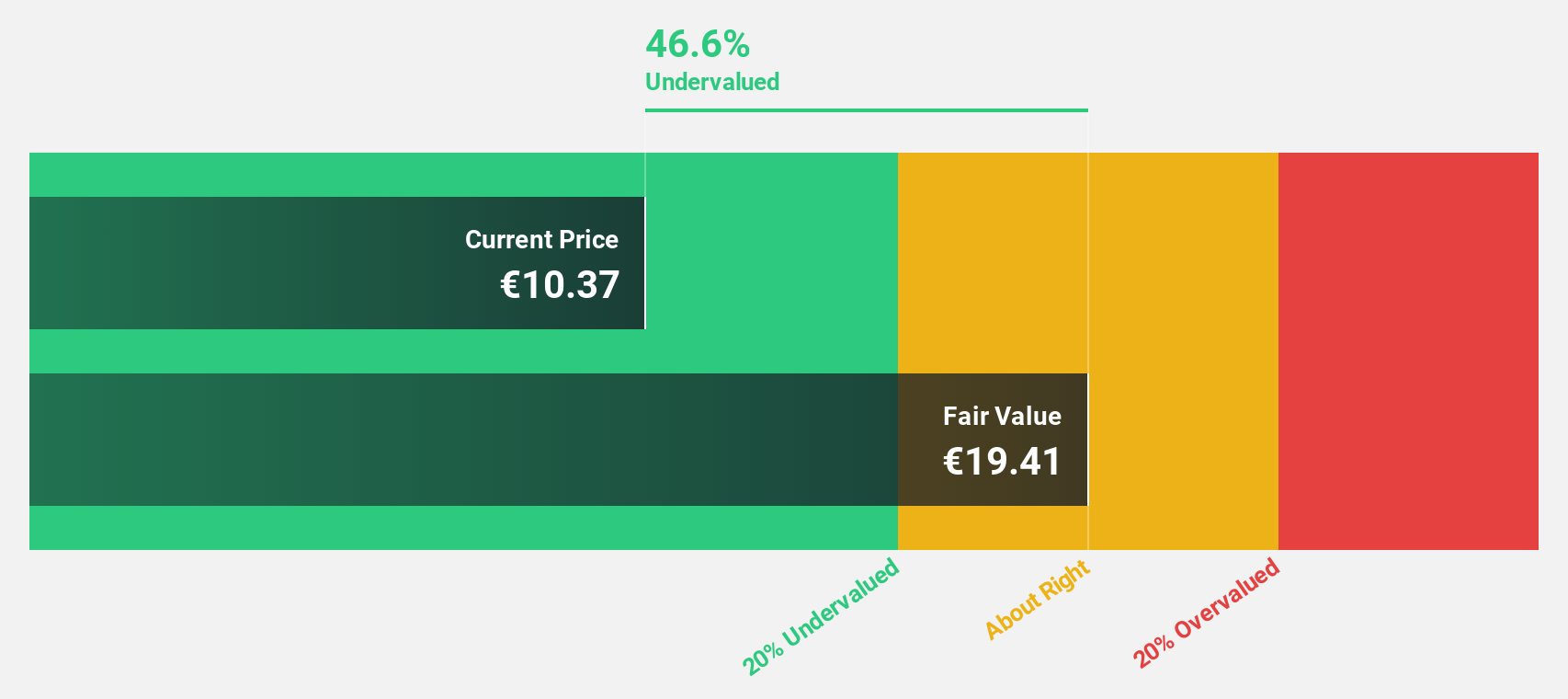

Estimated Discount To Fair Value: 30.3%

Acerinox is trading at a significant discount, 30.3% below its estimated fair value of €17.2, indicating potential undervaluation based on cash flows. Despite forecasted revenue growth of 8.9% annually surpassing the Spanish market's 4.7%, recent earnings have been impacted by large one-off items and are not well covered by free cash flows or earnings, raising sustainability concerns for its 5.18% dividend yield amidst weak interest coverage ratios.

- In light of our recent growth report, it seems possible that Acerinox's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Acerinox.

PostNL (ENXTAM:PNL)

Overview: PostNL N.V. offers postal and logistics services to businesses and consumers in the Netherlands, Europe, and internationally, with a market cap of €534.11 million.

Operations: The company's revenue is primarily derived from its Parcels segment at €2.41 billion and Mail in the Netherlands at €1.32 billion, with additional contributions from Post NL Other amounting to €247 million.

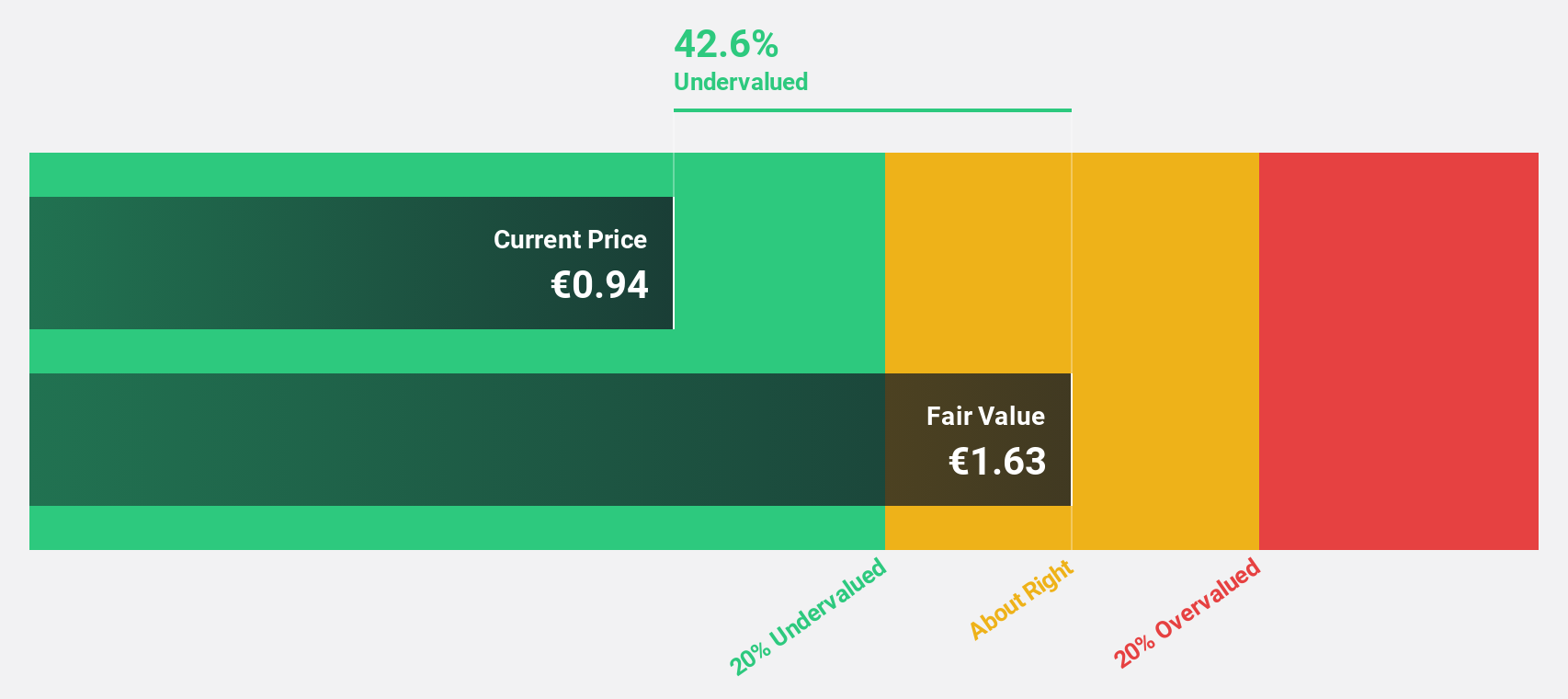

Estimated Discount To Fair Value: 32.9%

PostNL is trading 32.9% below its estimated fair value, highlighting potential undervaluation based on cash flows. Despite a net loss of €63 million for the nine months ending September 2025, the company is expected to achieve profitability within three years with a forecasted annual earnings growth of 75.32%. However, revenue growth remains modest at 2.7% annually and interest payments are not adequately covered by earnings, which poses challenges for its dividend sustainability.

- The growth report we've compiled suggests that PostNL's future prospects could be on the up.

- Click here to discover the nuances of PostNL with our detailed financial health report.

PolyPeptide Group (SWX:PPGN)

Overview: PolyPeptide Group AG is a contract development and manufacturing company operating in Europe, the United States, and India with a market cap of CHF823.14 million.

Operations: The company's revenue segments consist of Custom Projects (€120.47 million), Contract Manufacturing (€192.49 million), and Generics and Cosmetics (€55.88 million).

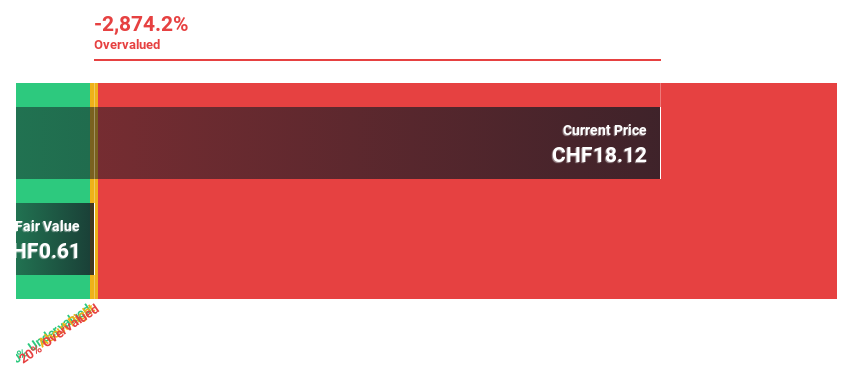

Estimated Discount To Fair Value: 16%

PolyPeptide Group is trading at CHF24.95, approximately 16% below its estimated fair value of CHF29.7, suggesting potential undervaluation based on cash flows. The company forecasts a robust revenue growth of 14.9% annually, surpassing the Swiss market average, and anticipates profitability within three years with earnings expected to grow substantially at 65.3% per year. Recent strategic expansions in Malmo aim to double production capacity, supporting long-term growth despite current low forecasted return on equity of 6.2%.

- Upon reviewing our latest growth report, PolyPeptide Group's projected financial performance appears quite optimistic.

- Dive into the specifics of PolyPeptide Group here with our thorough financial health report.

Key Takeaways

- Delve into our full catalog of 192 Undervalued European Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報