European Growth Companies With High Insider Ownership In December 2025

As European markets navigate a mixed landscape with the pan-European STOXX Europe 600 Index ending slightly lower and major stock indexes showing varied performances, investors are closely watching central bank policies for cues on economic resilience. In this environment, growth companies with high insider ownership can be appealing as they often indicate confidence from those who know the company best, potentially offering stability amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| CD Projekt (WSE:CDR) | 29.7% | 51.8% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.6% |

Let's dive into some prime choices out of the screener.

Ambu (CPSE:AMBU B)

Simply Wall St Growth Rating: ★★★★☆☆

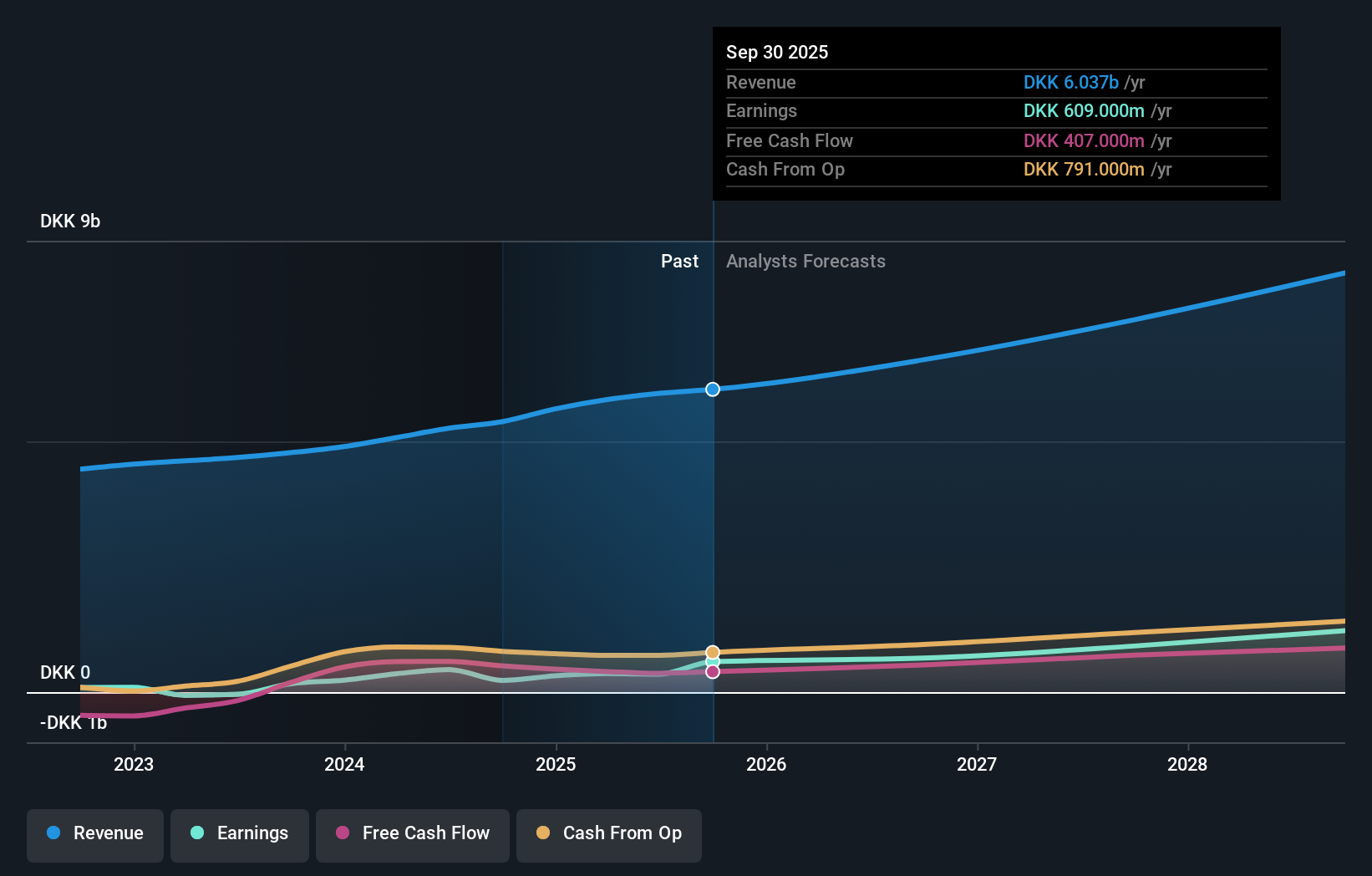

Overview: Ambu A/S, along with its subsidiaries, is involved in the research, development, manufacturing, marketing, and sale of medical technology solutions across North America, Europe, and globally; it has a market cap of DKK23.15 billion.

Operations: Ambu's revenue is primarily derived from its Medical Technology Solutions segment, which generated DKK6.04 billion.

Insider Ownership: 20.1%

Ambu A/S has demonstrated strong growth, with earnings increasing by 159.1% over the past year and expected to continue growing at 20% annually, outpacing the Danish market. The company reported full-year sales of DKK 6.04 billion and a net income of DKK 609 million. Insider transactions show more buying than selling recently, indicating confidence in its future prospects. Despite trading below fair value estimates, analysts predict a potential price increase of 33.1%.

- Delve into the full analysis future growth report here for a deeper understanding of Ambu.

- Our comprehensive valuation report raises the possibility that Ambu is priced lower than what may be justified by its financials.

Norbit (OB:NORBT)

Simply Wall St Growth Rating: ★★★★★☆

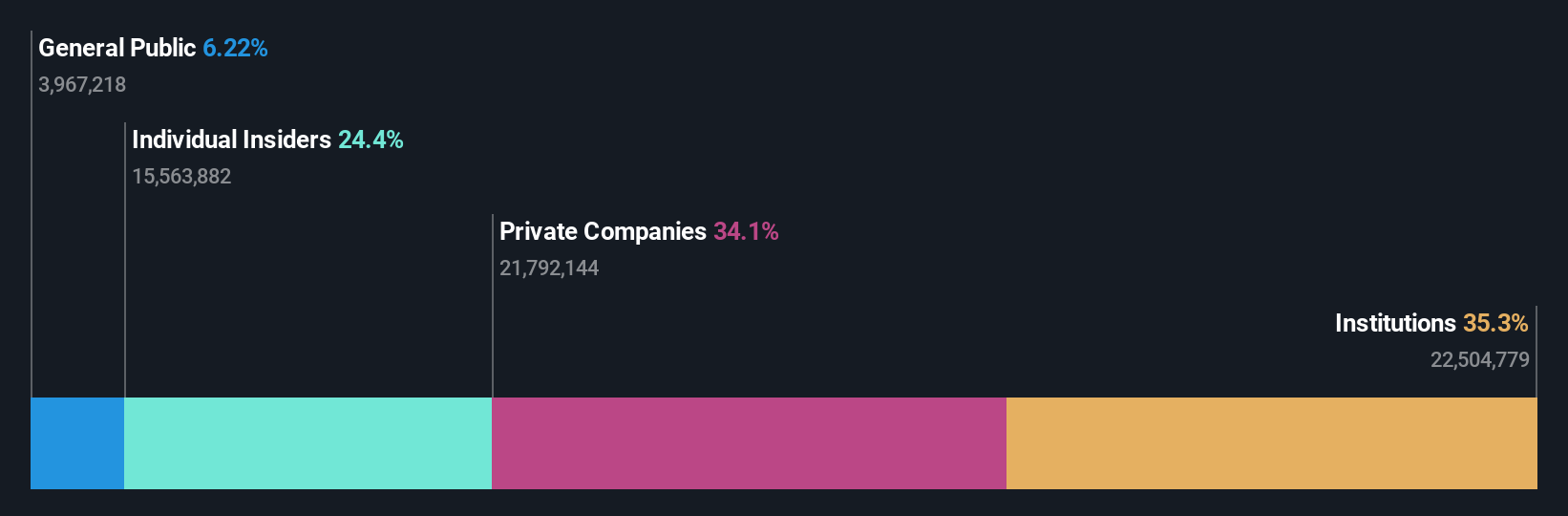

Overview: Norbit ASA offers technology solutions across various industries and has a market capitalization of NOK11.32 billion.

Operations: The company generates revenue from its Oceans segment with NOK933.50 million, Connectivity segment with NOK575.90 million, and Product Innovation and Realization (PIR) segment with NOK826.90 million.

Insider Ownership: 24.4%

Norbit has shown robust growth, with earnings increasing by 110% last year and projected to grow significantly at 21.9% annually, surpassing the Norwegian market. Recent insider activity indicates more buying than selling, reflecting confidence in its trajectory. The company reported substantial Q3 sales of NOK 505.4 million and secured significant contracts totaling NOK 280 million across various sectors. Norbit trades below fair value estimates and anticipates strong revenue growth between NOK 2.5 billion and NOK 2.6 billion for 2025.

- Click here and access our complete growth analysis report to understand the dynamics of Norbit.

- The valuation report we've compiled suggests that Norbit's current price could be quite moderate.

New Wave Group (OM:NEWA B)

Simply Wall St Growth Rating: ★★★★☆☆

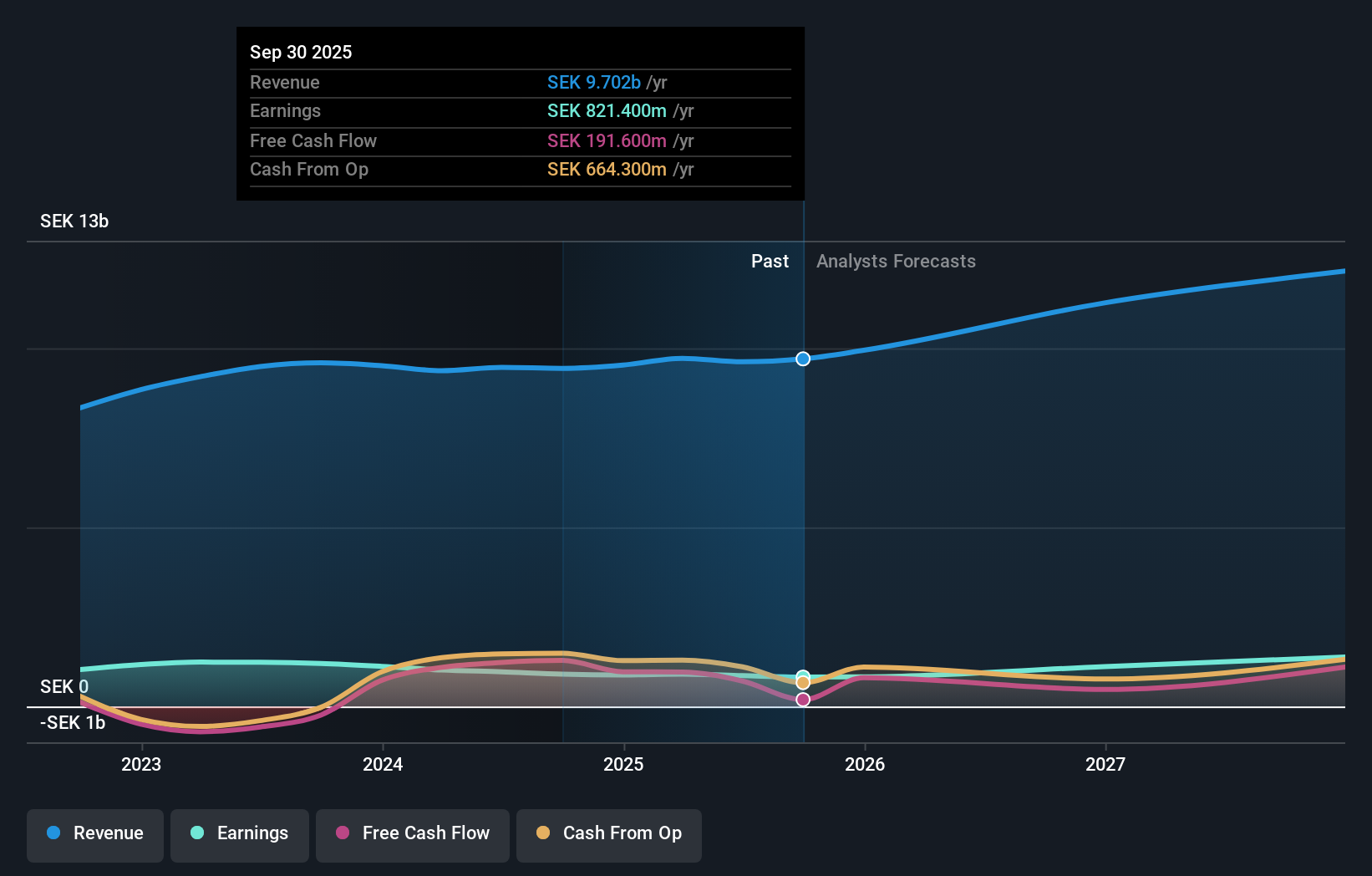

Overview: New Wave Group AB (publ) is involved in designing, acquiring, and developing brands and products across the corporate, sports, gifts, and home furnishings sectors with operations spanning Sweden, the United States, Central Europe, other Nordic countries, Southern Europe, and internationally; it has a market cap of approximately SEK14.98 billion.

Operations: The company's revenue segments consist of SEK4.80 billion from Corporate, SEK4.05 billion from Sports & Leisure, and SEK855.50 million from Gifts & Home Furnishings.

Insider Ownership: 34.7%

New Wave Group is trading at a significant discount to its estimated fair value, suggesting potential upside. Although revenue growth of 10.4% per year is slower than the desired 20%, it surpasses the Swedish market average. Earnings are projected to grow significantly at 24.7% annually, outpacing market expectations. However, debt coverage by operating cash flow is weak and recent earnings reports show declining profitability with Q3 net income dropping to SEK 166 million from SEK 204 million year-over-year.

- Get an in-depth perspective on New Wave Group's performance by reading our analyst estimates report here.

- Our valuation report here indicates New Wave Group may be undervalued.

Seize The Opportunity

- Click here to access our complete index of 209 Fast Growing European Companies With High Insider Ownership.

- Seeking Other Investments? These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報