The Bull Case For EMCOR Group (EME) Could Change Following Attention To Its Low P/E And Upgraded Outlook

- In recent days, coverage of EMCOR Group has emphasized its lower price-to-earnings ratio relative to Construction & Engineering peers and highlighted upbeat analyst revisions to earnings forecasts.

- This combination of relatively modest valuation multiples and upgraded growth expectations has sharpened investor attention on how the company is being priced against its outlook.

- Now, we’ll explore how this renewed focus on EMCOR’s comparatively low P/E ratio may influence its investment narrative and future assumptions.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

EMCOR Group Investment Narrative Recap

To own EMCOR Group, you need to be comfortable with a business built around large mechanical and electrical construction projects, where execution, bidding discipline and end market health matter more than short term price swings. The recent focus on EMCOR’s lower P/E multiple and upgraded earnings forecasts does not materially change the key near term catalyst, which remains management’s 2025 guidance, or the biggest risk, which is margin pressure from labor costs and complex project work.

Among recent announcements, the raised full year 2025 revenue guidance to US$16.7 billion to US$16.8 billion stands out, because it gives context to the current conversation about valuation and earnings revisions. It helps frame whether the lower P/E is a reflection of cautious expectations or simply a lag in how the market is digesting EMCOR’s updated outlook for its project pipeline and earnings power over the next year.

Yet even with improving earnings expectations, investors should be aware of how prolonged labor cost pressures could...

Read the full narrative on EMCOR Group (it's free!)

EMCOR Group's narrative projects $20.6 billion revenue and $1.4 billion earnings by 2028.

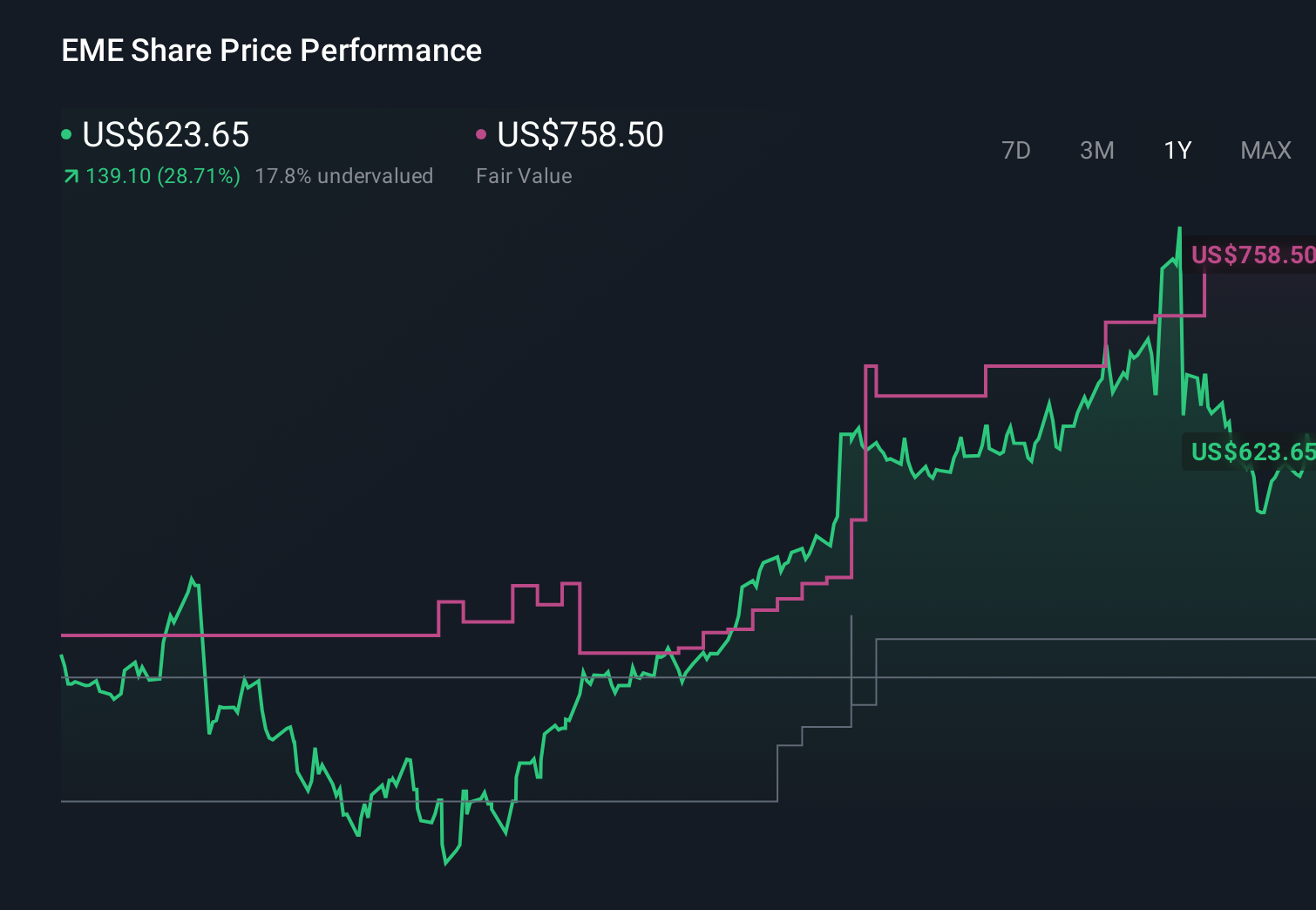

Uncover how EMCOR Group's forecasts yield a $758.50 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span roughly US$469 to US$910 per share, showing how far apart individual views can be. Set these against the current focus on EMCOR’s relatively low P/E and 2025 guidance, and you can see why it helps to weigh several different assumptions about how sustainable margins and project volumes might be.

Explore 8 other fair value estimates on EMCOR Group - why the stock might be worth 25% less than the current price!

Build Your Own EMCOR Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EMCOR Group research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free EMCOR Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EMCOR Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報