Restaurant Brands Asia Limited's (NSE:RBA) Share Price Is Matching Sentiment Around Its Revenues

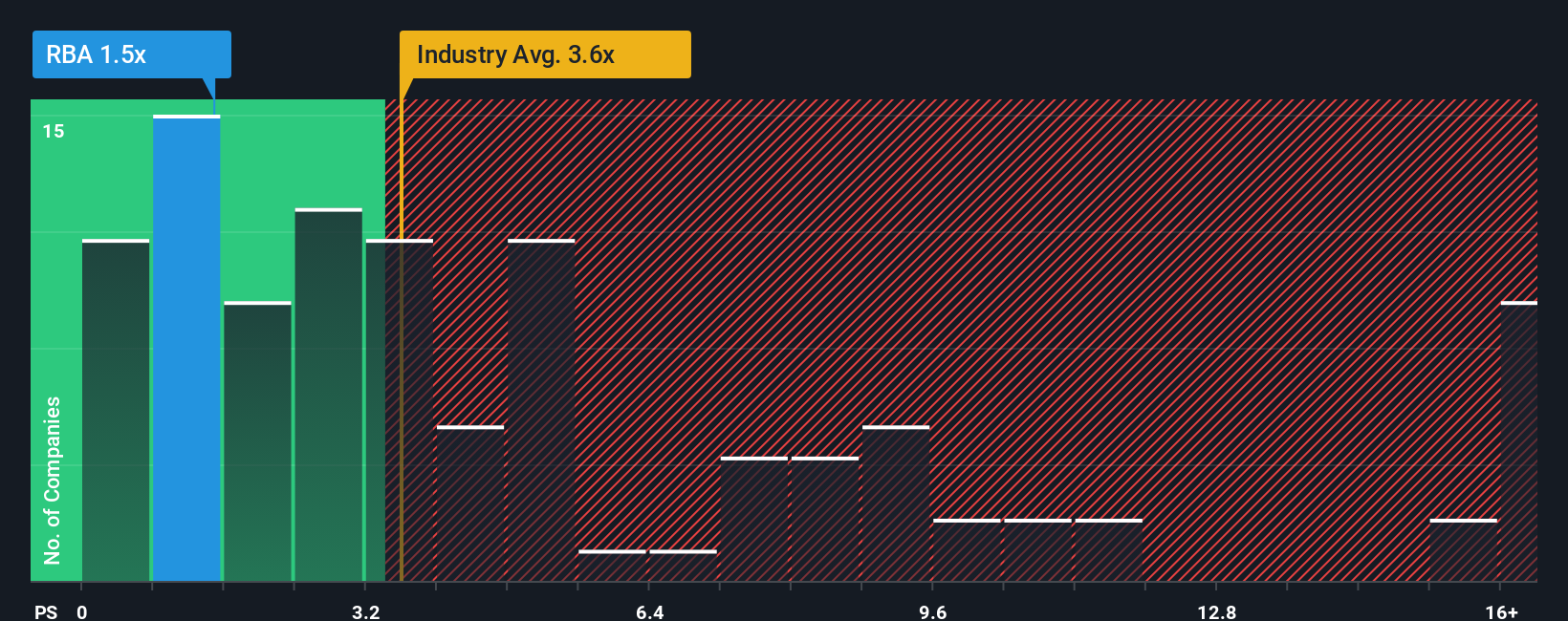

Restaurant Brands Asia Limited's (NSE:RBA) price-to-sales (or "P/S") ratio of 1.5x might make it look like a strong buy right now compared to the Hospitality industry in India, where around half of the companies have P/S ratios above 3.6x and even P/S above 8x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Restaurant Brands Asia

What Does Restaurant Brands Asia's Recent Performance Look Like?

Recent times haven't been great for Restaurant Brands Asia as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Restaurant Brands Asia's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Restaurant Brands Asia?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Restaurant Brands Asia's to be considered reasonable.

Retrospectively, the last year delivered a decent 7.8% gain to the company's revenues. The latest three year period has also seen an excellent 45% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 17% each year as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 43% each year, which is noticeably more attractive.

In light of this, it's understandable that Restaurant Brands Asia's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Restaurant Brands Asia's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Restaurant Brands Asia maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Restaurant Brands Asia, and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報