El Al Israel Airlines (TLV:ELAL) delivers shareholders fantastic 74% CAGR over 3 years, surging 9.5% in the last week alone

Generally speaking, investors are inspired to be stock pickers by the potential to find the big winners. You won't get it right every time, but when you do, the returns can be truly splendid. One such superstar is El Al Israel Airlines Ltd. (TLV:ELAL), which saw its share price soar 426% in three years. It's even up 9.5% in the last week.

Since the stock has added ₪724m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

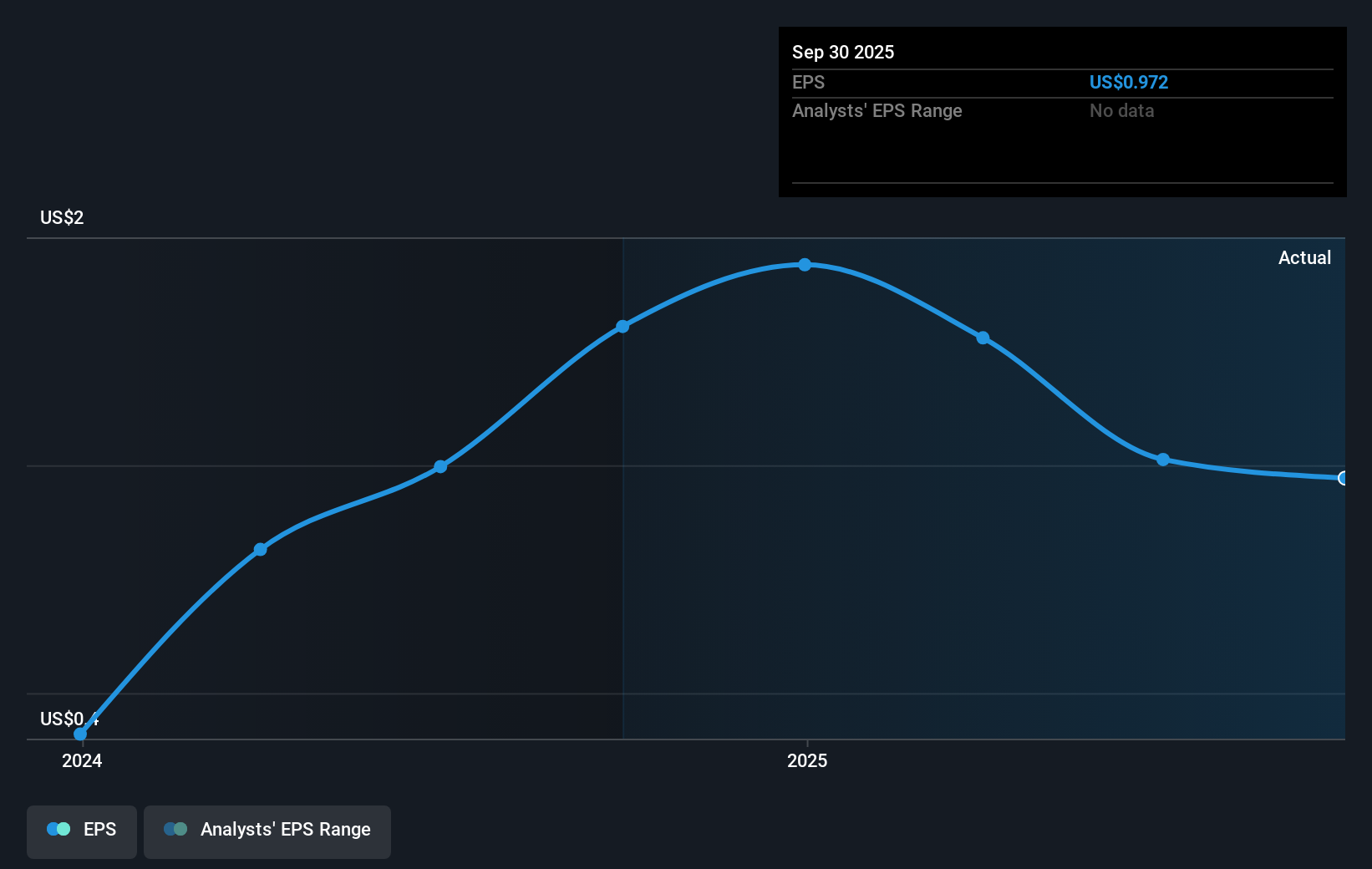

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, El Al Israel Airlines moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on El Al Israel Airlines' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that El Al Israel Airlines shareholders have received a total shareholder return of 125% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 29% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for El Al Israel Airlines that you should be aware of.

But note: El Al Israel Airlines may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Israeli exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報