Natera (NTRA): Assessing Valuation After Strong Multi‑Year Share Price Rally

Natera (NTRA) shares have quietly outpaced much of the biotech space this year, climbing strongly on the back of double digit revenue growth and rapidly improving net income trends that have investors rethinking its valuation.

See our latest analysis for Natera.

Beyond the latest results, the share price has surged to $231.95, with a roughly 35% 3 month share price return and a 3 year total shareholder return above 430%, which together signal solid, momentum driven optimism around Natera’s long term growth story.

If Natera’s run has you thinking about what else is working in healthcare, this could be a good moment to explore healthcare stocks for more potential ideas.

With the stock hovering just below analyst targets after a powerful multi year rally, the key question now is whether Natera is still trading below its intrinsic value or if investors are already pricing in years of future growth.

Most Popular Narrative Narrative: 1.2% Undervalued

With Natera closing at $231.95 against a narrative fair value of $234.68, the story pivots on ambitious growth and profitability assumptions taking shape.

Investment in new product launches (e.g., Fetal Focus NIPT, Signatera Genome, AI-based biomarkers) and a robust R&D pipeline positions Natera to capture growth from long-term trends in personalized medicine and early detection, underpinning future revenue expansion.

Want to see why this narrative backs a premium valuation despite today’s losses? The real twist lies in its bold profit swing and rich growth runway.

Have a read of the narrative in full and understand what's behind the forecasts.

However, this optimism still hinges on clinical trial success and regulatory approvals; delays or setbacks could quickly challenge today’s growth heavy valuation.

Find out about the key risks to this Natera narrative.

Another View: Rich Multiples, Different Story

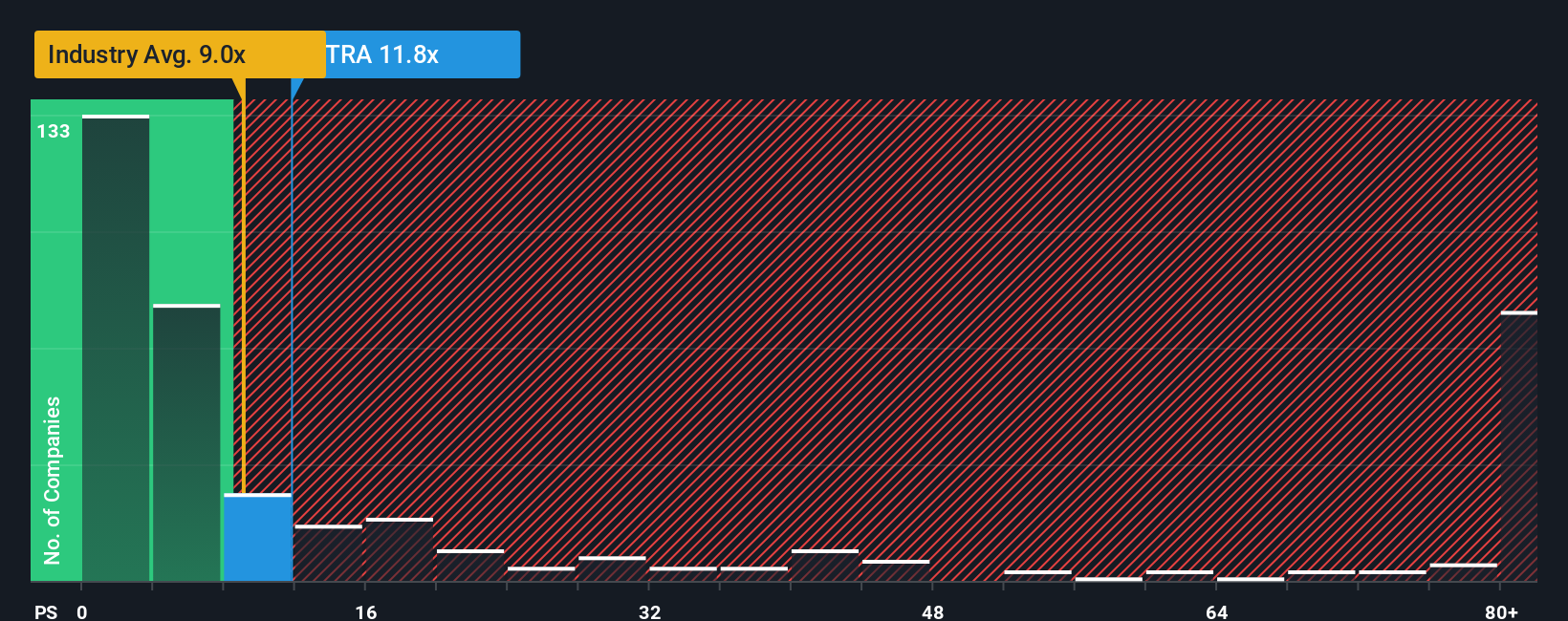

While the narrative fair value suggests only a small discount, Natera’s price to sales of 15.1 times towers over both the US Biotechs average of 12.1 times and its own fair ratio of 8.3 times. This gap hints at valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Natera Narrative

If you see the story differently or would rather dive into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Natera research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at Natera; use the Simply Wall St Screener right now to uncover fresh, data backed opportunities before other investors catch on.

- Capitalize on mispriced quality by targeting companies trading below their cash flow potential with these 908 undervalued stocks based on cash flows, before the market closes the gap.

- Explore the next wave of innovation by backing emerging automation leaders through these 26 AI penny stocks that may reshape entire industries.

- Seek reliable cash returns while rates shift by focusing on steady income opportunities using these 13 dividend stocks with yields > 3% before yields compress.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報