Reassessing JB Hi-Fi (ASX:JBH) Valuation After Major Institutional Exits and Prolonged Share Price Downtrend

Recent filings show major institutions exiting JB Hi-Fi (ASX:JBH), just as the stock slips into a sustained downtrend with clear selling pressure. This combination naturally sharpens investor focus on valuation and risk.

See our latest analysis for JB Hi-Fi.

That selling has shown up clearly in the tape, with a 90 day share price return of minus 19.22 percent dragging JB Hi Fi to A$91.81. Its five year total shareholder return of 153.35 percent still tells a strong long term story, suggesting momentum is fading near term while the franchise track record keeps longer term holders patient.

If JB Hi Fi’s shift in momentum has you rethinking your watchlist, this could be a moment to explore fast growing stocks with high insider ownership for other ideas with different upside narratives.

With institutions trimming exposure even as JB Hi Fi still trades at a double digit discount to consensus and an even steeper gap to intrinsic value estimates, is this a contrarian entry point, or is the market rightly discounting future growth?

Most Popular Narrative: 20.8% Overvalued

According to Robbo, the narrative fair value for JB Hi-Fi sits well below the last close of A$91.81, framing today’s price as rich against fundamentals.

That said, JB Hi-Fi remains a household name in Australia. The acquisition of The Good Guys has cemented its dominant position in the appliance retail space. Its stores have a smaller footprint than major rival Harvey Norman, resulting in higher sales per square metre. JB is also known for its lean operations, impressive in an industry characterised by low margins. A return on equity (ROE) of around 28% is remarkable in this context. The company also has a track record of buying back shares, signalling that management maintains confidence in the business.

Want to know why a business with strong returns is still tagged as overvalued in this narrative? The engine room is future earnings power and the profit multiple it could command. Curious which growth assumptions, margin expectations, and required return make that lower fair value number add up? The full narrative unpacks every step.

Result: Fair Value of $76.0 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower domestic growth or a reinvigorated in store brand identity could reignite earnings momentum and challenge today’s cautious overvaluation narrative.

Find out about the key risks to this JB Hi-Fi narrative.

Another View: Market Ratios Point the Other Way

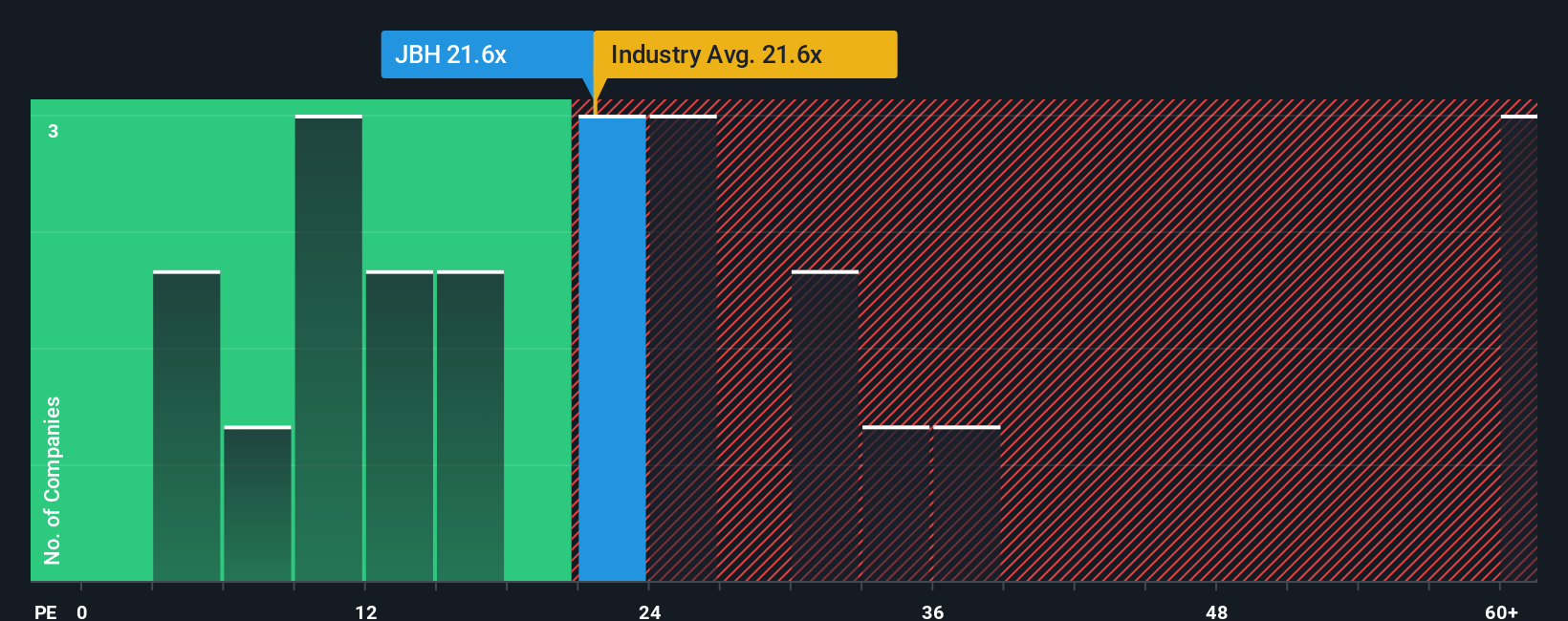

Our valuation checks using a single earnings based multiple tell a different story to Robbo’s narrative. At 21.7 times earnings, JB Hi Fi trades below peers on 26.1 times and just under a fair ratio of 23.1 times, which hints at modest upside rather than a big downside reset. Which lens deserves more weight in your process?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own JB Hi-Fi Narrative

If you see the numbers differently, or would rather dig into the details yourself, you can build a fresh view in under three minutes: Do it your way.

A great starting point for your JB Hi-Fi research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at one retailer when smarter opportunities may be waiting. Use the Simply Wall St Screener to uncover focused ideas before the crowd reacts.

- Target resilient income by reviewing these 13 dividend stocks with yields > 3% that can potentially steady your portfolio when markets turn choppy.

- Ride structural growth trends by analysing these 26 AI penny stocks positioned at the heart of the artificial intelligence boom.

- Strengthen your value strategy by scanning these 908 undervalued stocks based on cash flows where market pessimism might have overshot the fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報