Bausch + Lomb (NYSE:BLCO) valuation after analyst upgrades highlight confidence in growth and margin improvement

Bausch + Lomb (NYSE:BLCO) just got a confidence boost, with recent analyst upgrades helping nudge the stock higher even as the company reshapes its balance sheet through a multibillion dollar debt refinancing.

See our latest analysis for Bausch + Lomb.

The recent analyst upgrades and debt refinancing have helped the share price regain some momentum, with a 30 day share price return of about 9% and a 3 year total shareholder return of roughly 15%, even though year to date share price performance remains slightly negative.

If this kind of turnaround story interests you, it is also worth exploring other healthcare stocks that may be quietly setting up for their next leg of growth.

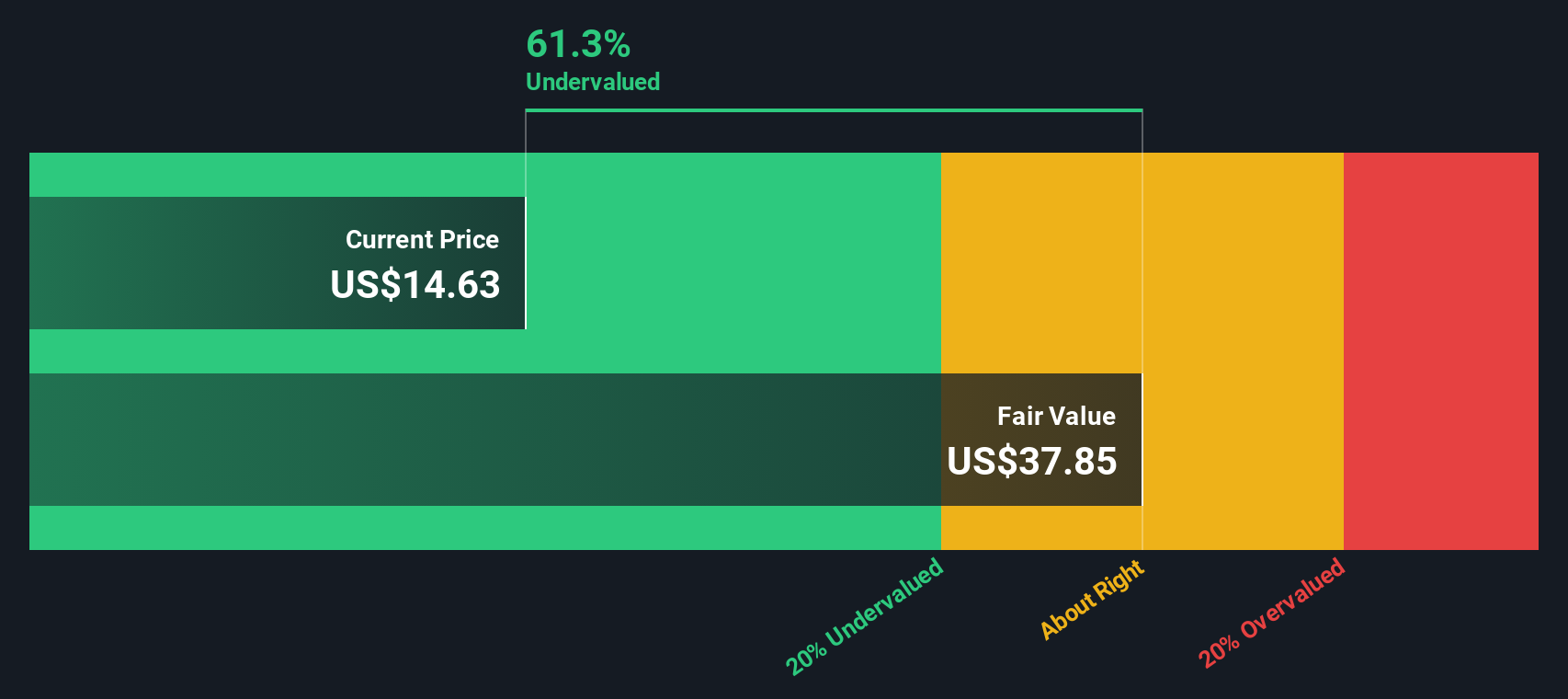

With analyst targets sitting only slightly above the current price, but our estimates implying a much deeper discount, the key question now is: Are investors still underestimating Bausch + Lomb, or is the market already pricing in its next phase of growth?

Price to Sales of 1.2x: Is it justified?

Bausch + Lomb looks inexpensive on a sales basis, with the shares at $16.99 implying a 1.2x price to sales ratio that screens as undervalued against both peers and its own fair ratio.

The price to sales multiple compares the market value of the company to the revenue it generates, which is especially useful for businesses that are not yet consistently profitable but have meaningful top line scale. For a diversified eye health company with nearly $5 billion in annual revenue, this lens helps investors judge how much they are paying for each dollar of sales while the turnaround in profitability is still in progress.

Here the gap is striking, with Bausch + Lomb trading at 1.2x sales versus an estimated fair price to sales ratio of 2.4x and peer averages that sit even higher. That kind of discount suggests the market is heavily marking down its growth and margin potential compared to similar medical equipment names and to where the SWS model indicates the multiple could eventually migrate if execution and profitability improve.

Compared with the US Medical Equipment industry average price to sales of 3.5x and a peer group average of 2.7x, Bausch + Lomb is priced at a steep relative discount. If sentiment and fundamentals converge toward the modeled fair ratio, there is considerable room for the market’s multiple to re rate closer to sector norms.

Explore the SWS fair ratio for Bausch + Lomb

Result: Price to Sales of 1.2x (UNDERVALUED)

However, investors still face execution risk around returning to sustainable profitability, as well as the possibility that slower revenue growth caps any prospective multiple re rating.

Find out about the key risks to this Bausch + Lomb narrative.

Another View: What Our DCF Model Says

Our DCF model paints an even starker picture, putting fair value around $36.37, more than double the recent $16.99 share price. That implies Bausch + Lomb could be significantly undervalued if cash flows recover as expected, but are those optimistic forecasts realistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bausch + Lomb for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bausch + Lomb Narrative

If you have a different take or want to dive into the numbers yourself, you can quickly craft a personalised view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Bausch + Lomb.

Looking for more investment ideas?

Before the next leg of this story unfolds, give yourself an edge and line up your watchlist with fresh, data driven opportunities on Simply Wall Street.

- Strengthen your growth game by targeting these 26 AI penny stocks that could benefit most from the next wave of automation and intelligent software adoption.

- Lock in potential value upside by focusing on these 908 undervalued stocks based on cash flows where market expectations still trail the underlying cash flow potential.

- Boost your income strategy by zeroing in on these 13 dividend stocks with yields > 3% that aim to deliver steady cash returns alongside long term capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報