3 UK Stocks Estimated To Be Undervalued By Up To 49%

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, reflecting broader global economic concerns. Amidst these fluctuations, identifying undervalued stocks becomes crucial as they can offer potential opportunities for investors looking to capitalize on mispriced assets in a volatile environment.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tortilla Mexican Grill (AIM:MEX) | £0.41 | £0.78 | 47.4% |

| Pinewood Technologies Group (LSE:PINE) | £3.635 | £7.13 | 49% |

| PageGroup (LSE:PAGE) | £2.312 | £4.52 | 48.8% |

| Nichols (AIM:NICL) | £9.74 | £18.53 | 47.4% |

| Motorpoint Group (LSE:MOTR) | £1.36 | £2.67 | 49.1% |

| Ibstock (LSE:IBST) | £1.334 | £2.65 | 49.7% |

| Gym Group (LSE:GYM) | £1.50 | £2.94 | 49% |

| Fintel (AIM:FNTL) | £1.95 | £3.78 | 48.4% |

| CAB Payments Holdings (LSE:CABP) | £0.68 | £1.30 | 47.7% |

| Airtel Africa (LSE:AAF) | £3.07 | £5.80 | 47.1% |

Here's a peek at a few of the choices from the screener.

Tristel (AIM:TSTL)

Overview: Tristel plc develops, manufactures, and sells infection prevention products across the United Kingdom, Australia, Germany, Western Europe, and internationally with a market cap of £190.99 million.

Operations: Tristel's revenue is primarily derived from Hospital Medical Device Decontamination (£40.38 million) and Hospital Environmental Surface Disinfection (£3.69 million).

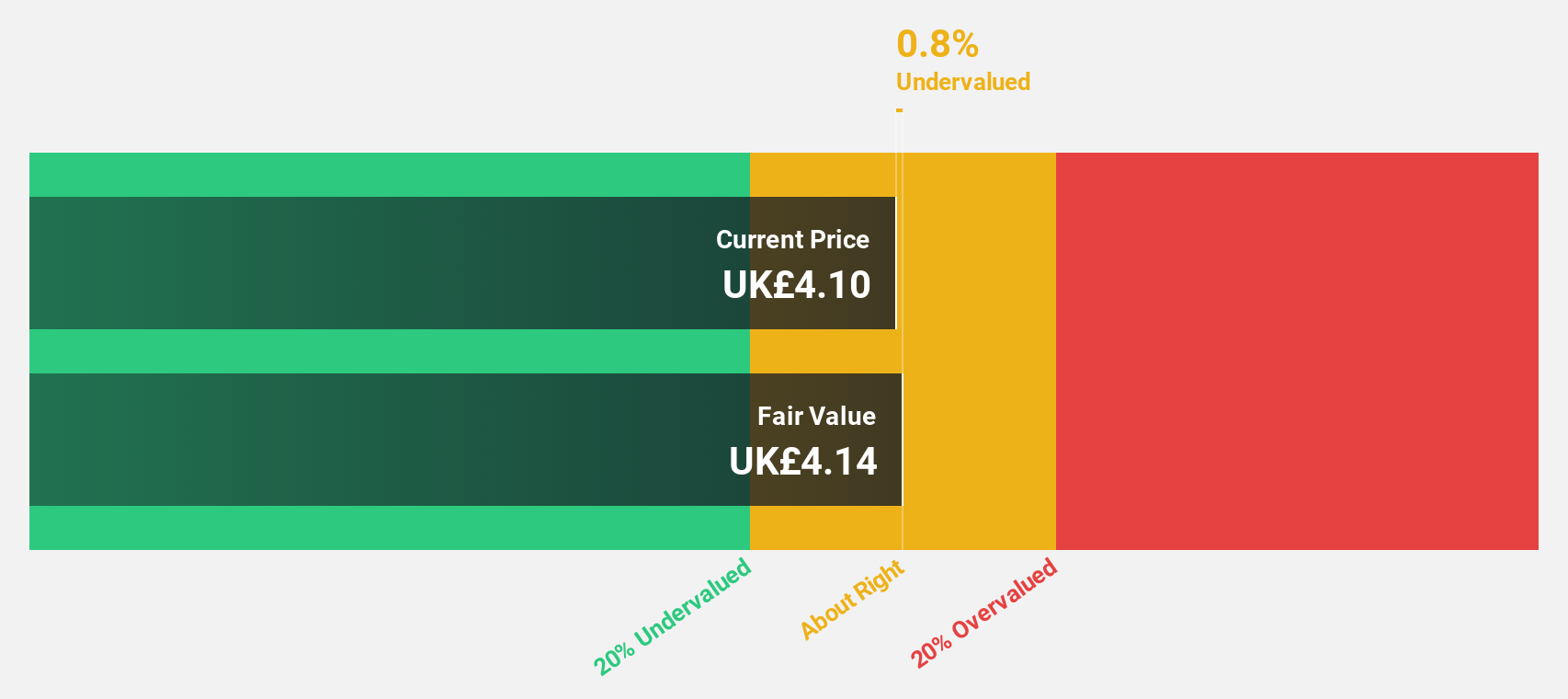

Estimated Discount To Fair Value: 22.3%

Tristel is trading 22.3% below its estimated fair value of £5.15, suggesting potential undervaluation based on discounted cash flow analysis. The company's earnings are forecast to grow at 15.2% annually, outpacing the UK market average, while recent product expansions in the US and UK bolster its revenue prospects. However, a dividend yield of 3.55% is not well covered by earnings, posing a risk to income-focused investors despite strong projected growth metrics and innovative product offerings in high-level disinfection solutions.

- The analysis detailed in our Tristel growth report hints at robust future financial performance.

- Get an in-depth perspective on Tristel's balance sheet by reading our health report here.

Gym Group (LSE:GYM)

Overview: The Gym Group plc operates a network of gym facilities under the Gym Group brand name in the United Kingdom, with a market capitalization of £268.12 million.

Operations: The company's revenue is primarily derived from the provision of high-quality health and fitness facilities, amounting to £235.20 million.

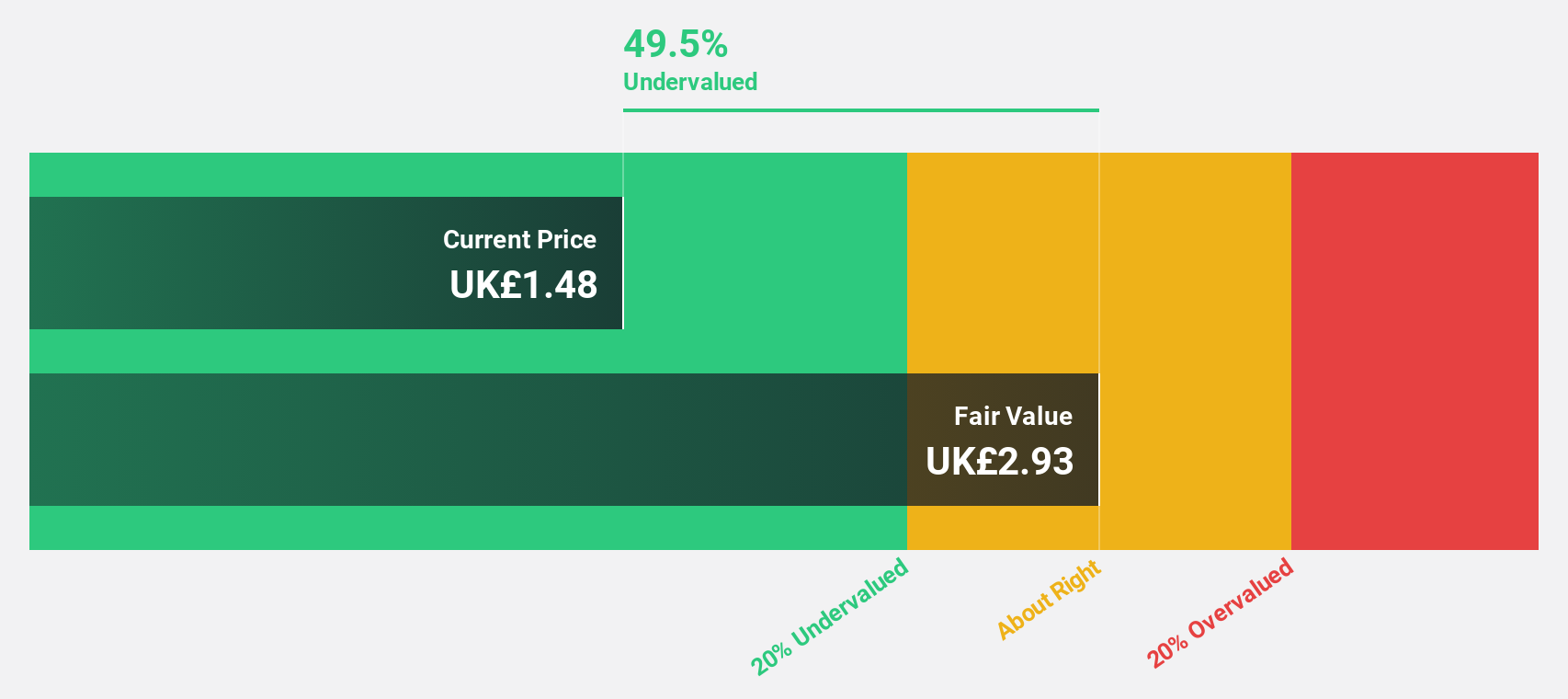

Estimated Discount To Fair Value: 49%

Gym Group is trading at £1.5, significantly below its estimated fair value of £2.94, highlighting potential undervaluation based on cash flow analysis. The company's earnings are forecast to grow 22.7% annually, surpassing the UK market average growth rate of 14.2%, despite revenue growth projections being moderate at 8.9% per year. Recent profitability and strong earnings forecasts are tempered by low expected return on equity in the coming years and large one-off items affecting financial results.

- Our comprehensive growth report raises the possibility that Gym Group is poised for substantial financial growth.

- Navigate through the intricacies of Gym Group with our comprehensive financial health report here.

Mitie Group (LSE:MTO)

Overview: Mitie Group plc, with a market cap of £2.10 billion, provides facilities management and professional services in the United Kingdom and internationally through its subsidiaries.

Operations: Mitie Group's revenue is primarily derived from Business Services (£2.43 billion) and Technical Services (£2.04 billion).

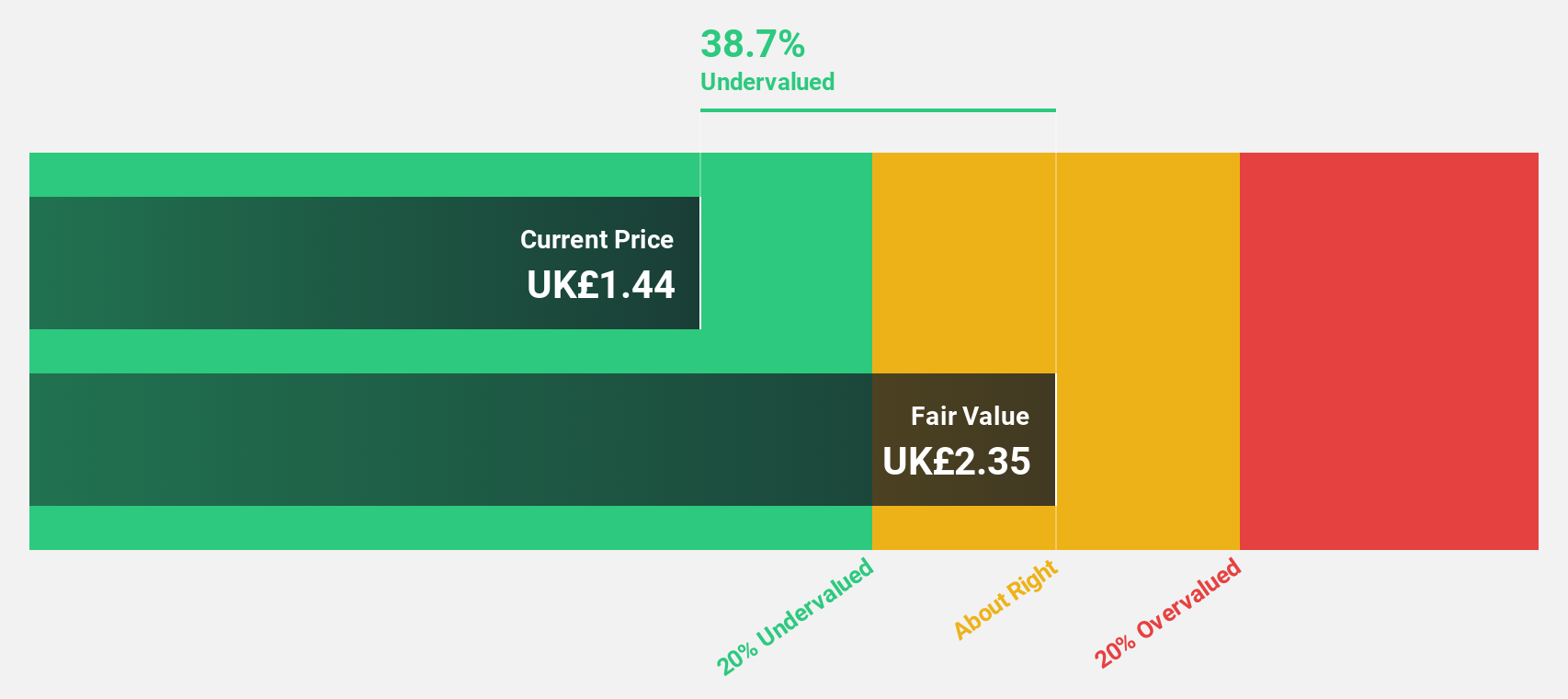

Estimated Discount To Fair Value: 30.2%

Mitie Group, trading at £1.63, is notably undervalued compared to its estimated fair value of £2.34 based on cash flow analysis. Despite a high level of debt and unstable dividend history, the company forecasts robust earnings growth at 27.3% annually, outpacing the UK market's average. Recent half-year results showed increased sales but a dip in net income year-on-year. A £100 million share buyback program could mitigate dilution from employee incentive schemes.

- Our growth report here indicates Mitie Group may be poised for an improving outlook.

- Take a closer look at Mitie Group's balance sheet health here in our report.

Where To Now?

- Click this link to deep-dive into the 56 companies within our Undervalued UK Stocks Based On Cash Flows screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報