European Growth Stocks With Up To 32% Insider Ownership

As the European market navigates a mixed landscape with slight declines in the STOXX Europe 600 Index and varying performances among major national indices, investors are closely monitoring economic indicators and central bank policies for signs of future growth. In this context, companies with high insider ownership can be particularly appealing as they often signal strong internal confidence in the business's long-term prospects.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| CD Projekt (WSE:CDR) | 29.7% | 51.8% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.6% |

We'll examine a selection from our screener results.

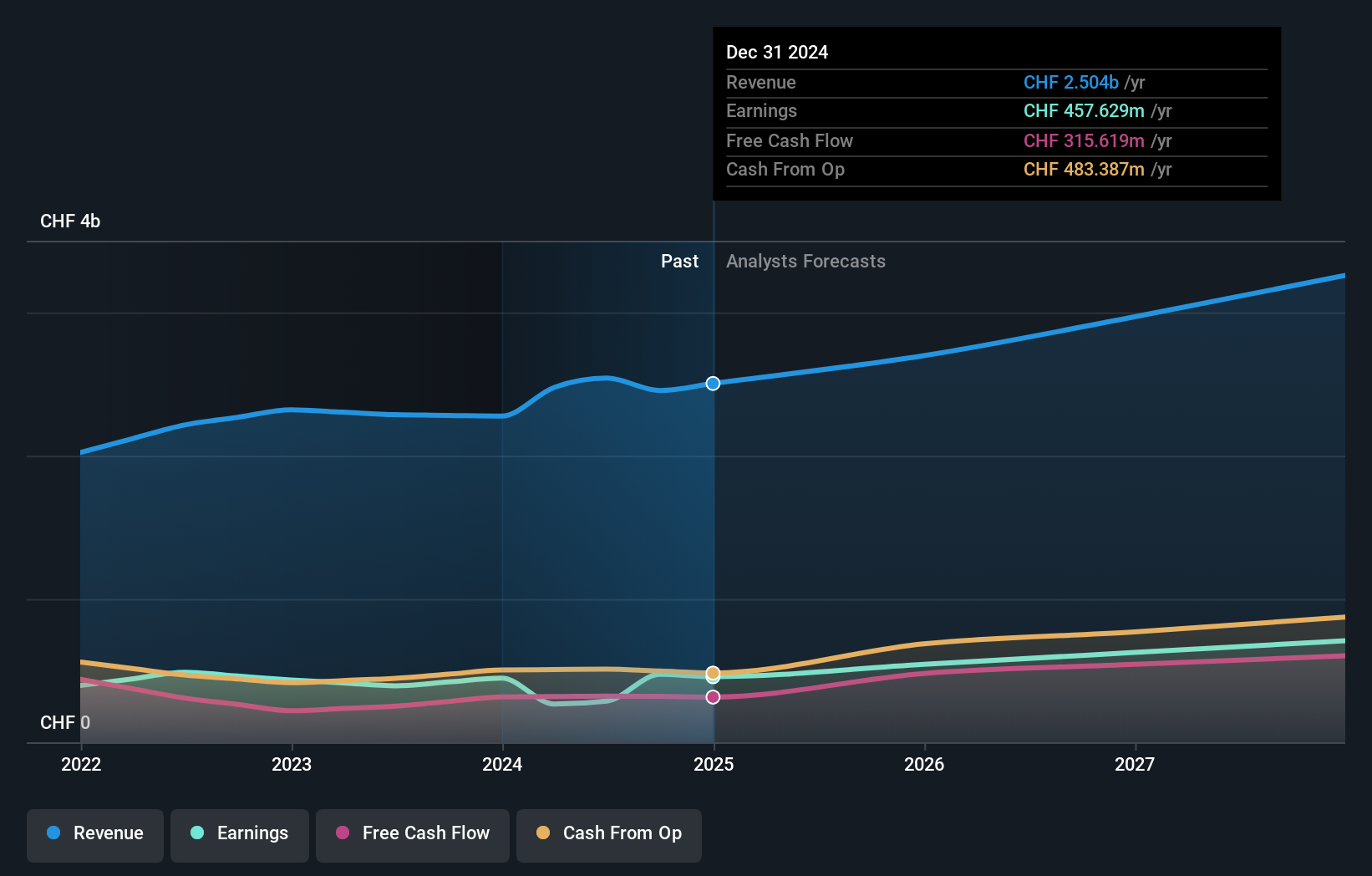

Straumann Holding (SWX:STMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Straumann Holding AG is a global provider of tooth replacement and orthodontic solutions, with a market cap of CHF15.19 billion.

Operations: Straumann Holding's revenue is derived from its operations in various regions, including CHF1.38 billion from Operations, CHF0.66 billion from Sales Asia Pacific (APAC), CHF0.78 billion from Sales North America (NAM), CHF0.29 billion from Sales Latin America (LATAM), and CHF1.14 billion from Sales Europe, Middle East and Africa (EMEA).

Insider Ownership: 32.3%

Straumann Holding demonstrates potential as a growth company with high insider ownership, despite moderate revenue growth forecasts of 8.3% annually. Its earnings are expected to outpace the Swiss market at 14.3% per year, supported by strategic partnerships like the one with Smartee Denti-Technology to enhance its clear aligner business. Trading significantly below estimated fair value and leveraging global partnerships could bolster Straumann's profitability and innovation in orthodontics, positioning it well for future expansion.

- Unlock comprehensive insights into our analysis of Straumann Holding stock in this growth report.

- Our valuation report here indicates Straumann Holding may be undervalued.

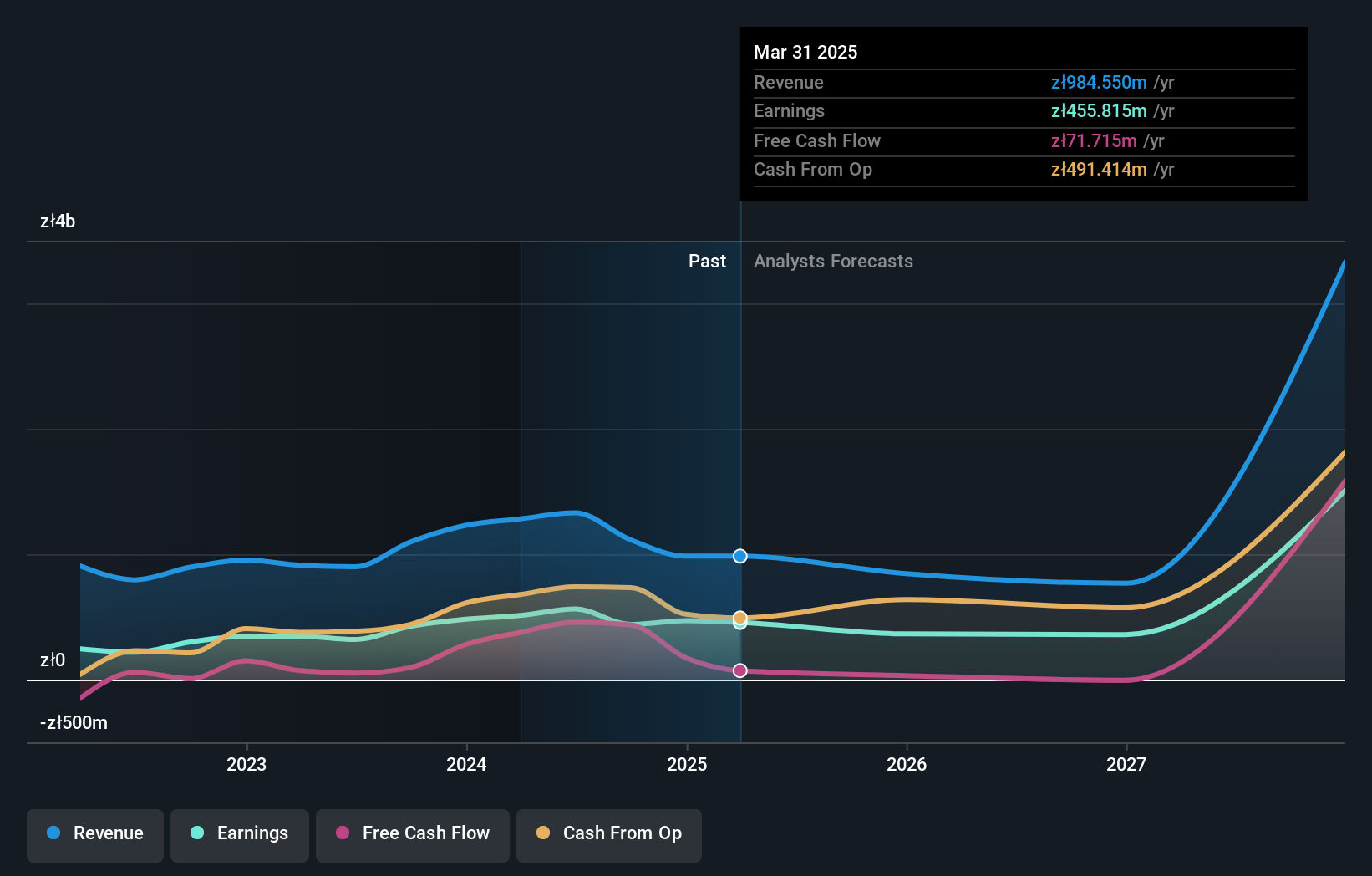

CD Projekt (WSE:CDR)

Simply Wall St Growth Rating: ★★★★★★

Overview: CD Projekt S.A., along with its subsidiaries, focuses on developing, publishing, and digitally distributing video games for personal computers and consoles in Poland, with a market cap of PLN24.75 billion.

Operations: The company's revenue is primarily derived from its CD PROJEKT RED segment, contributing PLN934.38 million, and GOG.Com segment, adding PLN205.61 million.

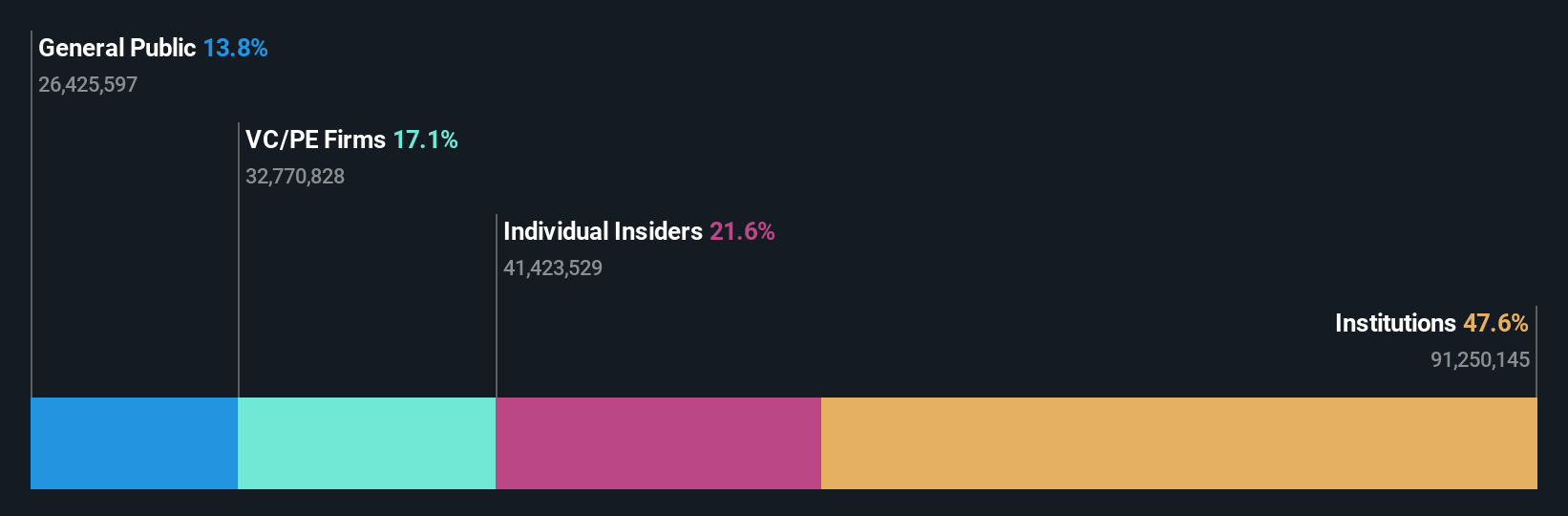

Insider Ownership: 29.7%

CD Projekt exhibits strong growth potential, with earnings forecasted to grow significantly at 51.75% annually, outpacing the Polish market. Recent collaborations, such as with VITURE for a Cyberpunk 2077 collector's edition, highlight its innovation in gaming and XR technology. The company's revenue is expected to rise by 37.8% per year, far exceeding market averages. Despite trading well below fair value estimates, CD Projekt has shown robust profit growth of 29.8% over the past year without substantial insider trading activity recently noted.

- Navigate through the intricacies of CD Projekt with our comprehensive analyst estimates report here.

- The analysis detailed in our CD Projekt valuation report hints at an inflated share price compared to its estimated value.

AUTO1 Group (XTRA:AG1)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AUTO1 Group SE is a technology company that operates a digital automotive platform for buying and selling used cars online across Germany, France, Italy, and other international markets, with a market cap of approximately €5.95 billion.

Operations: The company's revenue is primarily derived from two segments: Retail, generating €1.62 billion, and Merchant, contributing €6.12 billion.

Insider Ownership: 18.8%

AUTO1 Group shows promising growth prospects, with earnings expected to grow significantly at 31.4% annually, surpassing the German market. Recent strategic moves include expanding production centers in Italy, Austria, and the Netherlands to enhance capacity for its Autohero brand. The company has also increased its inventory financing capacity to €1.6 billion, supporting ambitious expansion plans across Europe. Despite trading below fair value estimates and having high insider ownership, AUTO1's debt coverage remains a concern due to insufficient operating cash flow.

- Get an in-depth perspective on AUTO1 Group's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that AUTO1 Group is trading beyond its estimated value.

Make It Happen

- Click this link to deep-dive into the 210 companies within our Fast Growing European Companies With High Insider Ownership screener.

- Searching for a Fresh Perspective? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報