Assessing Yangzijiang Financial Holding (SGX:YF8)’s Valuation After Spin-Off, Deal Termination and Leadership Overhaul

Yangzijiang Financial Holding (SGX:YF8) has just wrapped up a spin off of its maritime investments into a separate listed company, scrapped a sizeable restructuring deal, and overhauled its top leadership team in one sweep.

See our latest analysis for Yangzijiang Financial Holding.

The spin off and leadership reset come after a volatile stretch, with the 1 month share price return down sharply even as the 1 year total shareholder return has surged. This signals that momentum has cooled in the short term, but the longer term story remains compelling.

If this kind of strategic reshaping has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership for other potentially overlooked compounders.

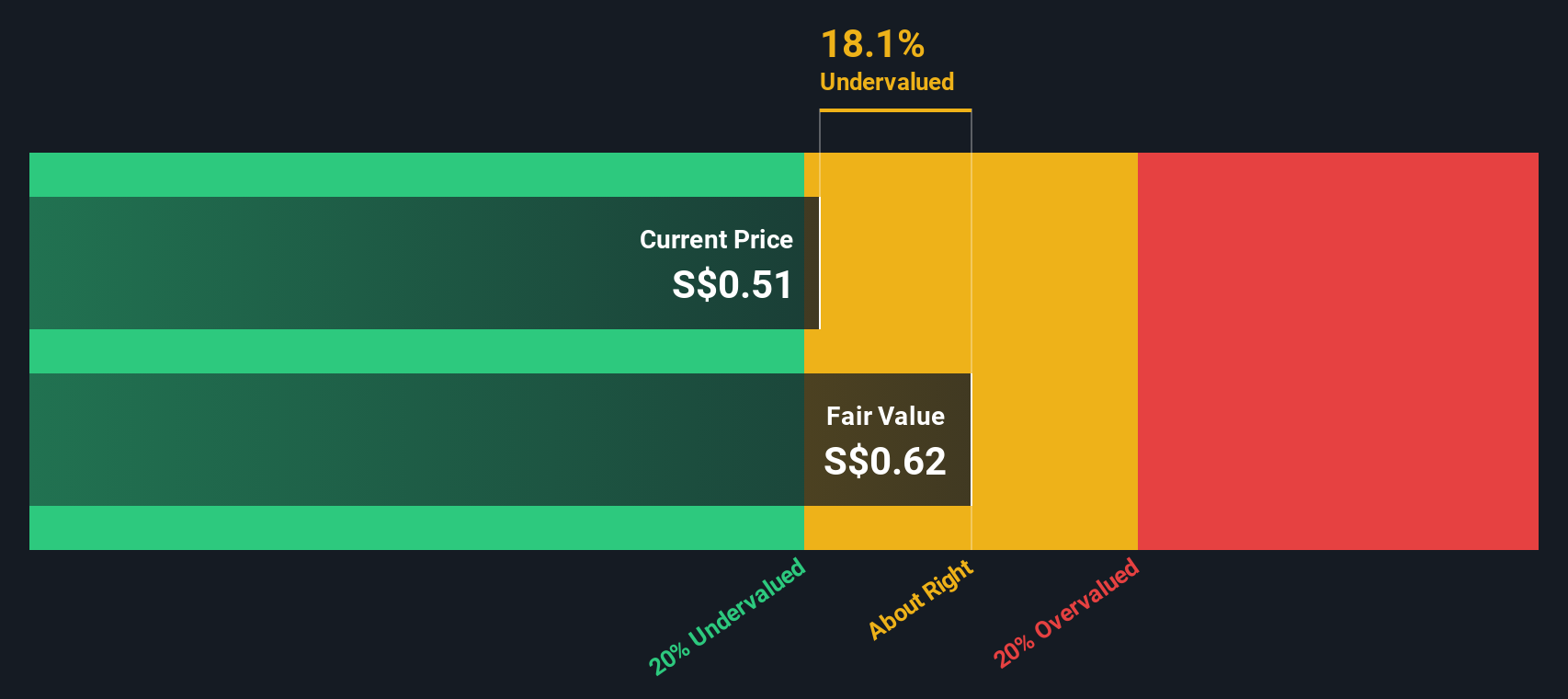

With the shares now trading well below analyst targets and a hefty implied discount to intrinsic value, the big question is whether investors are being offered mispriced upside or if the market is already baking in future growth.

Price-to-Earnings of 4.6x: Is it justified?

On a last close of SGD0.44, Yangzijiang Financial Holding appears materially undervalued when judged against its low price-to-earnings multiple of 4.6 times.

The price-to-earnings ratio compares what investors pay today with the company’s current earnings. This is a particularly relevant yardstick for a profitable capital markets and investment group.

At just 4.6 times earnings, the market is assigning a steep discount to Yangzijiang Financial Holding despite strong recent profit growth and high quality earnings, while our fair ratio work suggests the multiple could ultimately gravitate much higher. Against both peer averages near the high teens and an estimated fair price-to-earnings ratio of 16 times, the current valuation stands out as deeply compressed.

Explore the SWS fair ratio for Yangzijiang Financial Holding

Result: Price-to-Earnings of 4.6x (UNDERVALUED)

However, investors should weigh slowing net income growth and the still fresh restructuring pivot, which could expose execution risks and prolong the current period of derating.

Find out about the key risks to this Yangzijiang Financial Holding narrative.

Another Take: What Does Our DCF Say?

Our DCF model points to a fair value of about SGD0.63 per share, which is roughly 30% above the current SGD0.44 price and also screens as undervalued. When both earnings multiples and cash flow math lean the same way, the question becomes whether the market is overlooking something or pricing in risks that are hard to see.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Yangzijiang Financial Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Yangzijiang Financial Holding Narrative

If you would rather put your own spin on the numbers, you can dive into the data and craft a personalized view in just a few minutes, Do it your way.

A great starting point for your Yangzijiang Financial Holding research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investment move?

Do not stop at a single opportunity. Use the Simply Wall Street Screener now to uncover fresh angles, compare ideas, and stay ahead of slower investors.

- Target resilient income by reviewing these 13 dividend stocks with yields > 3% that can help anchor your portfolio through different market cycles.

- Capture early growth potential by scanning these 26 AI penny stocks that are harnessing artificial intelligence to reshape entire industries.

- Position yourself for asymmetric upside with these 80 cryptocurrency and blockchain stocks linked to the expanding world of digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報