KLA (KLAC) Valuation Check After Morgan Stanley’s Bullish WFE Outlook and Strong Cash Flow Signals

Morgan Stanley's upbeat wafer fab equipment outlook, supported by demand from TSMC and DRAM, has put KLA (KLAC) back in focus. Strong cash flows and bullish options activity are prompting investors to reassess the stock's potential upside.

See our latest analysis for KLA.

Despite a sharp 1 day share price pullback, KLA still sits near its record high at $1,193.92, with a 30 day share price return of 5.25 percent, a 90 day share price return of 20.73 percent and a standout year to date share price return of 87.54 percent. Its 5 year total shareholder return of 380.65 percent shows that long term momentum remains firmly intact.

If KLA's run has you thinking about where else capital might be working hard in semis and adjacent tech, it could be worth exploring high growth tech and AI stocks as your next hunting ground.

With the stock already brushing record highs and trading just below analyst targets, the key question is simple: Is KLA still mispriced relative to its cash flow power, or is the market already baking in the next leg of growth?

Most Popular Narrative: 7.3% Undervalued

With the narrative fair value sitting above KLA's last close of $1,193.92, the story frames current pricing as lagging its long term cash flow potential.

Multiyear customer investment roadmaps, especially at the leading edge in logic/foundry and HBM, are being supported by government incentives worldwide and increasing process complexity, giving KLA visibility into continued secular capital intensity and positioning the company to outperform WFE growth through 2026, sustaining long run revenue and FCF growth.

Curious what kind of revenue runway, margin gains, and earnings power are needed to back that higher fair value claim? The narrative leans on ambitious growth, rising profitability, and a punchy future earnings multiple. Want to see exactly how those moving parts add up to that price tag?

Result: Fair Value of $1287.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case still hinges on smooth execution, with China exposure and potential tariff escalation both capable of derailing those growth and margin assumptions.

Find out about the key risks to this KLA narrative.

Another Take: Market Ratios Flash Caution

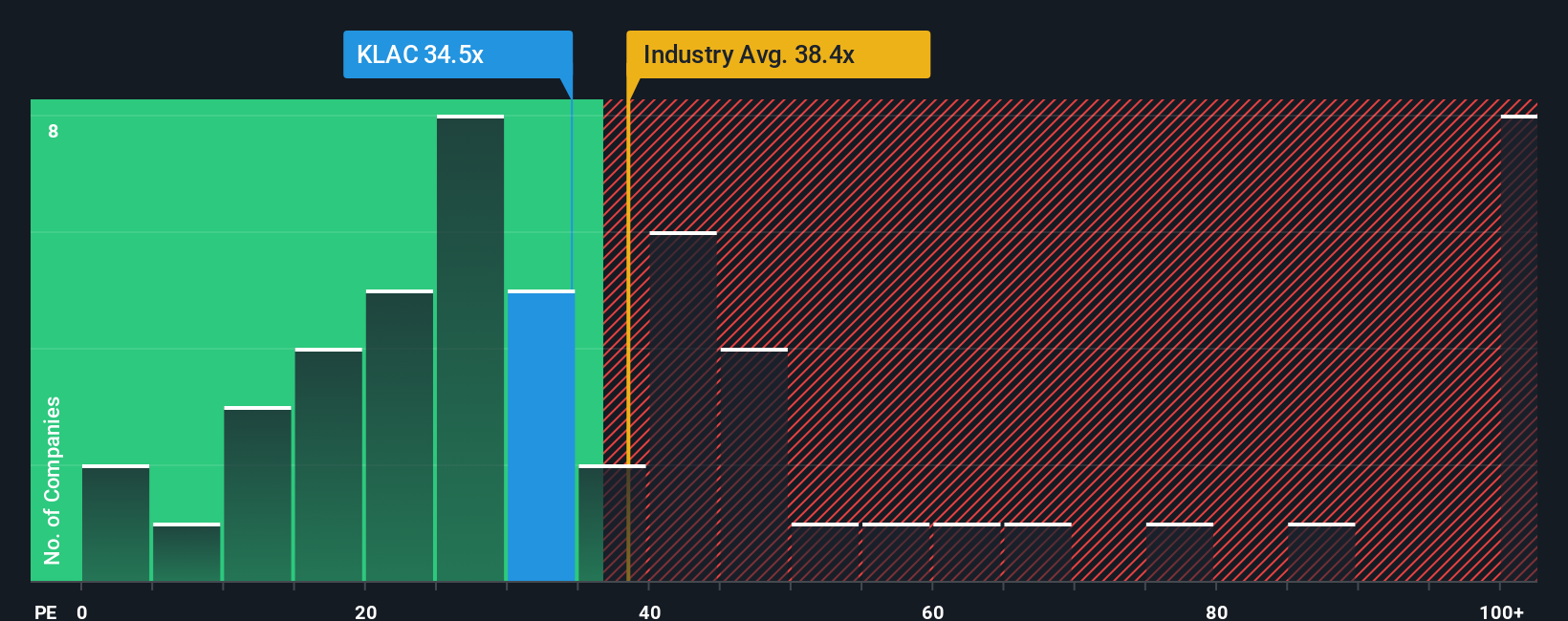

While the narrative points to a fair value above today’s price, the earnings multiple tells a cooler story. KLA trades on 37 times earnings, roughly in line with the US semiconductor average at 37 times and just below peers at 38.2 times, but well above its 28.5 times fair ratio. That gap suggests less room for error if growth or margins disappoint, so the question is whether the market is paying too much for quality.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KLA Narrative

If you see the story differently or want to stress test your own assumptions using the same data, you can build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding KLA.

Ready for your next investing move?

Do not stop at one great story. Use the Simply Wall Street screener to uncover fresh, data driven ideas that could sharpen and strengthen your portfolio.

- Explore potential mispriced quality by targeting companies trading below intrinsic value through these 908 undervalued stocks based on cash flows that may offer stronger long term upside.

- Position yourself for the next wave of innovation by backing potential winners in automation, data, and intelligent software with these 26 AI penny stocks.

- Seek dependable cash returns while markets shift by focusing on income opportunities in these 13 dividend stocks with yields > 3% that can support a steadier compounding journey.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報