Abu Dhabi National Hotels Company PJSC Leads 3 Middle Eastern Penny Stocks To Consider

The Middle Eastern stock markets have recently experienced a cooling period, with UAE stocks easing due to slipping oil prices and profit-taking following a strong rally. Despite these fluctuations, investors continue to explore opportunities in lesser-known segments of the market. Penny stocks, though an older term, still represent potential in smaller or newer companies that combine solid financials with growth possibilities. In this article, we explore three such penny stocks from the region that offer a blend of stability and potential upside for discerning investors.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.31 | SAR1.32B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.459 | ₪176.3M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.02 | AED2.08B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.60 | AED745.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR4.94 | SAR988M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.80 | AED323.4M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.67 | AED15.69B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.839 | AED510.32M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.521 | ₪197.89M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Abu Dhabi National Hotels Company PJSC (ADX:ADNH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Abu Dhabi National Hotels Company PJSC owns and manages hotels in the United Arab Emirates, with a market cap of AED5.70 billion.

Operations: The company generates revenue from various segments, including Hotels (AED1.50 billion), Catering Services (AED1.71 billion), and Transport Services (AED287.54 million).

Market Cap: AED5.7B

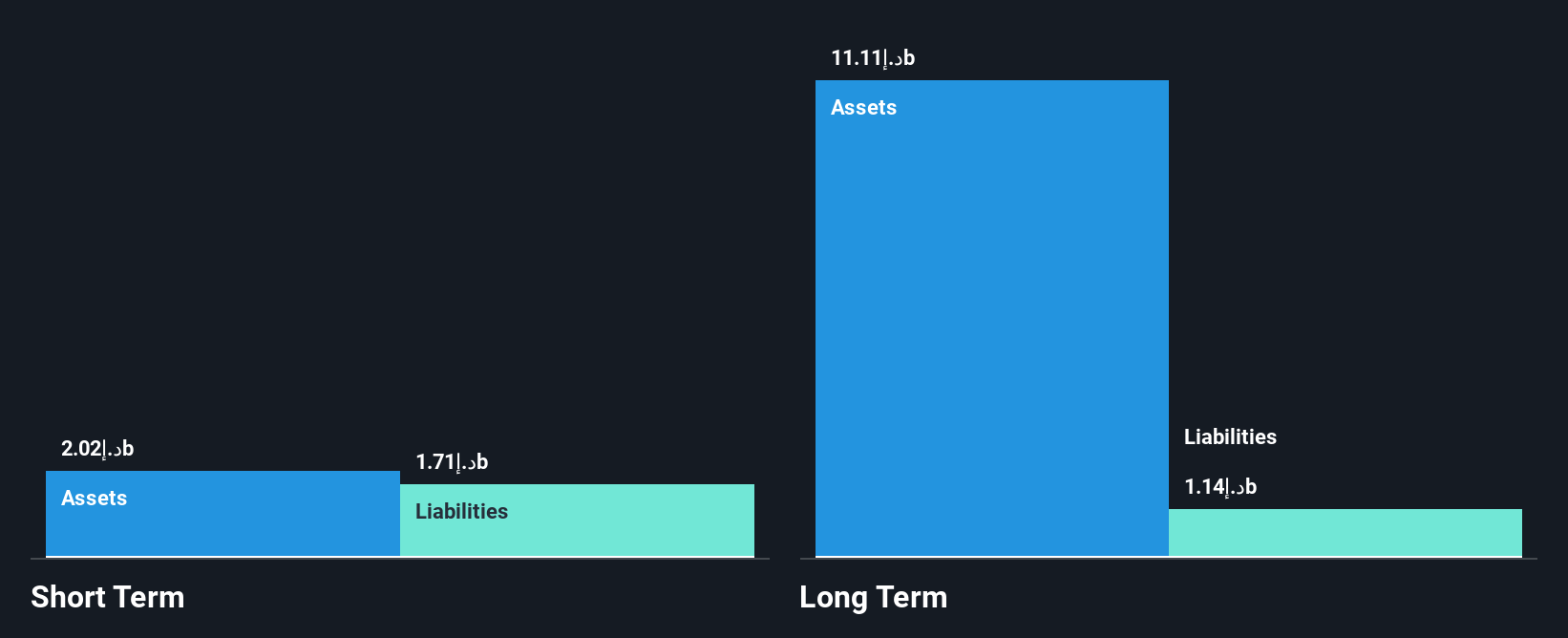

Abu Dhabi National Hotels Company PJSC, with a market cap of AED5.70 billion, has demonstrated financial stability through its diversified revenue streams across hotels, catering, and transport services. The company benefits from a seasoned management team and board of directors, alongside strong coverage of interest payments by EBIT (7.2x) and well-managed debt levels (net debt to equity ratio at 6.4%). However, despite significant earnings growth over the past five years, recent performance shows negative earnings growth and reduced profit margins compared to last year. The dividend yield remains high but is not fully covered by earnings or cash flows.

- Navigate through the intricacies of Abu Dhabi National Hotels Company PJSC with our comprehensive balance sheet health report here.

- Explore historical data to track Abu Dhabi National Hotels Company PJSC's performance over time in our past results report.

Al Wathba National Insurance Company PJSC (ADX:AWNIC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Al Wathba National Insurance Company PJSC operates in the general insurance and reinsurance sectors both within the United Arab Emirates and internationally, with a market capitalization of AED745.20 million.

Operations: The company generates revenue primarily from its Motor segment, amounting to AED297.39 million, and Investments, contributing AED233.76 million.

Market Cap: AED745.2M

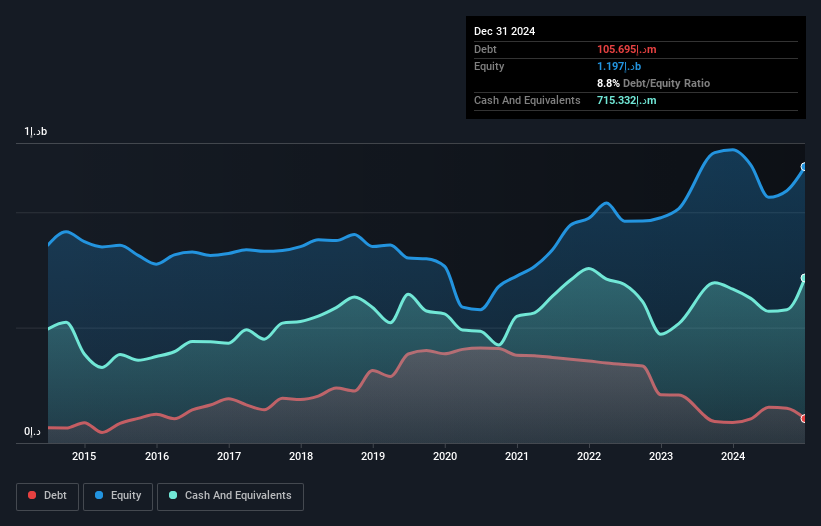

Al Wathba National Insurance Company PJSC, with a market cap of AED745.20 million, has shown resilience by achieving profitability over the past year. The company's financial health is bolstered by its cash reserves exceeding total debt and a reduced debt-to-equity ratio from 60.4% to 10.2% over five years. Recent earnings reports highlight significant growth, with net income for the third quarter reaching AED47.24 million, up from AED15.74 million a year ago, partly due to a one-off gain of AED90.5 million impacting results to September 2025. Despite high volatility in share price and an unstable dividend track record, the company maintains strong asset coverage against liabilities and benefits from experienced leadership under newly appointed CEO Shukri Salem Musabah Humaid Almheiri amid strategic transformation efforts.

- Click here to discover the nuances of Al Wathba National Insurance Company PJSC with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Al Wathba National Insurance Company PJSC's track record.

Tedea Technological Development and Automation (TASE:TEDE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tedea Technological Development and Automation Ltd., with a market cap of ₪18.22 million, operates through its subsidiaries to manufacture, import, market, and sell building materials in Israel.

Operations: The company generates revenue of ₪3.96 million from its Electronic Components & Parts segment.

Market Cap: ₪18.22M

Tedea Technological Development and Automation Ltd., with a market cap of ₪18.22 million, operates in the building materials sector but is currently unprofitable and lacks meaningful revenue. Despite this, the company benefits from being debt-free and having sufficient cash runway for over a year based on current free cash flow. Its seasoned management team, averaging 17.4 years of experience, may provide stability as it navigates financial challenges. However, short-term liabilities slightly exceed assets (₪5.2M vs ₪4.6M), highlighting potential liquidity concerns that investors should monitor closely in this volatile segment.

- Click here and access our complete financial health analysis report to understand the dynamics of Tedea Technological Development and Automation.

- Examine Tedea Technological Development and Automation's past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Gain an insight into the universe of 80 Middle Eastern Penny Stocks by clicking here.

- Ready For A Different Approach? We've found 13 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報