ASX Penny Stocks Spotlight: DUG Technology Among 3 Noteworthy Picks

As Australian shares face a challenging start to the week, influenced by global tech sector declines, investors may find themselves exploring alternative opportunities within the market. Penny stocks, often representing smaller or newer companies, continue to capture interest despite their somewhat outdated label. By focusing on those with solid financial foundations and potential for growth, these stocks can offer surprising value and stability in uncertain times.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.41 | A$117.5M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.495 | A$70.52M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.78 | A$48.57M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.88 | A$442.63M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.12 | A$230.45M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$39.99M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.90 | A$3.31B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.24 | A$1.37B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.94 | A$135.3M | ✅ 4 ⚠️ 3 View Analysis > |

| GWA Group (ASX:GWA) | A$2.41 | A$632.09M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 427 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

DUG Technology (ASX:DUG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DUG Technology Ltd is a technology company offering hardware and software solutions to the technology and resource sectors across Australia, the United States, the United Kingdom, Malaysia, and the United Arab Emirates, with a market cap of A$281.66 million.

Operations: The company's revenue is derived from three main segments: Hpcaas ($27.44 million), Services ($51.87 million), and Software ($10.47 million).

Market Cap: A$281.66M

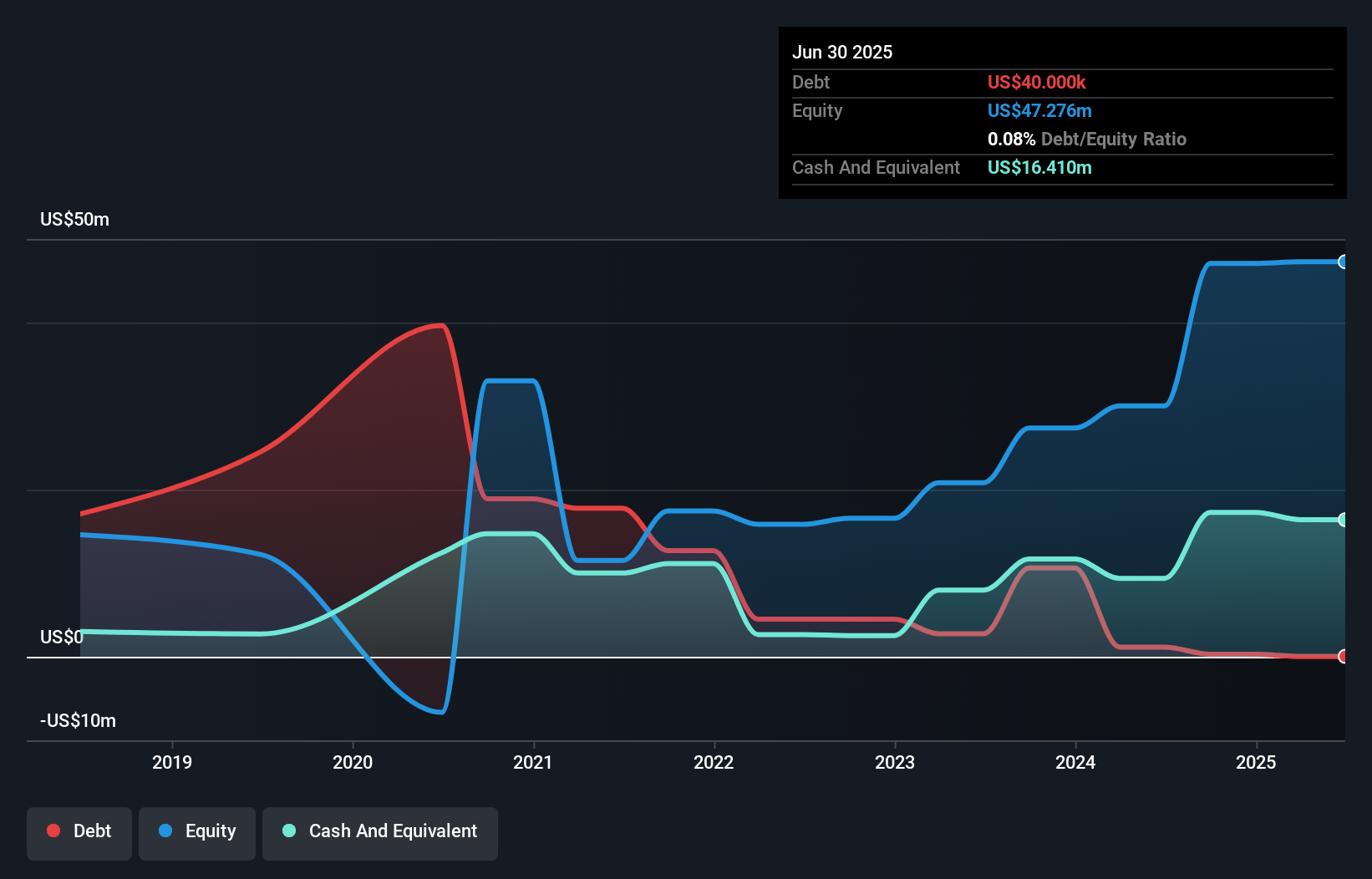

DUG Technology Ltd, with a market cap of A$281.66 million, provides hardware and software solutions to various sectors globally. The company has three revenue streams: Hpcaas (A$27.44 million), Services (A$51.87 million), and Software (A$10.47 million). Despite being unprofitable, DUG has improved its financial position from negative shareholder equity five years ago to positive now, indicating progress in reducing losses by 51.3% annually over the past five years. It trades at 83.1% below its estimated fair value and maintains more cash than total debt, suggesting potential for future growth despite current challenges in profitability and volatility stability at 7%.

- Jump into the full analysis health report here for a deeper understanding of DUG Technology.

- Understand DUG Technology's earnings outlook by examining our growth report.

Immutep (ASX:IMM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Immutep Limited is a biotechnology company focused on developing novel Lymphocyte Activation Gene-3 related immunotherapies for cancer and autoimmune diseases in Australia, with a market cap of A$552.65 million.

Operations: The company's revenue is primarily derived from its immunotherapy segment, which generated A$5.03 million.

Market Cap: A$552.65M

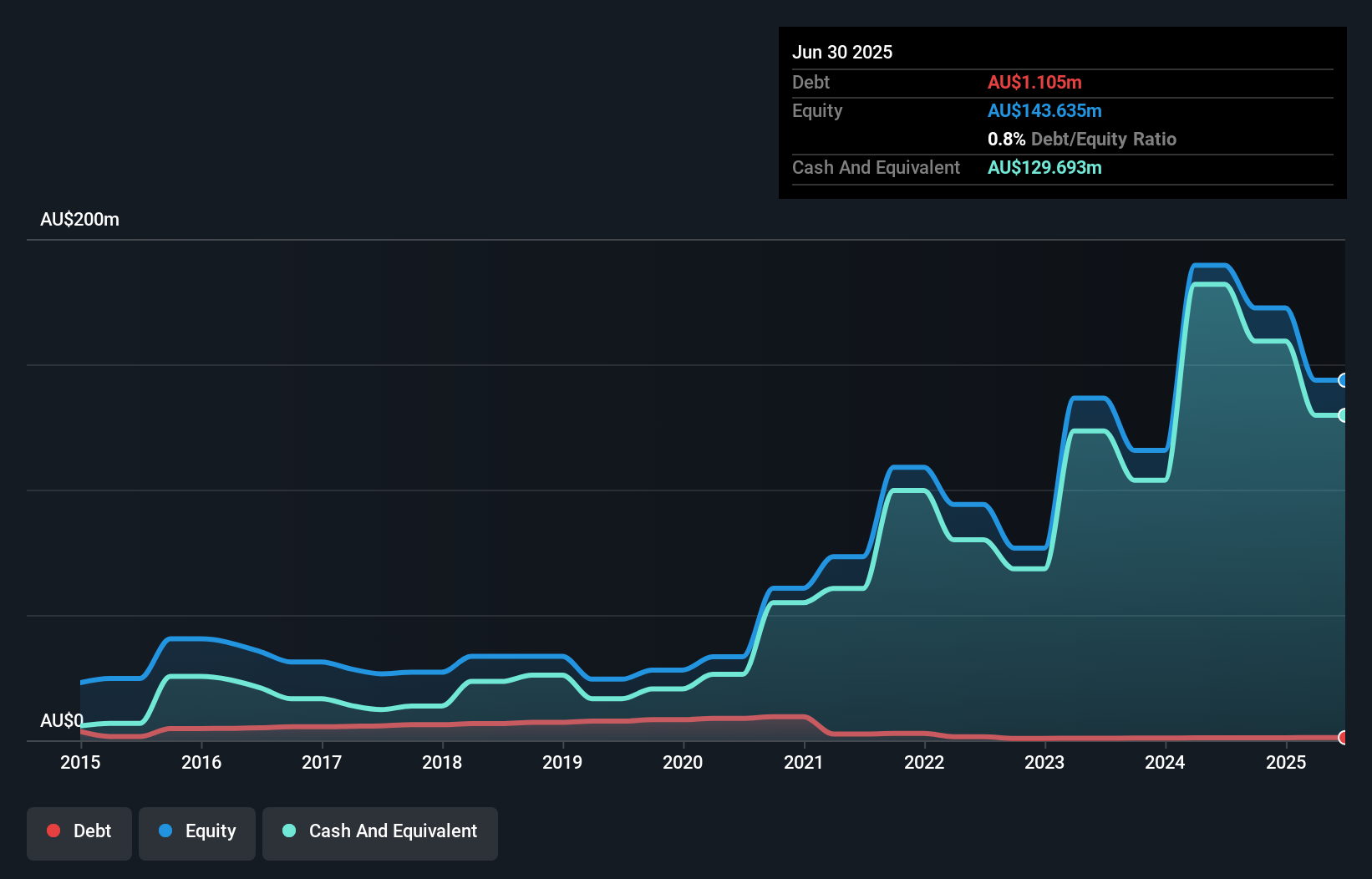

Immutep Limited, a biotechnology company with a market cap of A$552.65 million, is focused on developing immunotherapies and has recently entered into a strategic collaboration with Dr. Reddy’s Laboratories for the development and commercialization of its lead product, eftilagimod alfa (efti), in selected markets. The agreement includes an upfront payment of US$20 million and potential milestone payments up to US$349.5 million, alongside double-digit royalties on sales. Despite being pre-revenue with A$5 million in revenue from its immunotherapy segment, Immutep's strong cash position exceeds both short-term and long-term liabilities, supporting ongoing clinical trials for various cancers.

- Take a closer look at Immutep's potential here in our financial health report.

- Explore Immutep's analyst forecasts in our growth report.

Wagners Holding (ASX:WGN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wagners Holding Company Limited produces and sells construction and related building materials across several countries, including Australia, the United States, New Zealand, the United Kingdom, Papua New Guinea, and Malaysia; it has a market cap of A$719.01 million.

Operations: Wagners Holding generates revenue through its Construction Materials segment at A$257.69 million, Project Services at A$105.71 million, Earth Friendly Concrete at A$0.16 million, and Composite Fibre Technology at A$68.45 million.

Market Cap: A$719.01M

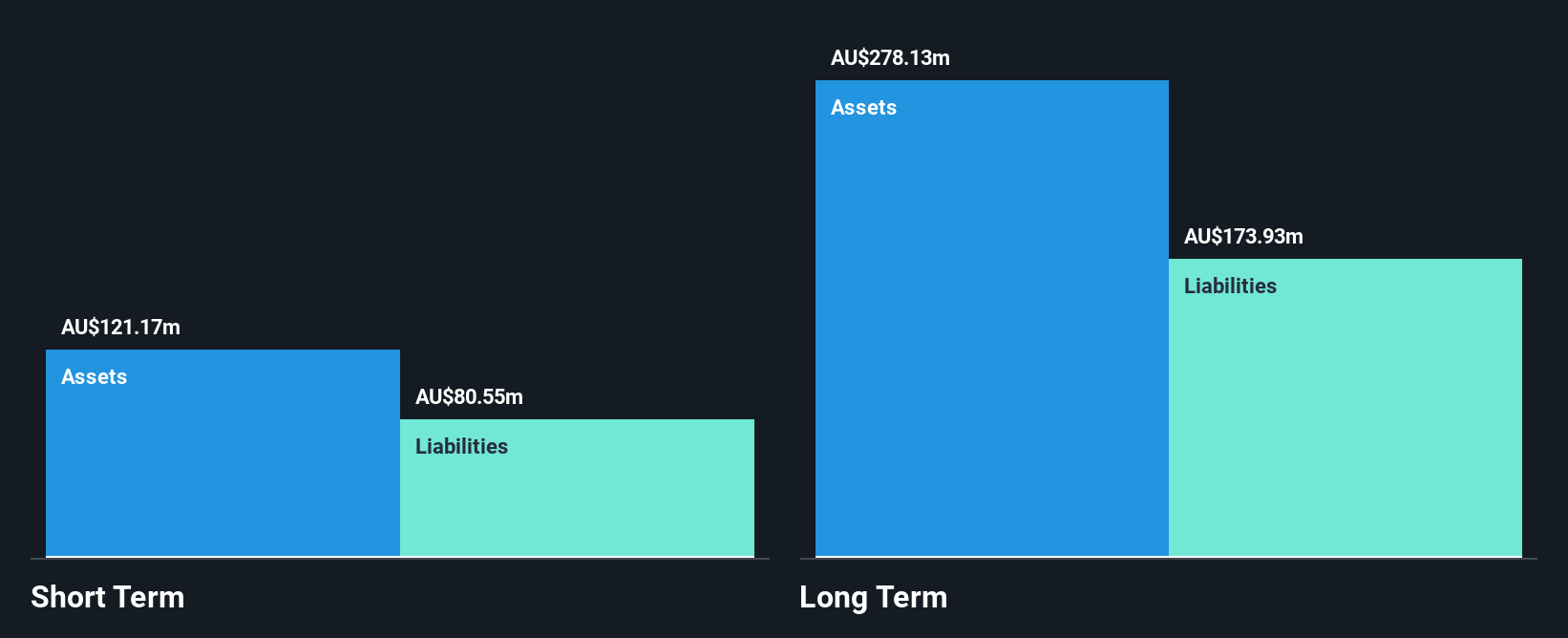

Wagners Holding, with a market cap of A$719.01 million, has shown robust financial health and growth potential. Its interest payments are well covered by EBIT, and the net debt to equity ratio of 12.6% is satisfactory. The company has experienced management and board teams with average tenures over eight years. While short-term assets cover short-term liabilities, they fall short for long-term obligations. However, Wagners' debt reduction over five years and substantial earnings growth of 120.9% last year indicate strong operational performance in its construction materials segment, supported by inclusion in the S&P/ASX Emerging Companies Index recently.

- Navigate through the intricacies of Wagners Holding with our comprehensive balance sheet health report here.

- Gain insights into Wagners Holding's outlook and expected performance with our report on the company's earnings estimates.

Make It Happen

- Explore the 427 names from our ASX Penny Stocks screener here.

- Looking For Alternative Opportunities? Uncover 11 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報