Vestas (CPSE:VWS) Valuation Check After Major New European Wind Turbine Orders and Growing Investor Optimism

Vestas Wind Systems (CPSE:VWS) has been busy, landing a string of European turbine orders from Germany to Poland and Italy, as well as a large undisclosed 660 MW EMEA deal that underlines sustained demand for its platforms.

See our latest analysis for Vestas Wind Systems.

These orders are landing against a strong backdrop, with the share price up 46.14 percent over the past 90 days and a hefty 63.51 percent year to date. The 1 year total shareholder return of 80.16 percent highlights how quickly sentiment has swung despite weak multi year total returns.

If this momentum in renewables has your attention, it could be a good moment to explore other opportunities in high growth tech and clean energy by screening high growth tech and AI stocks.

Yet with the share price already racing ahead of analyst targets and recent earnings growth, the real question now is whether Vestas still trades below its long term potential, or whether markets have fully priced in its clean energy runway.

Most Popular Narrative: 9.6% Overvalued

With Vestas shares closing at DKK171.20 against a narrative fair value of about DKK156.26, expectations are running ahead of the projected fundamentals.

The analysts have a consensus price target of DKK139.905 for Vestas Wind Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of DKK195.99, and the most bearish reporting a price target of just DKK60.0.

Want to see what kind of revenue ramp, margin lift and future earnings multiple could still justify today’s price, even after this rally? Dive in for the full playbook.

Result: Fair Value of $156.26 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, order volatility and offshore ramp up losses could quickly challenge margin assumptions, forcing analysts to reassess both earnings visibility and valuation.

Find out about the key risks to this Vestas Wind Systems narrative.

Another View: Multiples Paint A Different Picture

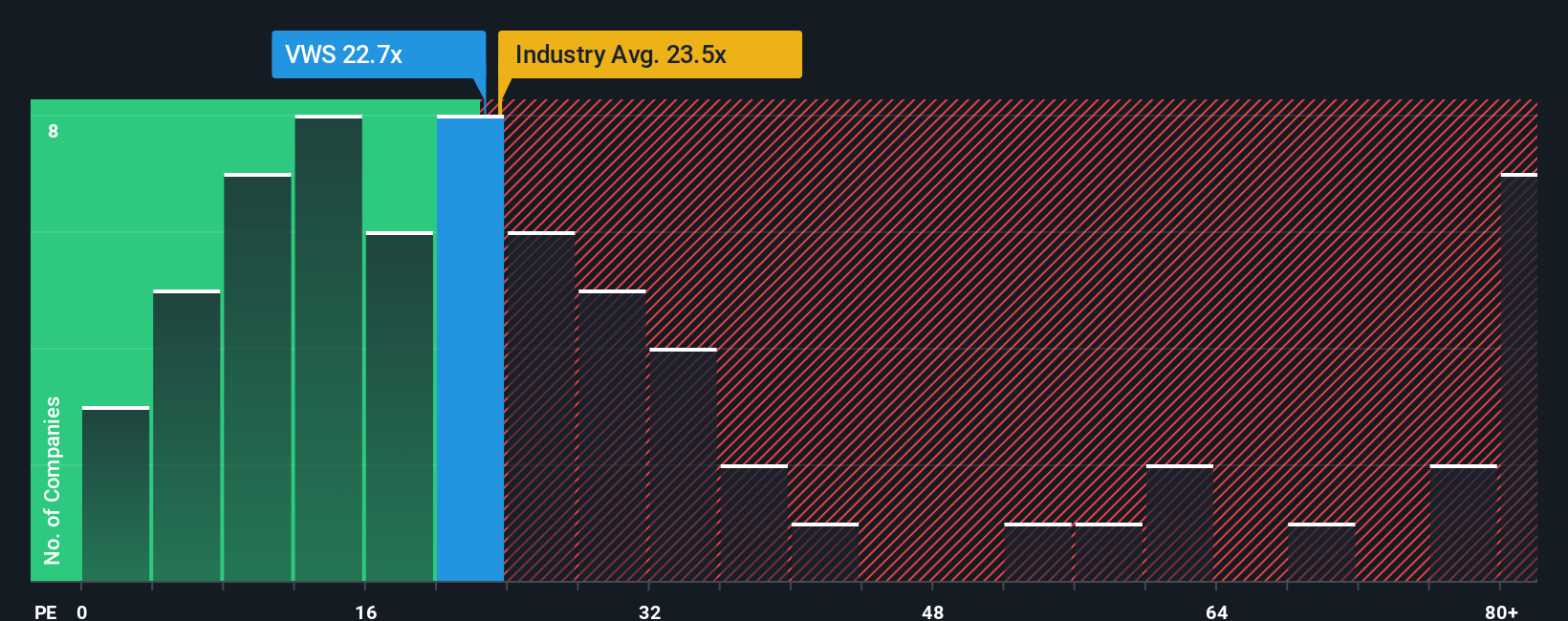

While the narrative fair value implies Vestas is 9.6 percent overvalued, its 24.3 times earnings multiple is actually cheaper than peers at 27.9 times and below a 27.2 times fair ratio. That gap hints at upside if sentiment stays strong, or it may flag valuation risk if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vestas Wind Systems Narrative

If you would rather challenge these assumptions with your own data checks and scenarios, you can build a complete narrative in minutes: Do it your way.

A great starting point for your Vestas Wind Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before this momentum shifts again, use the Simply Wall St screener to uncover fresh opportunities that match your strategy and keep you a step ahead.

- Target reliable income streams by scanning these 13 dividend stocks with yields > 3% that can support a compounding, long term portfolio.

- Position for megatrends in automation and data by focusing on these 26 AI penny stocks shaping the next wave of growth.

- Hunt for potential bargains by filtering these 908 undervalued stocks based on cash flows where market pessimism may have gone too far.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報