GF Securities: Will Hong Kong stocks be absent in this round of spring turbulence?

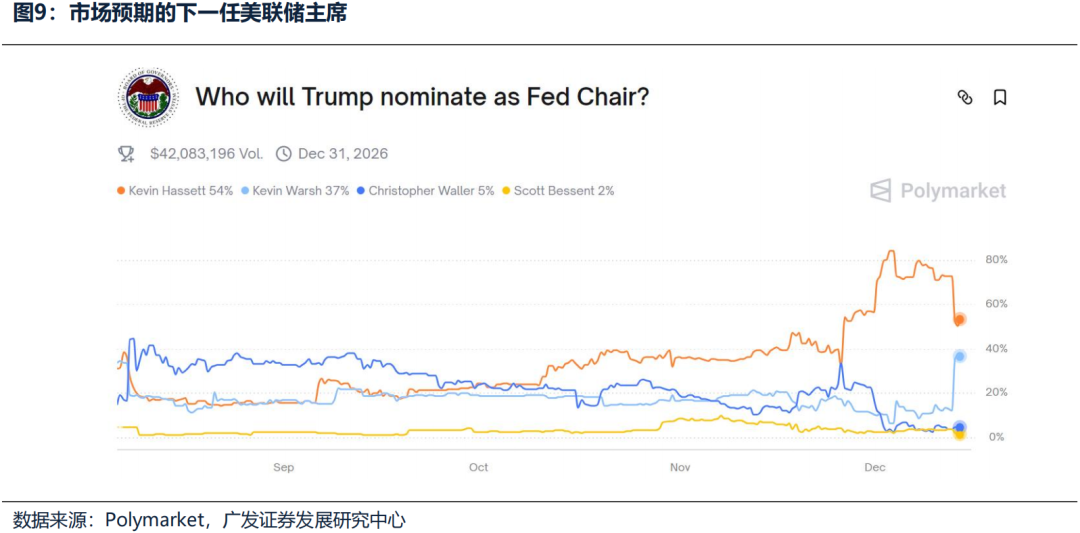

The Zhitong Finance App learned that GF Securities released a research report saying that the new Federal Reserve Chairman's interest rate cut path is hawkish. There is no need to worry. Hassett, who was the most likely chairman before, plummeted his chances of being elected from 78% to 54% after publishing hawkish interest rate cuts, indicating that the market expects the next Federal Reserve Chairman to be partial. In Trump's eyes, “obedience” is more important than “professional.” Therefore, no matter who becomes the next chairman of the Federal Reserve, it is unlikely that an extremely hawkish interest rate cut will occur. The spring turbulence of Hong Kong stocks will not be absent this year. It may be due to liquidity easing and incremental capital exceeding expectations, ushering in a year of strong spring turmoil. What we can look forward to and pay attention to at the beginning of next year is the progress of the DeepSeek model and the progress of C-side applications by major domestic internet companies, which may positively catalyze the emergence of fundamentals of the Hang Seng Technology Index.

The main views of GF Securities are as follows:

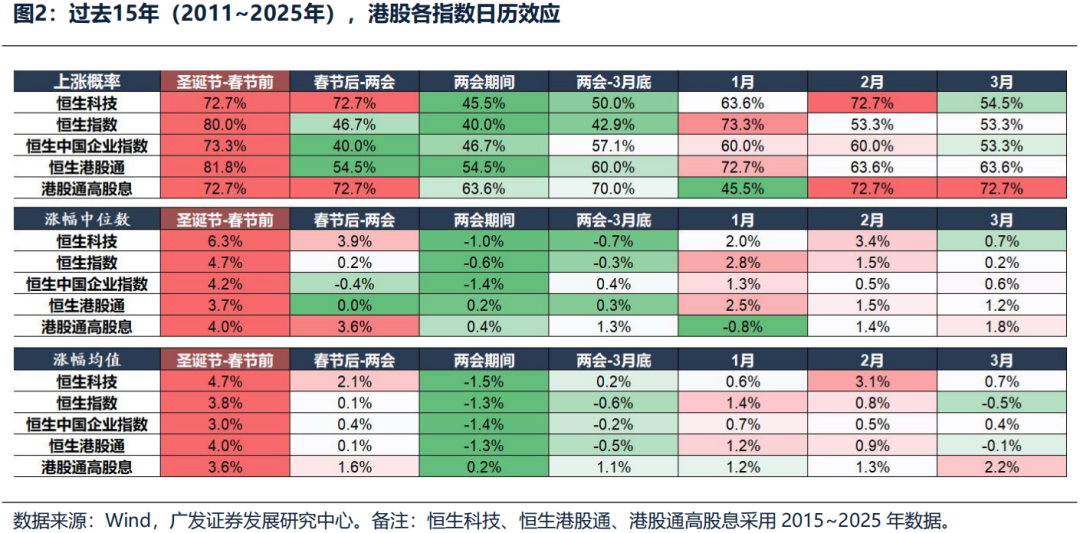

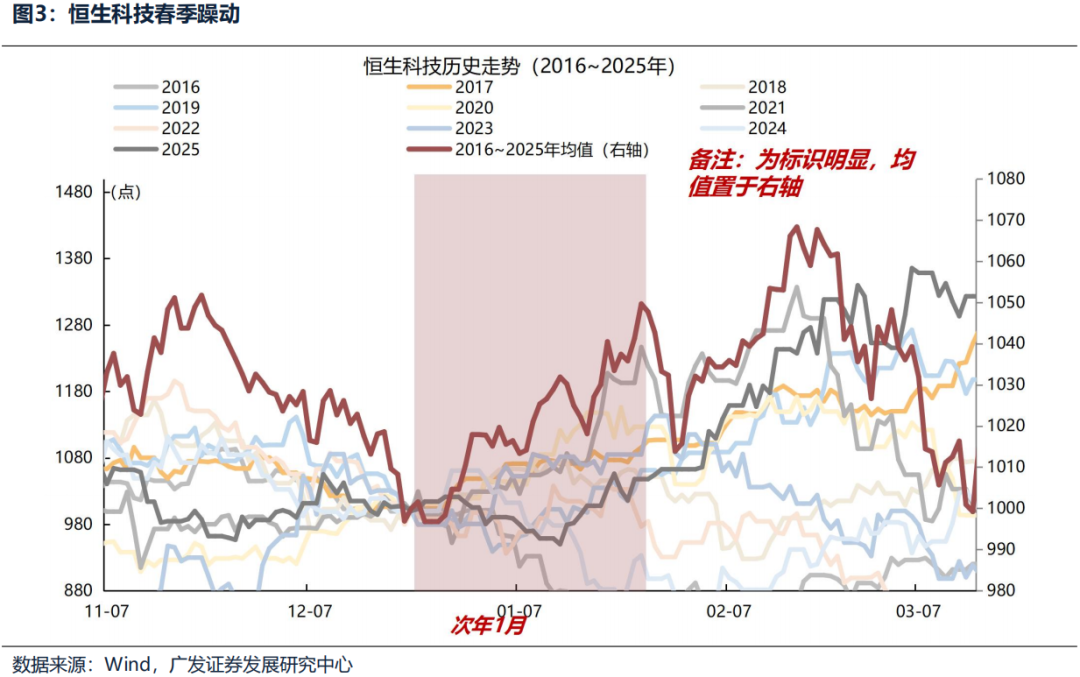

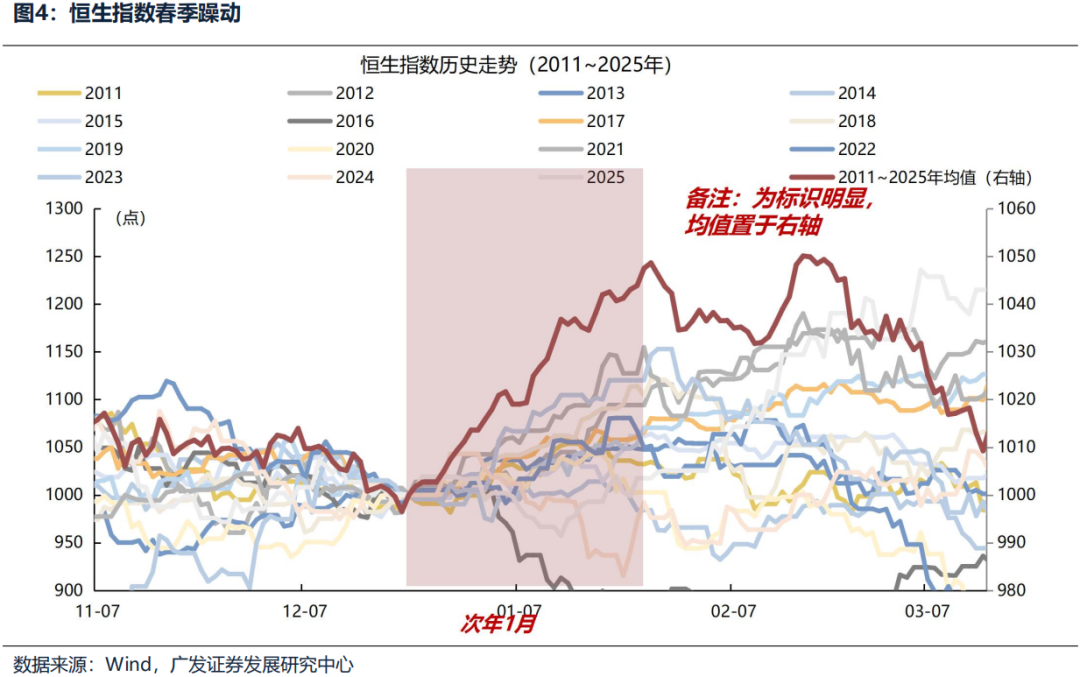

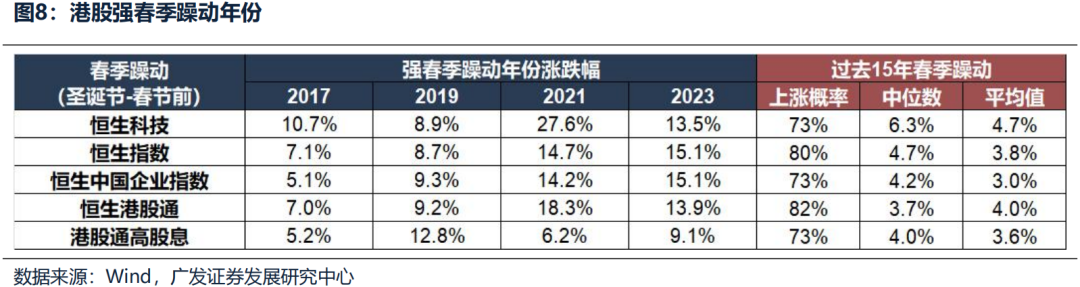

There is a clear time difference between the spring agitation of Hong Kong stocks (before Christmas to before the Spring Festival) and the spring agitation period for A-shares (after the Spring Festival - during the two sessions). In the past 15 years, during the spring turbulence of Hong Kong stocks, the probabilities of the Hang Seng Technology and Hang Seng Index rising were 72.7% and 80.0% respectively. The median increases were 6.3% and 4.7%, respectively, and the average increases were 4.7% and 3.8%, respectively.

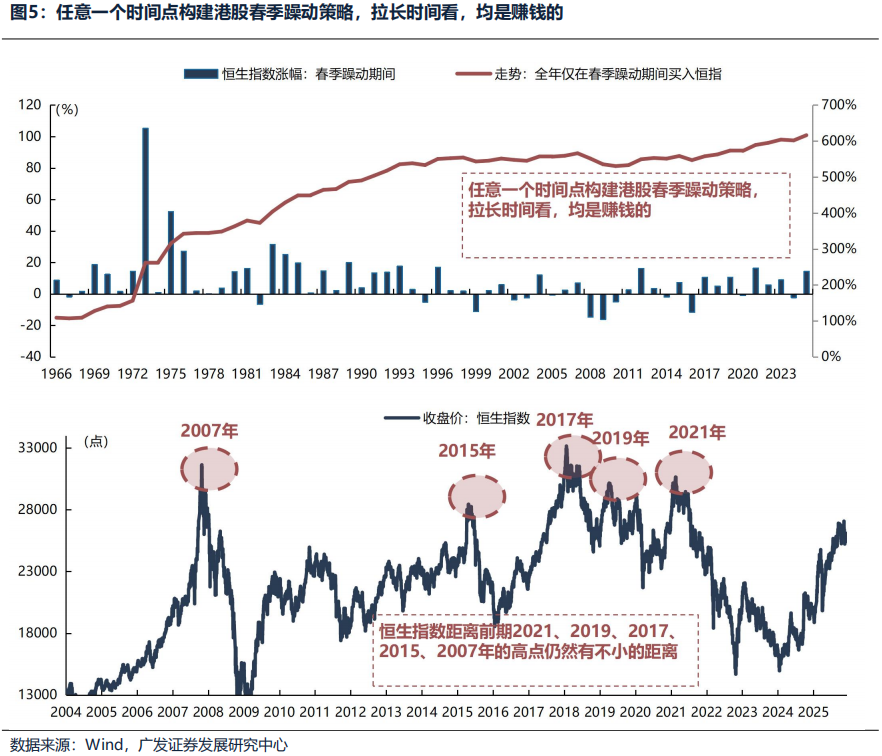

There is no particularly reasonable explanation for the emergence of the Christmas market, but due to the extremely high win rate and widespread dissemination of the Christmas market, the probability that the S&P 500 will rise 81% in the past 97 years and the probability that the Hang Seng Index will rise 77% in the past 59 years. Long-term seasonal patterns may reinforce investors' expectations and form a “self-fulfilling prophecy” momentum effect with the support of quantitative capital.

One way to boost earnings: Hong Kong stocks are restless in spring. Currently, the Hang Seng Index is still quite far from previous highs. However, due to the high winning rate of Hong Kong stocks in spring, it has been profitable to build a strategy focusing on investing in the Hang Seng Index in spring from any point in the past.

When will the spring turbulence of Hong Kong stocks fail/move backwards?

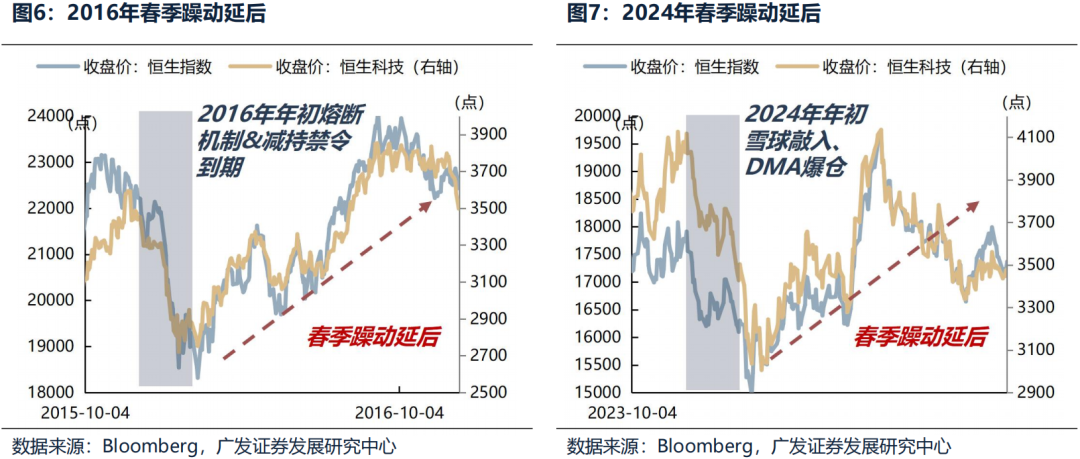

There was no spring agitation in 2014 due to overseas liquidity shocks; while 2016 and 2024 were mainly due to the impact of risk events. The former was due to the impact of risk events. The former was the concentration of snowballs knocking in & DMA bursting out of positions, causing spring unrest to move after the Spring Festival.

When are Hong Kong stocks more volatile in spring?

First, liquidity relaxation/incremental capital exceeded expectations, such as 2021 and 2023. Second, short-term macroeconomic data exceeded expectations/profits of listed companies increased, such as 2017 and 2019.

Will this round of spring turbulence in Hong Kong stocks expire? A few current liquidity concerns:

(1) Closing Japanese arbitrage trades: No need to worry too much. The market fully anticipates Japan's interest rate hike and the Federal Reserve's interest rate cut. Stock positions in arbitrage trading have clearly shrunk, and the probability of a liquidity impact is weak.

(2) Hong Kong stock ban lifted: The peak has passed, and there is little pressure to lift the ban. The peak of lifting the ban at the end of the year and the beginning of the year has passed. A total of HK$126 billion of restricted shares was lifted in December, and fell below HK$50 billion in January.

(3) The new Federal Reserve Chairman's interest rate cut path is hawkish: there is no need to worry. After issuing hawkish interest rate cuts, the probability of being elected plummeted from 78% to 54%, indicating that the market expects the next Federal Reserve Chairman to be partial. In Trump's eyes, “obedience” is more important than “professionalism.” Therefore, no matter who becomes the next chairman of the Federal Reserve, it is unlikely that an extremely hawkish interest rate cut will occur. The spring turbulence of Hong Kong stocks will not be absent this year. It may be due to liquidity easing and incremental capital exceeding expectations, ushering in a year of strong spring turmoil. What we can look forward to and pay attention to at the beginning of next year is the progress of the DeepSeek model and the progress of C-side applications by major domestic internet companies, which may positively catalyze the emergence of fundamentals of the Hang Seng Technology Index.

Risk warning: geopolitical risk, risk of overseas inflation, low expectations for steady domestic growth policies, etc.

Nasdaq

Nasdaq 華爾街日報

華爾街日報