Does BMW Still Offer Value After a 26.3% One Year Share Price Surge in 2025?

- If you are wondering whether Bayerische Motoren Werke is still good value after a strong run, you are not alone. This breakdown is designed to give you a clear, no nonsense view of the stock.

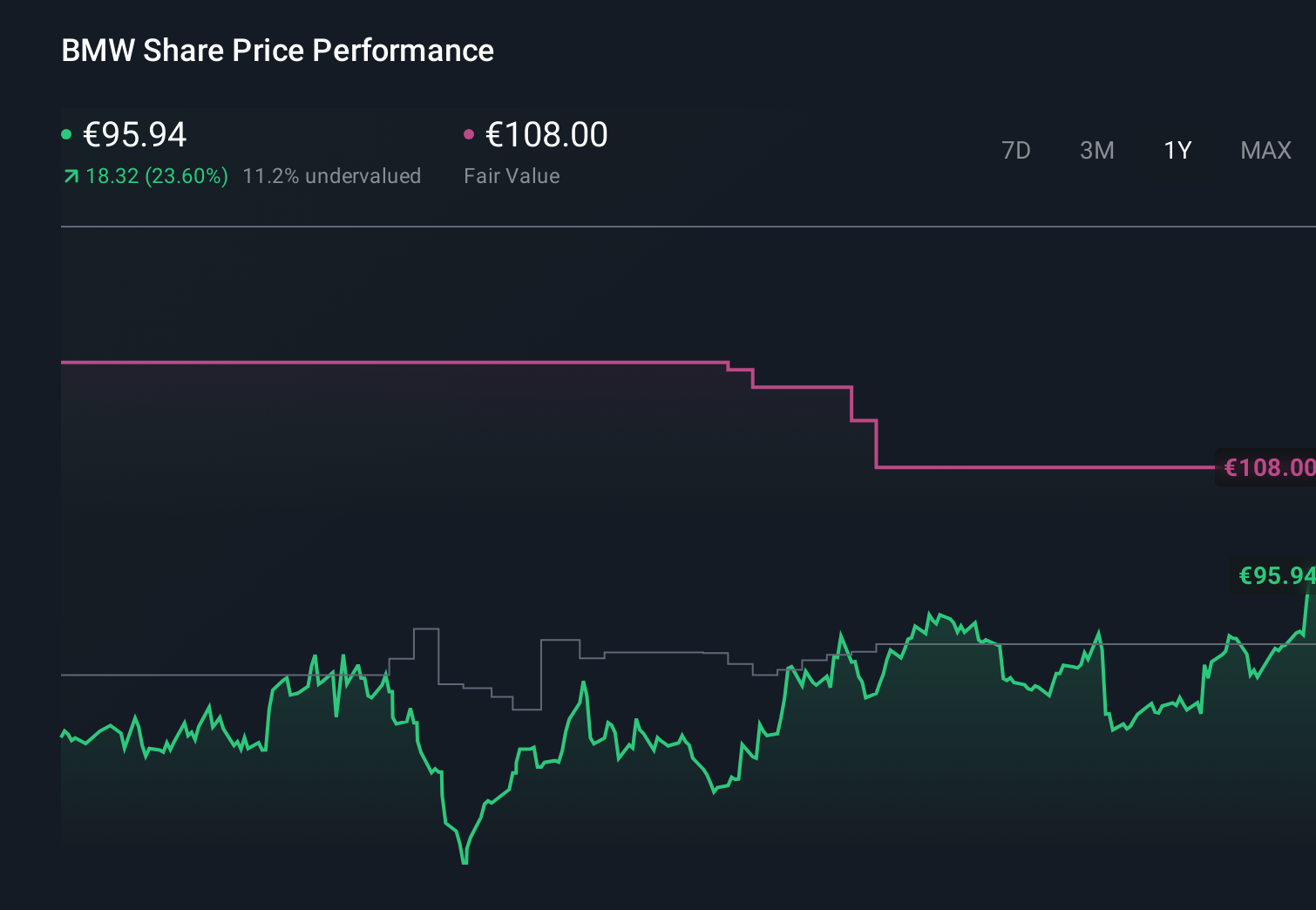

- The share price has climbed to about €95.94, locking in gains of roughly 8.1% over the last month, 22.8% year to date and 26.3% over the past year, while still sitting on a solid 73.0% return over five years despite a small 0.5% slip this week.

- Much of this momentum has been driven by ongoing optimism around BMW's push into higher margin models and its expanding electric vehicle lineup, alongside market expectations that traditional automakers with strong brands can still thrive in a more competitive EV landscape. At the same time, shifting sentiment around European industrials and auto demand, plus debate over regulatory changes in key markets, has added some extra volatility around the story.

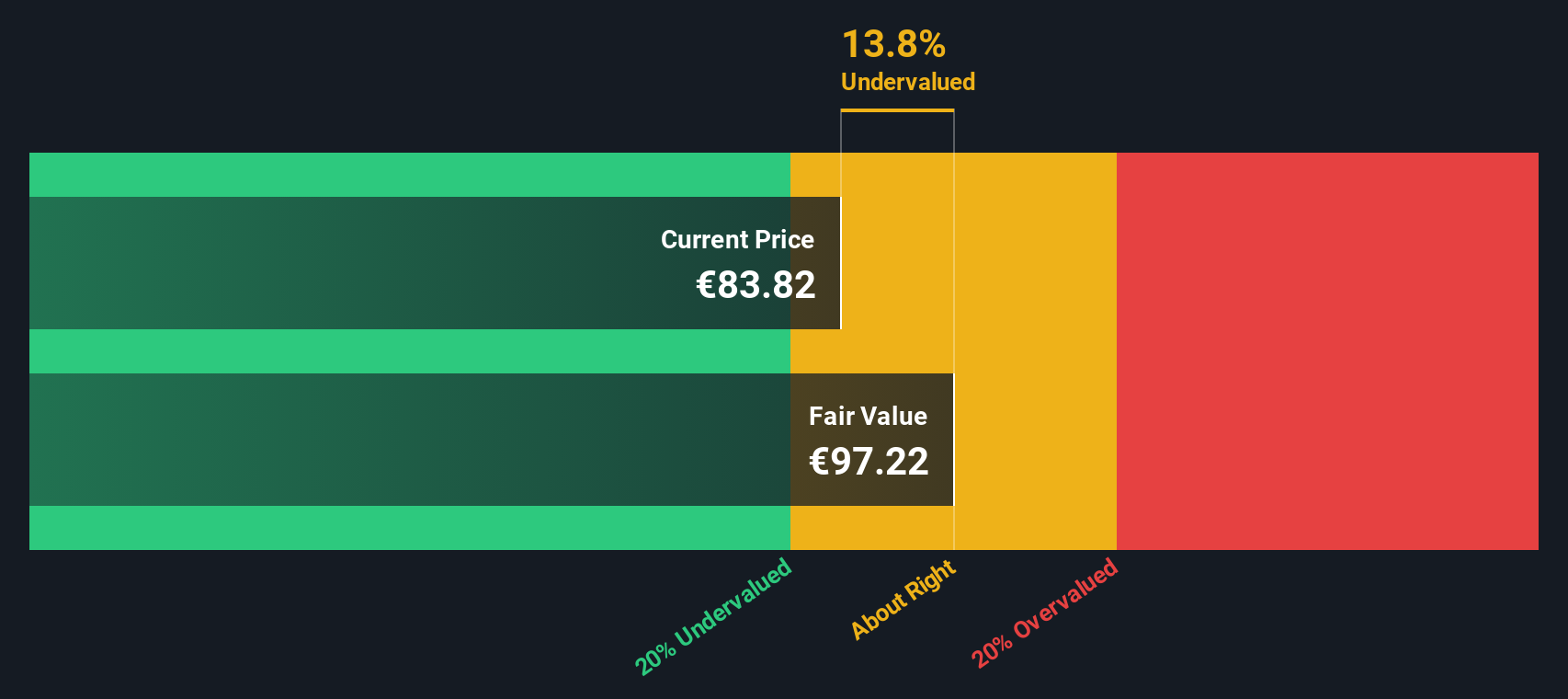

- On our numbers, Bayerische Motoren Werke scores a solid 5/6 valuation score. This suggests the market may still be underestimating parts of the business and sets us up to explore how different valuation methods stack up, before we finish with an even more intuitive way of thinking about what the stock is really worth.

Approach 1: Bayerische Motoren Werke Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in € terms.

For Bayerische Motoren Werke, the latest twelve month free cash flow is about €646 Million. Analysts and internal estimates see this rising steadily, with projections reaching roughly €8.6 Billion by 2035 as part of a 2 Stage Free Cash Flow to Equity model. Near term forecasts out to 2029, such as around €6.0 Billion to €7.0 Billion of annual free cash flow, are based on analyst estimates. The later years are extrapolated to reflect a slowing, more mature growth phase.

When all these future cash flows are discounted back, the model arrives at an intrinsic value of about €134.20 per share. Against the current share price near €95.94, this implies the stock is around 28.5% undervalued, suggesting a meaningful valuation gap if the cash flow trajectory proves accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bayerische Motoren Werke is undervalued by 28.5%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: Bayerische Motoren Werke Price vs Earnings

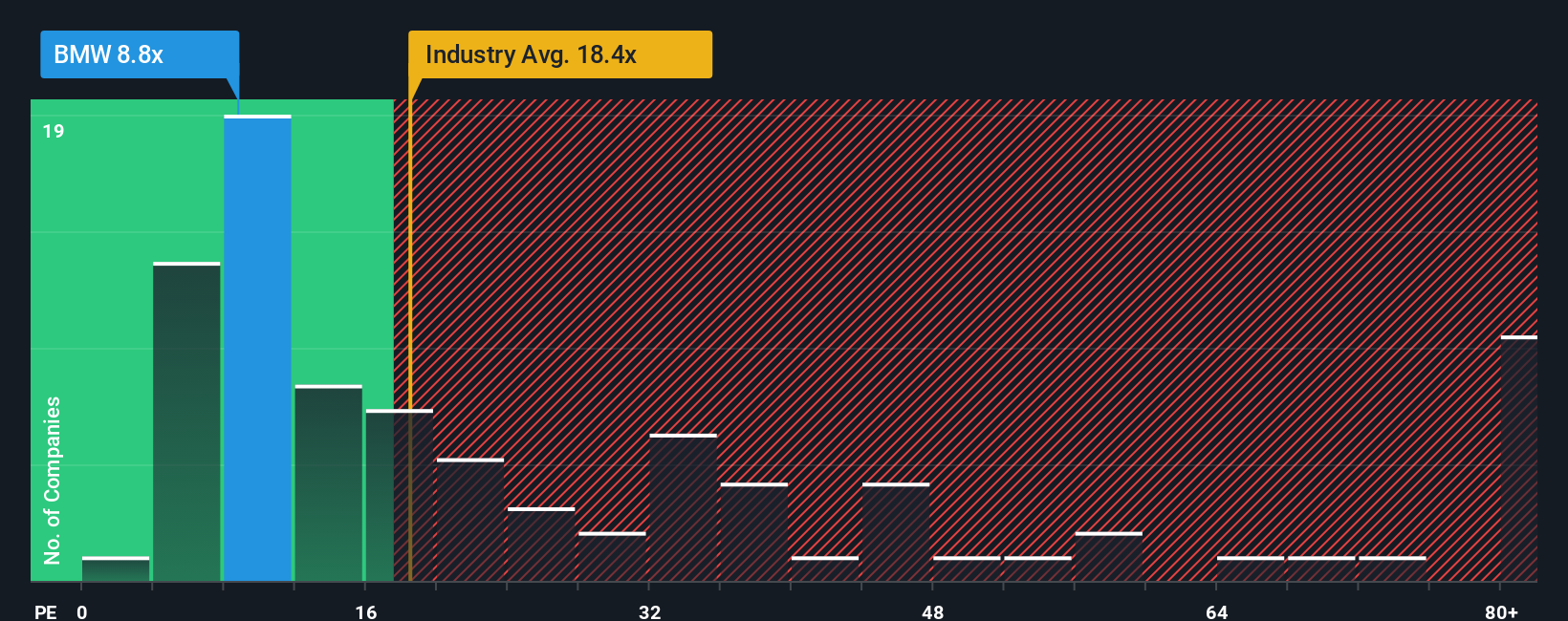

For a profitable and relatively mature business like Bayerische Motoren Werke, the price to earnings (PE) ratio is a practical way to gauge what investors are willing to pay for each euro of current profits. In general, companies with stronger growth prospects and lower perceived risk deserve a higher PE multiple, while slower growing or riskier firms tend to trade on lower PE ratios.

BMW currently trades on a PE of about 8.4x, which is well below both the Auto industry average of roughly 18.7x and a broader peer group average near 19.6x. On the surface, that discount might suggest the market is cautious about the sustainability of earnings or the cyclicality of auto demand.

Simply Wall St’s Fair Ratio framework refines this view by estimating what PE multiple BMW should trade on, given its earnings growth outlook, profitability, industry, market cap and risk profile. For BMW, this Fair Ratio comes out at about 12.2x, which indicates the stock may warrant a materially higher multiple than the current 8.4x. Because this approach adjusts for company specific fundamentals rather than relying solely on blunt peer or sector comparisons, it provides a more nuanced valuation signal and indicates that the shares may be undervalued on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bayerische Motoren Werke Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you describe the story you believe about a company and connect that story directly to your assumptions about future revenue, earnings, margins and fair value.

A Narrative links three things together: what you think will drive the business, how that translates into a financial forecast, and what that forecast implies as a fair value. This way, you are no longer looking at numbers in isolation but in the context of a clear, written thesis.

On Simply Wall St, Narratives are an easy to use tool available on the Community page. Millions of investors create and share their own perspectives, then see an automatically calculated fair value they can compare to the current share price to decide whether a stock looks like a buy, a sell, or something to watch.

Because Narratives are dynamically updated as new information comes in, such as earnings results or major news, your fair value view can evolve in real time. This is why for Bayerische Motoren Werke some investors currently see fair value near €135 while others are closer to €89, reflecting very different expectations for its long term EV success and profitability.

For Bayerische Motoren Werke however we will make it really easy for you with previews of two leading Bayerische Motoren Werke Narratives:

🐂 Bayerische Motoren Werke Bull Case

Fair value: €135.07

Implied undervaluation: 28.9%

Forecast revenue growth: 5%

- Sees BMW as a leading premium EV manufacturer in five years, driven by Neue Klasse models, strong brand power and resilient luxury demand.

- Expects margins to expand toward 8% to 10% on the back of higher margin software, digital services and premium models, alongside ongoing cost optimization.

- Views the current low P/E multiple as unjustified given BMW’s EV strategy and profitability, implying meaningful upside if execution on electrification stays on track.

🐻 Bayerische Motoren Werke Bear Case

Fair value: €88.59

Implied overvaluation: 8.3%

Forecast revenue growth: 3.38%

- Recognizes a strong pipeline of premium and ultra premium EV and luxury models, plus cost control and network optimization, as supports for margins and cash flow.

- Highlights material risks from tariffs, structural pressure and pricing challenges in China, and intense EV competition that could cap margins and growth.

- Concludes that the current price is close to analyst fair value, suggesting limited upside unless execution and external conditions turn out better than expected.

Do you think there's more to the story for Bayerische Motoren Werke? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報