Reassessing Air France-KLM (ENXTPA:AF) Valuation After CMA CGM’s Convertible Bond Linked to Its 8.8% Stake

Why CMA CGM's Move Jolted Air France-KLM Shares

The latest jolt in Air France-KLM (ENXTPA:AF) came from outside the cockpit, with major shareholder CMA CGM announcing a three year equity linked bond tied to its entire 8.8% stake.

This structure effectively puts a timer on potential share issuance. That helps explain why the stock slid around 9% as investors quickly repriced dilution risk, future selling pressure, and the balance between short term volatility and long term value.

See our latest analysis for Air France-KLM.

The move lands after a strong run, with the share price up about 37% year to date and the 1 year total shareholder return near 39%. However, that 90 day share price pullback hints that momentum is now wobbling rather than building.

If this kind of volatility has you thinking about diversification across transport and defense names, it could be worth exploring aerospace and defense stocks as a way to spot other ideas on your radar.

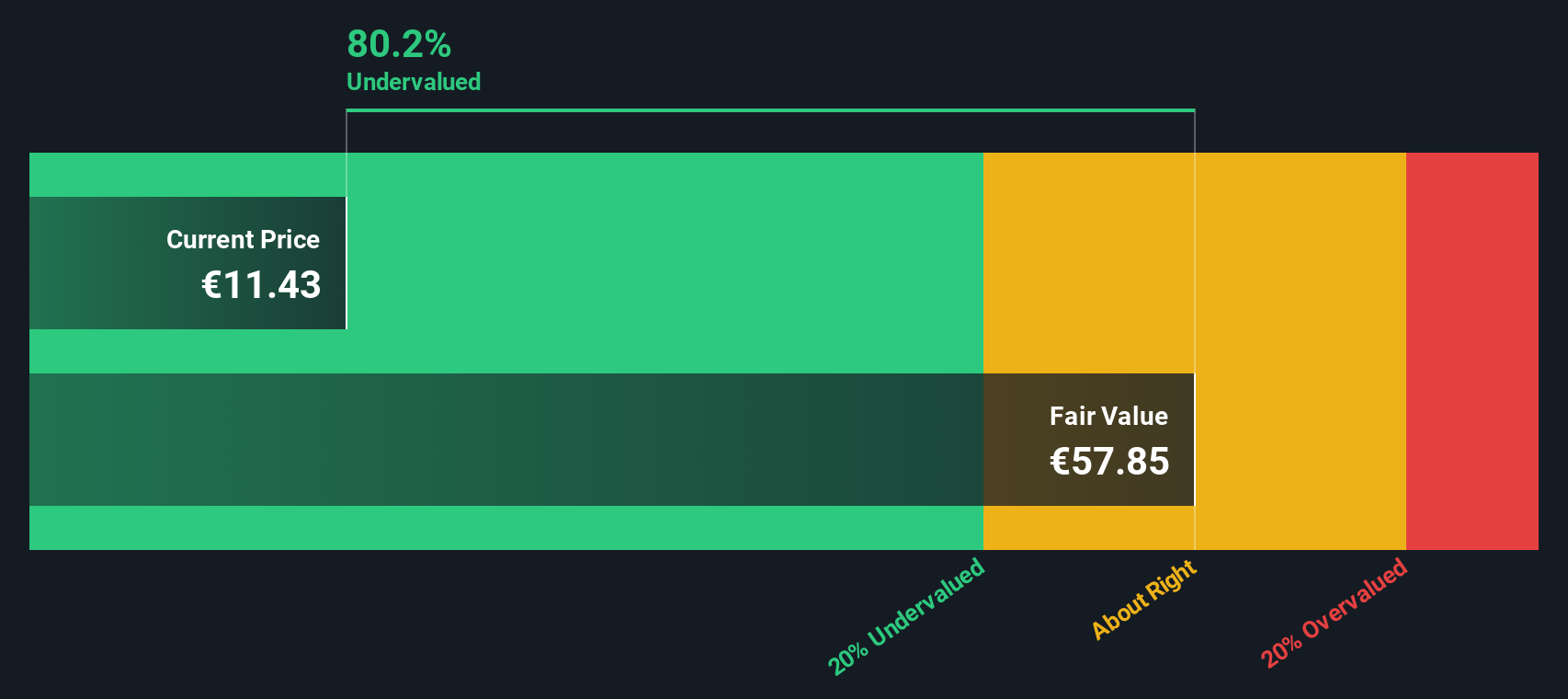

With the stock up sharply this year but still trading below many estimates of fair value, investors now face a key question: is Air France KLM genuinely undervalued, or is the market already pricing in the recovery and future growth?

Price-to-Earnings of 3.2x: Is it justified?

On a price-to-earnings basis, Air France-KLM looks deeply discounted, with its 3.2x multiple sitting well below both peers and the broader airlines industry.

The price-to-earnings ratio compares the current share price to the company’s earnings. It is a direct gauge of how much investors are paying for each euro of profit. For a mature, cyclical business such as an airline, it is one of the most commonly watched yardsticks because it links changes in profitability directly to valuation expectations.

In Air France-KLM’s case, the low 3.2x multiple suggests the market is heavily discounting its earnings power. This is despite the company having turned profitable over the past five years and delivering very strong recent earnings growth. Relative to an estimated fair price-to-earnings ratio of 14.4x, there is a wide gap that the market could close if investors gain confidence that current profits are sustainable.

Compared with the global airlines industry average of 9.3x and a peer average of 25.8x, Air France-KLM’s 3.2x price-to-earnings ratio stands out as markedly cheaper. This reinforces the view that the stock is priced for significantly lower expectations than competitors even after its earnings rebound.

Explore the SWS fair ratio for Air France-KLM

Result: Price-to-Earnings of 3.2x (UNDERVALUED).

However, investors should watch for weaker demand or renewed cost pressures, as either could quickly erode margins and challenge the current undervaluation thesis.

Find out about the key risks to this Air France-KLM narrative.

Another View on Value

Our SWS DCF model paints an even starker picture, suggesting Air France KLM could be trading about 81% below its fair value at roughly €58.55 per share. If both earnings and cash flow based views indicate potential upside, is the market being too cautious, or identifying risks you are not accounting for?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Air France-KLM for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Air France-KLM Narrative

If you see the story differently or want to stress test these assumptions with your own research, you can build a personalized view in just a few minutes: Do it your way

A great starting point for your Air France-KLM research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at a single opportunity, use the Simply Wall Street Screener to lock onto fresh, data driven ideas before other investors react.

- Capitalize on market mispricing by targeting quality companies trading below intrinsic value with these 908 undervalued stocks based on cash flows tailored to strong cash flow fundamentals.

- Ride structural growth in automation, data, and smart software by focusing on next wave innovators through these 26 AI penny stocks built around AI led business models.

- Strengthen your income stream by hunting for consistent payouts and attractive yields using these 13 dividend stocks with yields > 3% tuned for reliable dividend potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報