Singapore Technologies Engineering (SGX:S63): Valuation After Record Order Book, Satcom Impairment and Special Dividend Announcement

Singapore Technologies Engineering (SGX:S63) just combined a record S$32.6 billion order book and S$14 billion in new contracts with a hefty S$667 million satcom impairment and a proposed special dividend tied to divestment proceeds.

See our latest analysis for Singapore Technologies Engineering.

Despite the hefty satcom write down, the market seems focused on the record order book and special dividend. The share price is at S$8.34 and a powerful year to date share price return near 80 percent is driving a three year total shareholder return of around 170 percent. This suggests momentum is very much alive rather than fading.

If this mix of defense exposure and long term contracts appeals to you, it could be worth exploring other aerospace and defense names through aerospace and defense stocks as potential additions to your watchlist.

With earnings growing, a record S$32.6 billion order book, a modest discount to analyst targets and a special dividend on the table, is Singapore Technologies Engineering still a buy, or is the market already pricing in its future growth?

Most Popular Narrative: 5.6% Undervalued

Compared with the last close at S$8.34, the most widely followed narrative points to a slightly higher fair value, hinting at modest upside grounded in long term growth assumptions.

The company has a robust order book of $28.5 billion, providing significant revenue visibility with $8.8 billion expected for delivery in 2025, suggesting strong future revenue prospects.

Strategic investments in new airframe MRO capacities and other facilities are expected to enhance operational capabilities and efficiency, which could lead to improved margins and earnings.

Curious how a hefty impairment can coexist with rising margins, accelerating earnings and a richer future earnings multiple than many peers? The narrative stitches these moving parts into one valuation roadmap, built around compounding revenue, wider profit margins and a premium but gradually declining valuation multiple. Want to see exactly how those assumptions work together to reach that fair value target?

Result: Fair Value of $8.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if geopolitical tensions ease faster than expected or if commercial aerospace supply chain issues drag longer than analysts anticipate.

Find out about the key risks to this Singapore Technologies Engineering narrative.

Another Angle on Valuation

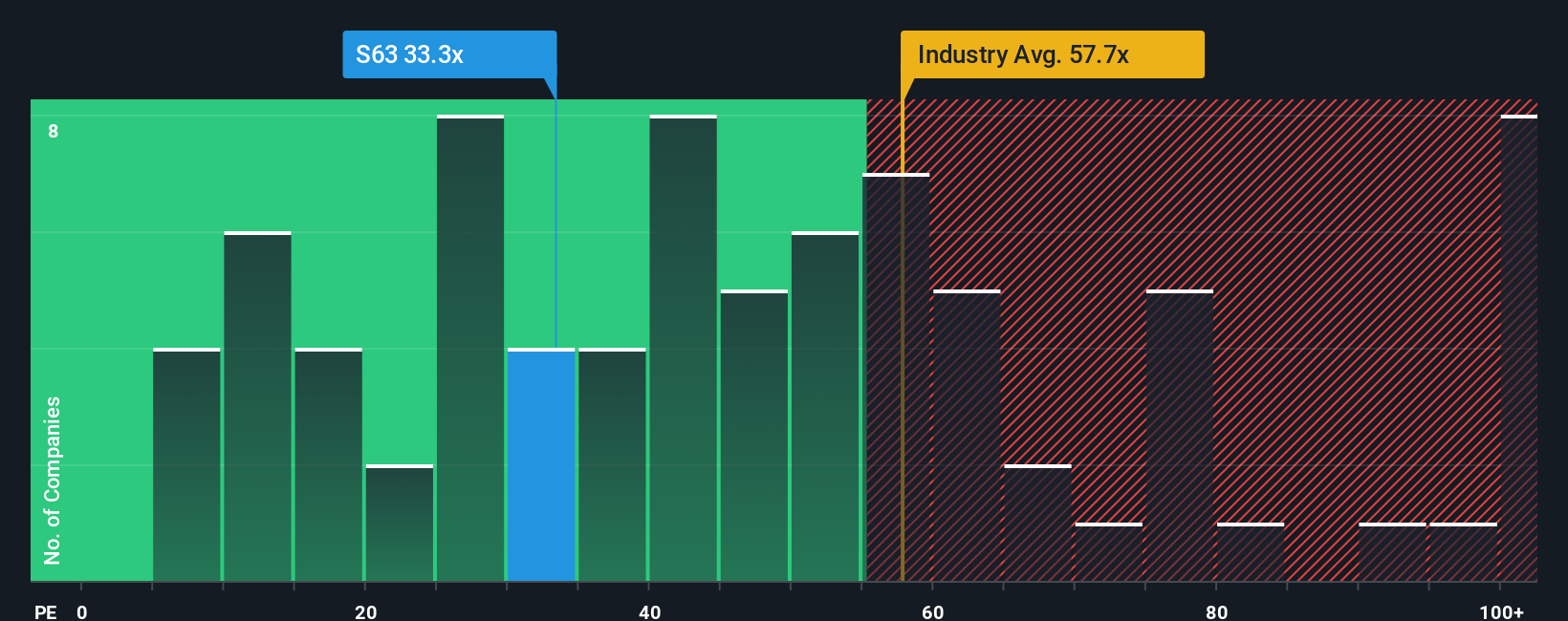

Our valuation checks suggest Singapore Technologies Engineering looks cheap against our fair value estimate, but traditional earnings multiples present a more cautious picture. The stock trades on a P/E of 33.8x, above our fair ratio of 23.7x and ahead of peer averages around 21.4x, which implies less margin for error if growth were to slow.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Singapore Technologies Engineering Narrative

If you see things differently or want to stress test the assumptions yourself, you can build a custom view in just minutes. Do it your way.

A great starting point for your Singapore Technologies Engineering research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before markets move on without you, put Simply Wall St to work and uncover fresh opportunities that match your style instead of settling for your current watchlist.

- Capture potential mispricings by scanning these 908 undervalued stocks based on cash flows where strong cash flows may not yet be fully recognized in the share price.

- Harness megatrends in automation and machine learning through these 26 AI penny stocks and position your portfolio alongside companies shaping tomorrow's technology.

- Strengthen your income stream by targeting reliable payers with these 13 dividend stocks with yields > 3% and avoid missing businesses that regularly reward shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報