Could StoneCo’s (STNE) Securities Settlement Quiet a Legacy Risk or Complicate Its Capital Allocation Story?

- In December 2025, Labaton Keller Sucharow LLP announced that StoneCo and lead plaintiff Indiana Public Retirement System reached a proposed US$26,750,000 class action settlement covering investors who bought StoneCo shares between May 27, 2020 and November 16, 2021, pending court approval in February 2026.

- The proposed settlement, which StoneCo agreed to while denying any wrongdoing, could reshape how investors assess its legal exposure, governance practices, and potential future capital allocation priorities.

- We will now examine how resolving a legacy securities lawsuit through a US$26,750,000 proposed settlement may influence StoneCo’s existing investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

StoneCo Investment Narrative Recap

To own StoneCo, you need to believe its Brazilian payments and financial-services platform can keep gaining share and lifting profitability, even after past missteps. The proposed US$26,750,000 securities class action settlement, if approved, looks manageable against StoneCo’s recent earnings trajectory and does not appear to alter the key near term catalysts around digital payments growth or the main risks tied to credit quality and competitive pressure.

The recent series of large buyback programs, including the May 2025 authorization of up to BRL 2,000 million in share repurchases, is especially relevant here, as resolving legacy litigation could clarify future capital allocation. With gross profit and EPS guidance for 2025 already raised, how management balances ongoing repurchases against any lingering legal and credit costs will matter for how investors judge StoneCo’s progress from here.

Yet beneath this improving story, investors should still pay close attention to StoneCo’s growing credit book and the risk that...

Read the full narrative on StoneCo (it's free!)

StoneCo's narrative projects R$17.4 billion revenue and R$5.0 billion earnings by 2028.

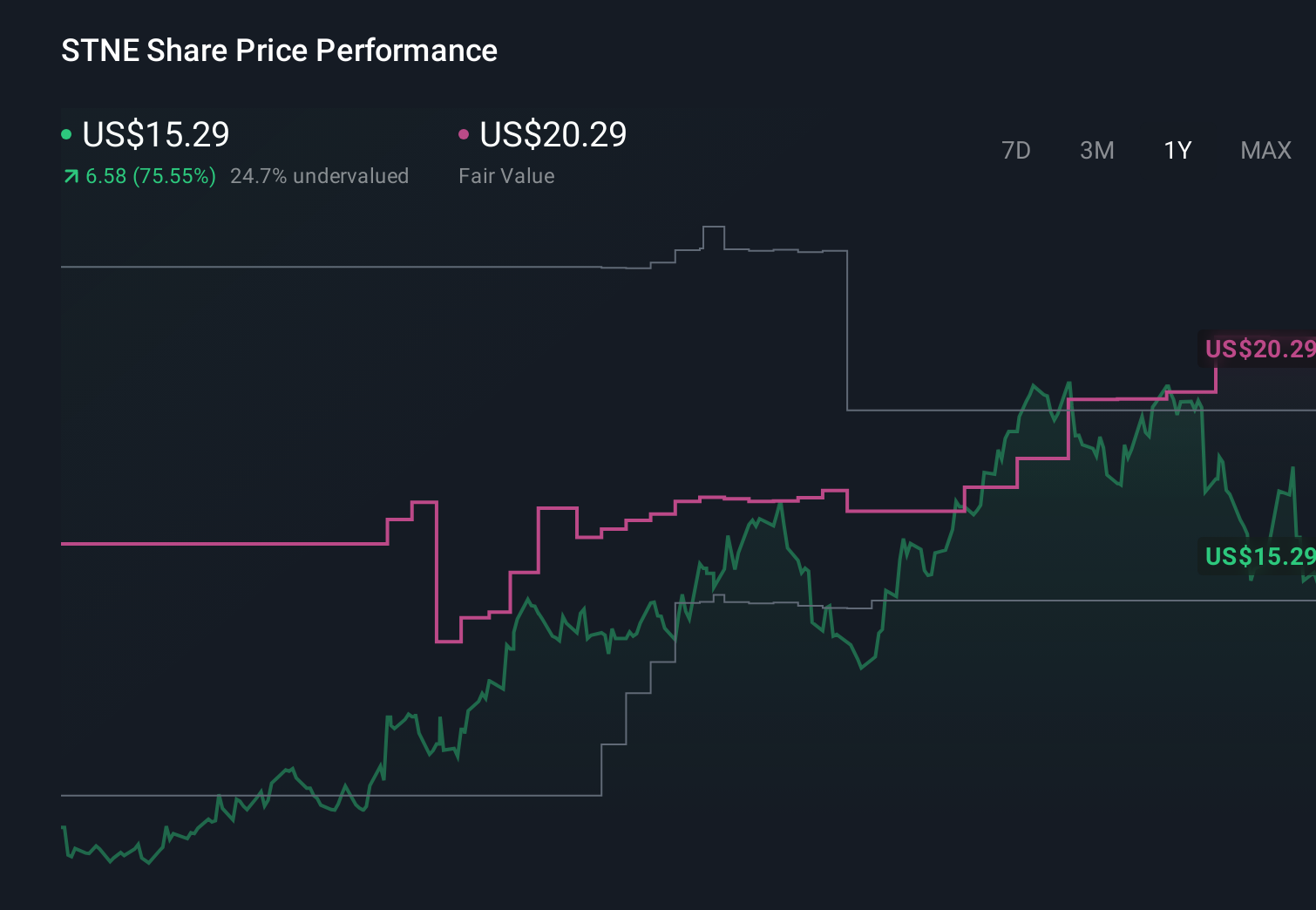

Uncover how StoneCo's forecasts yield a $20.29 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community range from US$14.33 to US$35.26 per share, showing how differently individual investors see StoneCo’s potential. You should weigh this dispersion against the risk that slower TPV growth and softer MSMB demand could constrain revenue and margins over time, then explore several contrasting views before forming your own stance.

Explore 8 other fair value estimates on StoneCo - why the stock might be worth over 2x more than the current price!

Build Your Own StoneCo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your StoneCo research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free StoneCo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate StoneCo's overall financial health at a glance.

No Opportunity In StoneCo?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報