Kroger (KR) Swings to Q3 Loss, Margin Hit Challenges High-Growth Earnings Narrative

Kroger (KR) has just posted a tough Q3 2026, with revenue of about $33.9 billion and a basic EPS of roughly -$2.02, swinging from a profit in prior quarters as net income excluding extra items came in at around -$1.3 billion. Over the past few quarters, the company has seen quarterly revenue hold in a tight band around the mid $30 billion range while basic EPS moved from $0.64 in Q2 2025 to $0.85 in Q3 2025, $0.91 in Q4 2025, $1.30 in Q1 2026, $0.92 in Q2 2026 and then this latest negative print. That sets up a results season in which investors are laser focused on how sustainable margins really are.

See our full analysis for Kroger.With the headline numbers on the table, the next step is to weigh them against the dominant narratives around Kroger's growth, profitability and risk to see which stories hold up and which ones the latest margin picture calls into question.

See what the community is saying about Kroger

Margins Squeezed to 0.5 percent Trailing

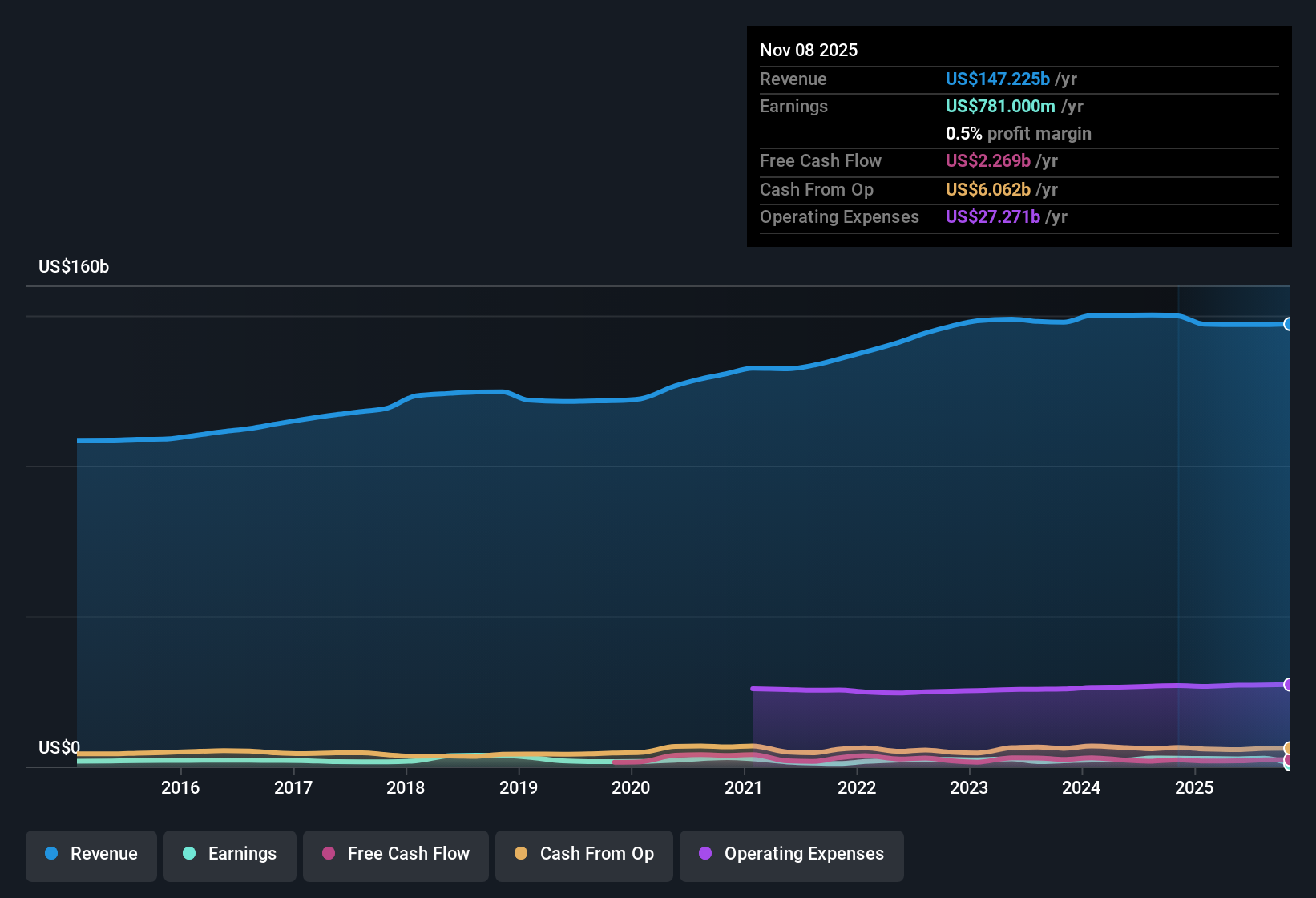

- Over the last 12 months, Kroger generated about $147.2 billion in revenue but only $0.8 billion in net income, taking trailing net profit margins down to 0.5 percent from 1.8 percent a year earlier and including a one off loss of $3.3 billion.

- Consensus narrative points to cost controls, automation and supply chain modernization as levers for margin improvement, yet

- the sharp step down in trailing margin from 1.8 percent to 0.5 percent shows that, so far, profitability has moved the opposite way despite those efficiency efforts.

- the combination of modest forecast revenue growth of 2.5 percent per year and a big one off hit means bulls need those cost initiatives to show up clearly in future margins, which is not visible in the current trailing numbers.

Investors watching Kroger's push into automation and fresh offerings may want to see how quickly that 0.5 percent margin can recover before calling this dip a simple bump in the road. 🐂 Kroger Bull Case

29 point 6 percent Earnings Growth vs Slower Sales

- Analysts expect earnings to grow around 29.6 percent per year even though revenue is only forecast to rise about 2.5 percent annually, which implies that most of the upside has to come from higher margins rather than faster top line expansion.

- Bears argue that unprofitable e commerce, rising labor costs and heavy investment needs could weigh on those margin gains, and

- the recent swing from $612 million of net income in Q2 2026 to a $1.3 billion loss in Q3 2026 underlines how sensitive profits are when costs and one off items move against the business.

- the trailing net profit of just $0.8 billion on $147.2 billion of sales gives very little buffer if e commerce losses, store closures or wage inflation continue to pressure operating costs.

For cautious investors, the gap between 2.5 percent expected revenue growth and 29.6 percent expected earnings growth makes the bearish focus on cost pressure and execution risk look particularly relevant right now. 🐻 Kroger Bear Case

High P E but DCF Implies Upside

- Kroger trades on a trailing P E of 51.2 times, well above the US consumer retailing average of 22.7 times and peer average of 20.3 times, yet a DCF fair value of $90.12 versus the current $63.19 share price implies roughly 29.9 percent upside from that model.

- What is striking for valuation focused investors is how the bullish case for long term earnings growth and the cautious view on recent profitability intersect here, because

- the premium P E multiple sits on top of trailing earnings that include a $3.3 billion one off loss and a 0.5 percent net margin, which makes the historical valuation look stretched compared with peers.

- at the same time, the DCF fair value assumes analysts can deliver on forecasts for higher margins and earnings of about $3.3 billion by around 2028, so the stock’s apparent discount depends heavily on that improvement actually showing up.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Kroger on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use your own lens on Kroger’s results, build a clear story in just a few minutes, and Do it your way.

A great starting point for your Kroger research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Explore Alternatives

Kroger’s razor thin margins, recent swing into losses and premium valuation highlight how little cushion investors have if profitability keeps stalling.

If you want more predictable performance and fewer margin surprises, use our stable growth stocks screener (2104 results) to quickly focus on companies with steadier earnings trajectories and clearer operating leverage.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報