Green Thumb Industries (CNSX:GTII): Revisiting Valuation After Adult-Use Expansion and Stronger Growth Momentum

Insider sale against a backdrop of improving growth metrics

Green Thumb Industries (CNSX:GTII) just saw director Dawn Wilson Barnes sell 3,500 shares, a move landing as the company leans into adult use cannabis expansion and improving growth trends that have been nudging the stock higher.

See our latest analysis for Green Thumb Industries.

The timing of the sale comes as Green Thumb’s shares have surged recently, with a 30 day share price return of 65.88 percent and a 1 year total shareholder return of 14.40 percent, suggesting momentum is rebuilding despite still muted multi year gains.

If this rebound has you rethinking your watchlist, it could be a good moment to scout other growth stories and discover fast growing stocks with high insider ownership.

With shares up sharply but still trading below analyst targets and our estimate of intrinsic value, the real question is: does Green Thumb remain mispriced by a skeptical market, or are investors already discounting its next leg of growth?

Most Popular Narrative: 21.9% Undervalued

With Green Thumb Industries last closing at CA$13.27 against a narrative fair value near CA$17.00, the disconnect centers on how aggressively future earnings compound from here.

The company's strong brand portfolio and focused efforts to increase consumer engagement and awareness through lifestyle branding, events, and new product launches (such as THC beverages) position Green Thumb to capture shifting consumer preferences towards mainstream cannabis adoption and health/wellness trends, which should support both revenue and pricing power (impacting margins).

Want to see how modest top line growth can still translate into a far larger profit pool and lower future multiple than today, all in one narrative? See our AI narrative and valuation for Green Thumb Industries.

Result: Fair Value of $17.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent price compression and heavy capital spending could squeeze margins and returns, challenging assumptions that Green Thumb’s earnings power will expand as projected.

Find out about the key risks to this Green Thumb Industries narrative.

Another Lens on Valuation

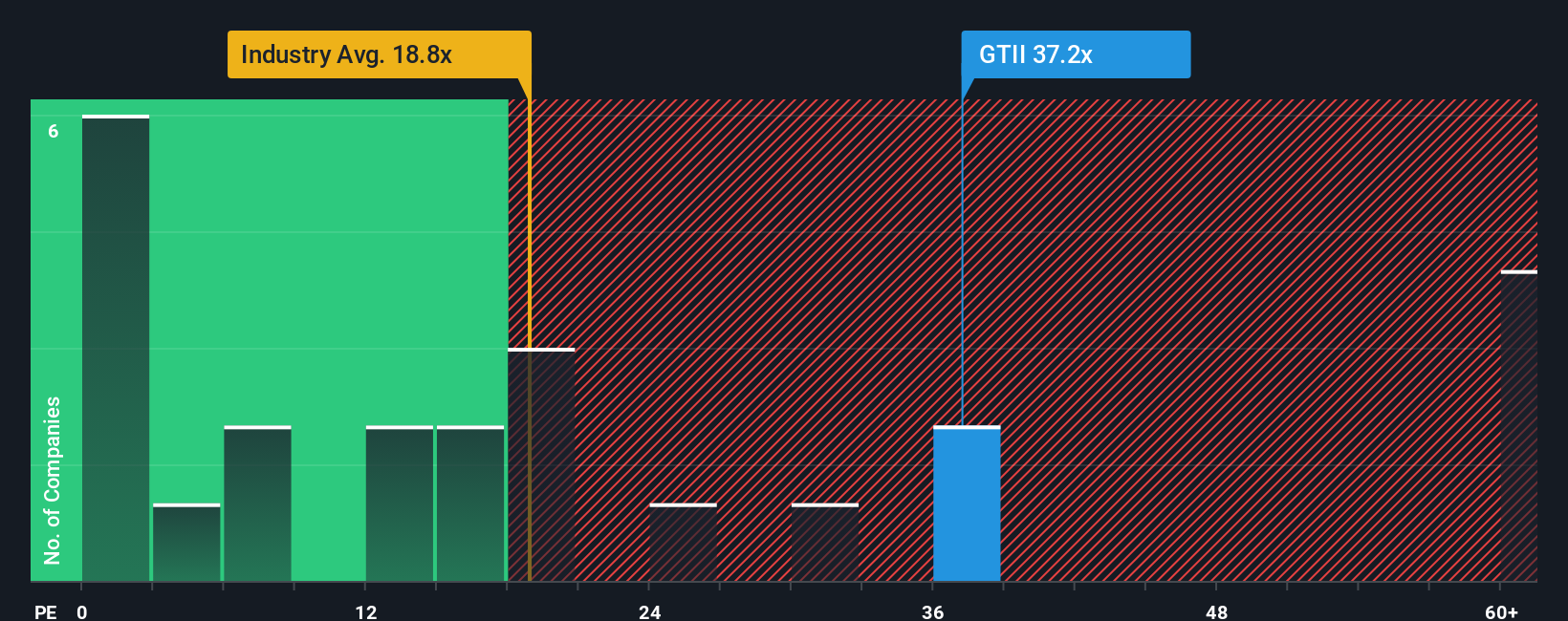

Step away from narratives and Green Thumb starts to look stretched on a simple earnings yardstick. The shares trade at about 51 times earnings, roughly double peer averages near 25 times and above a fair ratio of 41 times, which raises the risk of a sharp rerating if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Green Thumb Industries Narrative

If you see the story differently or simply want to dive into the numbers yourself, you can build a personalized view in minutes with Do it your way.

A great starting point for your Green Thumb Industries research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before this momentum passes you by, use the Simply Wall St Screener to uncover fresh opportunities that match your strategy and keep your portfolio one step ahead.

- Capture mispriced opportunities by scanning these 908 undervalued stocks based on cash flows that may be trading well below their long term cash flow potential.

- Ride the next wave of innovation by targeting these 26 AI penny stocks at the intersection of data, automation, and scalable software models.

- Lock in reliable income streams by focusing on these 13 dividend stocks with yields > 3% that can support steady returns through different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報