Asian Value Stocks: 3 Companies Trading Below Estimated Intrinsic Value

Amidst global economic shifts, Asian markets are navigating a complex landscape influenced by interest rate adjustments and deflationary pressures, particularly in China. As investors seek opportunities within this environment, identifying stocks trading below their estimated intrinsic value can be a prudent strategy for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tianqi Lithium (SZSE:002466) | CN¥51.64 | CN¥101.91 | 49.3% |

| Taiwan Union Technology (TPEX:6274) | NT$443.00 | NT$867.93 | 49% |

| Sany Heavy Equipment International Holdings (SEHK:631) | HK$8.20 | HK$16.17 | 49.3% |

| NEXON Games (KOSDAQ:A225570) | ₩12510.00 | ₩24473.30 | 48.9% |

| Mobvista (SEHK:1860) | HK$15.70 | HK$30.71 | 48.9% |

| Meitu (SEHK:1357) | HK$7.50 | HK$14.65 | 48.8% |

| KIYO LearningLtd (TSE:7353) | ¥700.00 | ¥1383.95 | 49.4% |

| H.U. Group Holdings (TSE:4544) | ¥3319.00 | ¥6592.59 | 49.7% |

| HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540) | ₩449500.00 | ₩891919.87 | 49.6% |

| Beijing HyperStrong Technology (SHSE:688411) | CN¥264.26 | CN¥515.51 | 48.7% |

Here's a peek at a few of the choices from the screener.

Plover Bay Technologies (SEHK:1523)

Overview: Plover Bay Technologies Limited is an investment holding company that designs, develops, and markets software-defined wide area network routers, with a market capitalization of HK$6.90 billion.

Operations: The company's revenue segments include sales of SD-WAN routers for fixed first connectivity at $16.01 million, mobile first connectivity at $70.82 million, and software licenses along with warranty and support services totaling $35.61 million.

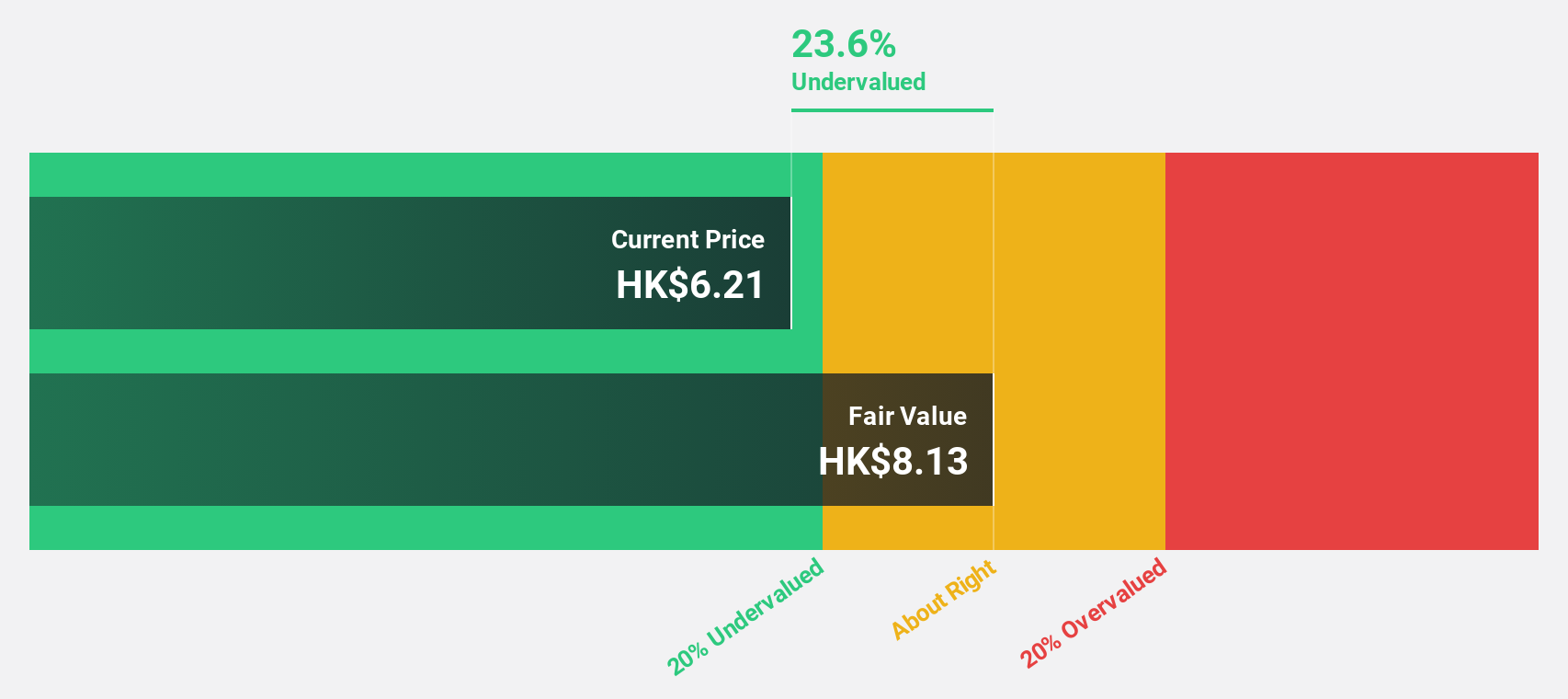

Estimated Discount To Fair Value: 27.3%

Plover Bay Technologies, recently added to the S&P Global BMI Index, is trading at HK$6.25, below its estimated fair value of HK$8.6, indicating it's undervalued based on cash flows. Despite a dividend yield of 4.74% not being well covered by free cash flows and modest revenue growth forecasts (15.3% per year), its earnings are expected to grow faster than the Hong Kong market at 15.9% annually, with a very high future return on equity projected at 82.5%.

- The growth report we've compiled suggests that Plover Bay Technologies' future prospects could be on the up.

- Get an in-depth perspective on Plover Bay Technologies' balance sheet by reading our health report here.

Sany Heavy Equipment International Holdings (SEHK:631)

Overview: Sany Heavy Equipment International Holdings Company Limited is engaged in the manufacturing and sale of mining and logistics equipment, electricity and power station project products, petroleum and new energy manufacturing equipment, along with spare parts and related services, with a market cap of HK$26.50 billion.

Operations: Sany Heavy Equipment International Holdings generates revenue through its production and sale of mining and logistics equipment, electricity and power station project products, petroleum and new energy manufacturing equipment, as well as spare parts and related services.

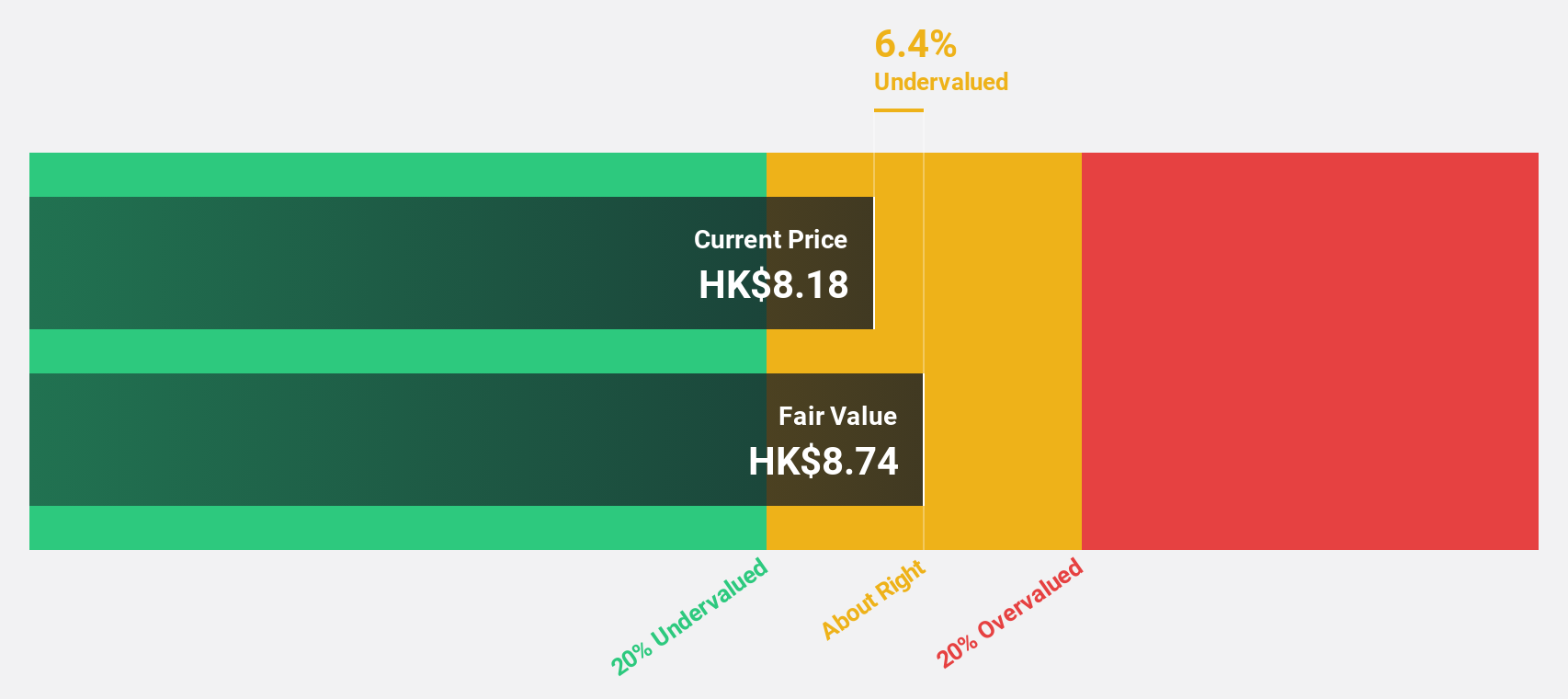

Estimated Discount To Fair Value: 49.3%

Sany Heavy Equipment International Holdings is trading at HK$8.2, significantly below its estimated fair value of HK$16.17, highlighting its undervaluation based on cash flows. With earnings expected to grow at 33.3% annually and revenue projected to increase by 18.1% per year, it surpasses the Hong Kong market's growth rates. However, recent management changes and the termination of several agreements may introduce uncertainties impacting future performance stability.

- According our earnings growth report, there's an indication that Sany Heavy Equipment International Holdings might be ready to expand.

- Take a closer look at Sany Heavy Equipment International Holdings' balance sheet health here in our report.

Shanghai OPM Biosciences (SHSE:688293)

Overview: Shanghai OPM Biosciences Co., Ltd. specializes in cell culture media and CDMO services both in China and internationally, with a market cap of CN¥6.07 billion.

Operations: The company's revenue segments include cell culture media and CDMO services, catering to both domestic and international markets.

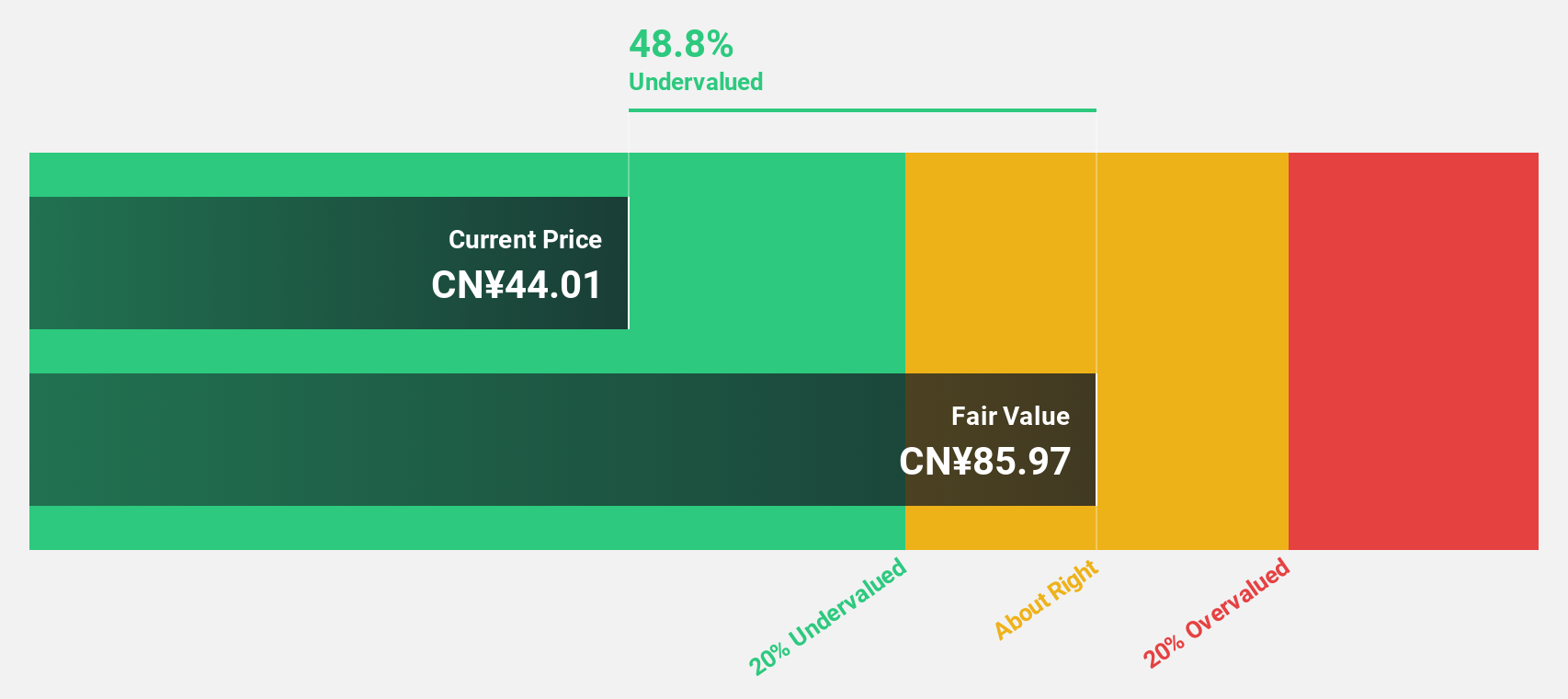

Estimated Discount To Fair Value: 42.3%

Shanghai OPM Biosciences is trading at CN¥53.35, significantly below its estimated fair value of CN¥92.53, indicating undervaluation based on cash flows. Earnings are forecast to grow by 46.5% annually, outpacing the Chinese market's growth rate of 27.2%. Despite high earnings growth expectations, the company's return on equity is projected to be low at 7%, and its dividend yield of 0.79% is not well covered by free cash flows.

- Our growth report here indicates Shanghai OPM Biosciences may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Shanghai OPM Biosciences' balance sheet health report.

Key Takeaways

- Dive into all 276 of the Undervalued Asian Stocks Based On Cash Flows we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報