Nihon Kohden (TSE:6849) Valuation Check as New EEG and Respiratory Tools Debut at Major U.S. Conferences

What is really moving interest around Nihon Kohden (TSE:6849) right now is not a headline grabbing deal; it is a cluster of new EEG and respiratory tools debuting at back to back medical conferences.

See our latest analysis for Nihon Kohden.

Despite this steady stream of EEG and respiratory innovations, Nihon Kohden’s ¥1,622.5 share price still reflects mixed sentiment, with recent short term share price gains contrasting with a weak year to date share price return but solid three year total shareholder return.

If these launches have you thinking more broadly about healthcare opportunities, it is worth exploring other specialised players using our healthcare stocks for fresh ideas beyond Nihon Kohden.

Yet with earnings growing faster than revenue, a near 30 percent discount to analyst targets and recent buybacks, investors must ask whether the current weakness is a mispricing or if markets are already pricing in future growth.

Price to Earnings of 14.6x: Is it justified?

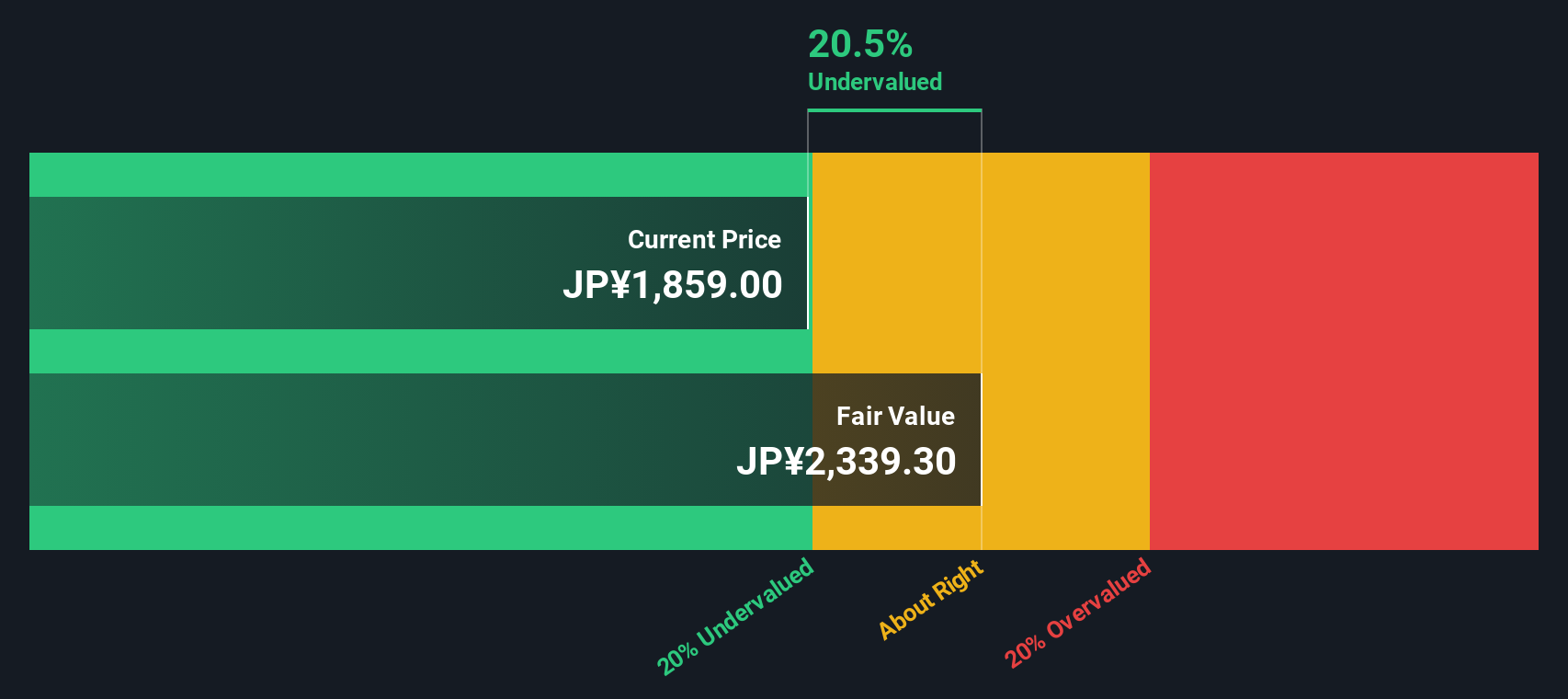

On a price to earnings ratio of 14.6 times, Nihon Kohden looks undervalued versus both peers and its own fair value estimates at the current ¥1,622.5 share price.

The price to earnings multiple compares what investors pay today with the company’s earnings per share, a key yardstick for profitable, mature medical equipment makers. For Nihon Kohden, the market seems to be assigning a modest earnings multiple despite a sharp rebound in profitability over the last year and forecasts that still point to positive earnings growth ahead.

Against its own history and fair value signals, that 14.6 times multiple looks restrained. Our models suggest a fair price to earnings ratio closer to 21.3 times, a level the market could rotate toward if confidence in the earnings trajectory continues to rebuild. Relative to both the Japanese medical equipment peer average of 20 times and the broader industry’s 15.7 times, the stock trades at a clear discount that implies investors are yet to fully price in recovering margins and improving earnings quality.

Explore the SWS fair ratio for Nihon Kohden

Result: Price-to-Earnings of 14.6x (UNDERVALUED)

However, lingering revenue growth near 3 percent and the 22 percent year to date share price decline suggest that execution missteps or weaker hospital demand could limit upside.

Find out about the key risks to this Nihon Kohden narrative.

Another View: Our DCF Cross Check

Our DCF model points the same way as the earnings multiple, suggesting fair value around ¥1,982.75, roughly 18 percent above today’s ¥1,622.5 price. If both cash flow and earnings say cheap, is the market doubting the forecasts or just overlooking a slow but steady compounder?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nihon Kohden for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nihon Kohden Narrative

If you see the data differently or want to put your own spin on the story, you can build a tailored view in minutes, Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Nihon Kohden.

Ready for your next investing edge?

Before you move on, lock in an information advantage by using the Simply Wall Street Screener to uncover focused, data backed opportunities you will not want to overlook.

- Capture potential income streams by targeting these 13 dividend stocks with yields > 3% that combine attractive yields with the financial strength needed to keep payouts coming.

- Position yourself early in transformative technologies by screening these 27 quantum computing stocks that could benefit most as real world adoption accelerates.

- Strengthen your watchlist with these 908 undervalued stocks based on cash flows that trade below their estimated cash flow value, before the market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報