A look at St. Joe (JOE) valuation as it launches Publix‑anchored Watersound West Bay Center expansion

St. Joe (JOE) is kicking off development of a Publix anchored lifestyle center at Watersound West Bay Center in Panama City Beach, a steady brick and mortar signal of how the company is leaning into corridor growth.

See our latest analysis for St. Joe.

That corridor story is showing up in the numbers too, with the share price at $62.82 after a roughly 41% year to date share price return and a three year total shareholder return of about 74%, suggesting momentum is building as investors price in continued growth.

If projects like Watersound West Bay Center have you thinking about where else growth and capital discipline might line up, this could be a good moment to explore fast growing stocks with high insider ownership.

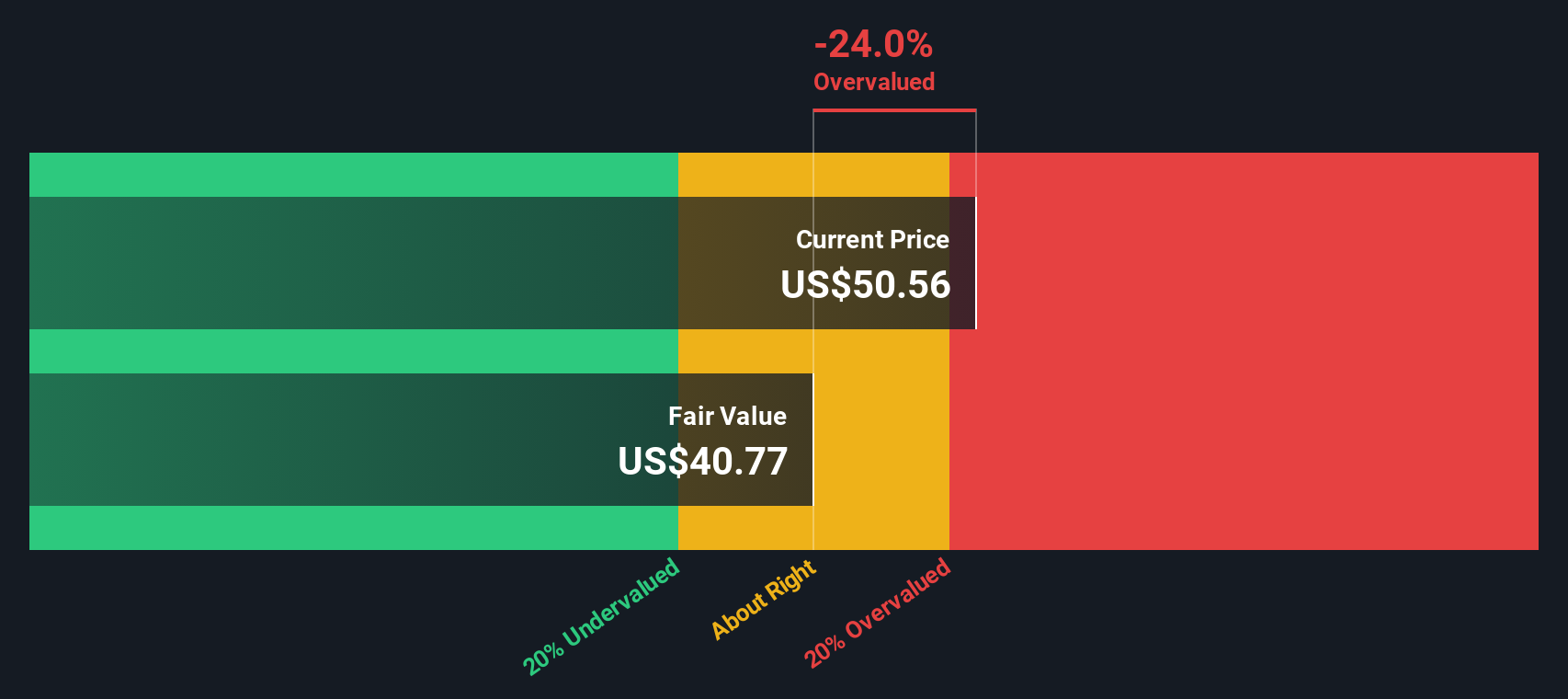

But with shares up strongly and trading at an implied premium to current earnings, the key question now is whether St. Joe is still undervalued on its land and pipeline, or if the market is already pricing in that future growth.

Price-to-Earnings of 34.7x: Is it justified?

On a trailing price to earnings basis, St. Joe changes hands at 34.7 times earnings, a level that signals investors are already paying up for growth versus the broader US real estate universe.

The price to earnings multiple compares the company’s market value to its current earnings, a key yardstick for real estate developers where visibility on recurring profits can be limited and investors often focus on how reliably those earnings are being generated.

In St. Joe’s case, the 34.7 times multiple looks steep against the US real estate industry average of 31.3 times earnings. However, it still sits at a discount to the 44.5 times average of its more directly comparable peers, suggesting the market is assigning a premium for quality and growth without fully matching peer exuberance.

In other words, investors are paying more than the sector average for each dollar of St. Joe’s earnings. At the same time, the gap to higher valued peers hints there could still be room for the multiple to expand if the company continues to outgrow the industry and sustain higher margins.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 34.7x (ABOUT RIGHT)

DCF Perspective Points to Further Upside

Our DCF model estimates a fair value of $80.17 per share for St. Joe, versus the recent $62.82 close, implying the stock trades at roughly a 21.6% discount even after the strong run.

The SWS DCF model projects St. Joe’s future cash flows and then discounts them back to today using an appropriate rate, aiming to capture both the scale and timing of those cash flows in a single present value number.

For a land rich, development heavy real estate business like St. Joe, where near term earnings can be lumpy but the underlying asset base and project pipeline are long dated, that cash flow lens can be especially important in separating short term noise from long term value creation.

Seen through that framework, the current price suggests the market may not yet be fully reflecting the company’s accelerated earnings growth, improving profit margins and the embedded value in projects like Watersound West Bay Center and its broader residential and hospitality pipeline.

Look into how the SWS DCF model arrives at its fair value.

Result: DCF Fair value of $80.17 (UNDERVALUED)

However, risks remain, including a cyclical real estate downturn or project delays that pressure cash flows and challenge the assumed upside in St. Joe’s valuation.

Find out about the key risks to this St. Joe narrative.

Another Way to Look at It

The SWS DCF model paints a more optimistic picture than the earnings multiple does, suggesting St. Joe could still be undervalued even after its rally. If the cash flows materialize as expected, does today’s price represent a late arrival or a second chance?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out St. Joe for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own St. Joe Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a complete view in minutes: Do it your way.

A great starting point for your St. Joe research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Simply Wall Street’s powerful Screener to work and uncover fresh opportunities that could reshape your portfolio’s returns this year.

- Turn small positions into potential standouts by scanning these 3612 penny stocks with strong financials that pair tiny prices with surprisingly solid financial foundations.

- Ride the next wave of innovation by targeting these 26 AI penny stocks positioned at the intersection of intelligent software, data and scalable growth.

- Review these 13 dividend stocks with yields > 3% that can support reliable cash flows beyond St. Joe.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報