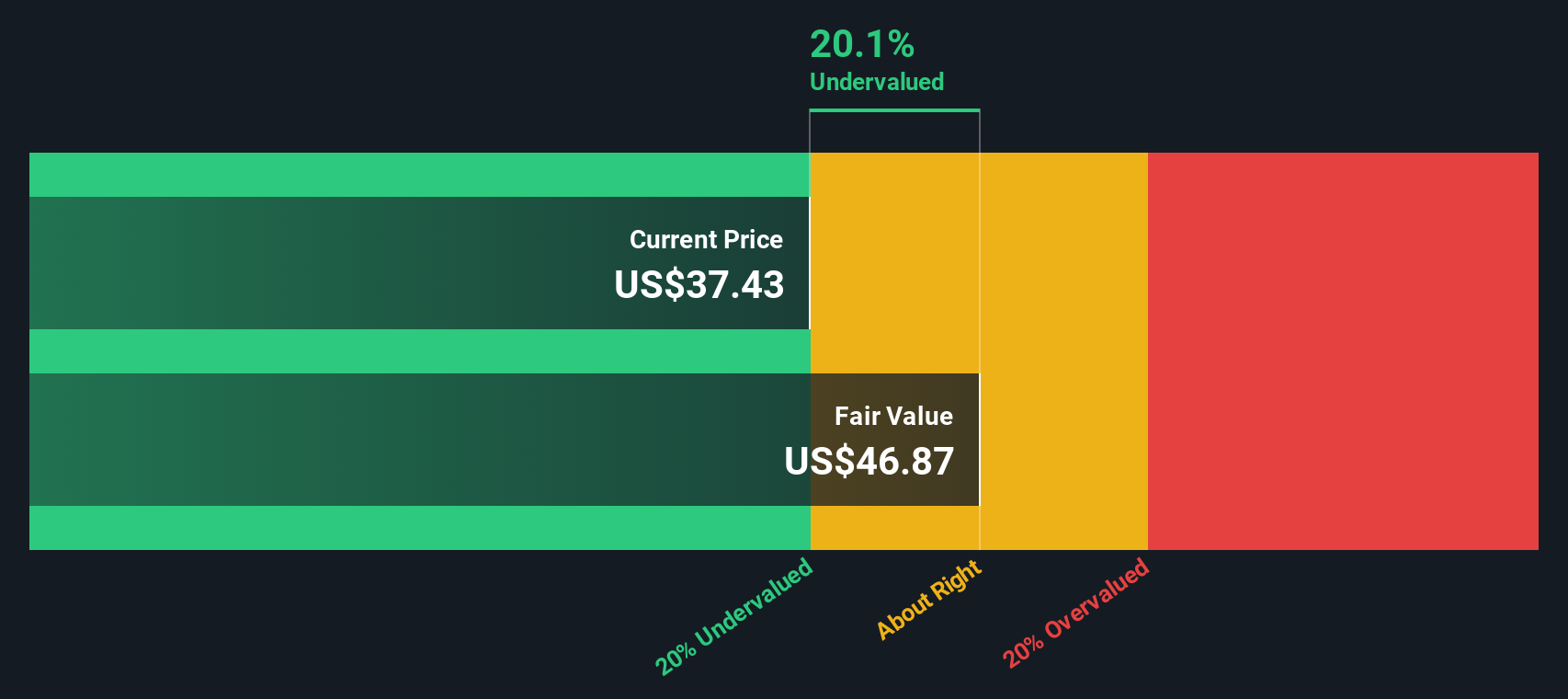

Intel (INTC) Valuation Check After Strong Multimonth Rally and Latest Share Price Pullback

Intel stock moves after steady multimonth rally

Intel (INTC) is coming off a strong run, with shares roughly doubling over the past year. The latest pullback has investors asking whether this is a breather or an early warning.

See our latest analysis for Intel.

The latest dip, including a 4.3% one-day share price return decline to $37.81, comes after an 86.99% year-to-date share price return and an 85.89% one-year total shareholder return. This suggests momentum is cooling but not broken.

If Intel has sharpened your interest in chips, this is also a good moment to explore other fast moving tech names using our high growth tech and AI stocks to spot fresh opportunities.

With earnings now recovering and the share price sitting almost exactly at Wall Street’s target, is Intel still a relatively inexpensive turnaround story in a pivotal industry, or has the market already priced in its next leg of growth?

Most Popular Narrative Narrative: 2% Overvalued

With Intel closing at $37.81 against a narrative fair value of about $37.27, the story hinges on a fragile but improving recovery trajectory.

Supportive balance sheet actions and aggressive investment in product and foundry buildout are viewed as increasing the probability that Intel can narrow its technology and scale gap with leading foundry peers over time, which underpins higher valuation multiples. Bullish analysts also note that potential customers across the ecosystem are evaluating Intel Foundry and advanced packaging technologies, which, even if initially low margin, are seen as important validation of the longer term foundry growth opportunity.

Curious how a slow growing topline can still support a punchy valuation? The narrative leans on a sharp earnings swing and richer future multiples. Want to see exactly how those moving parts are stitched together into that fair value?

Result: Fair Value of $37.27 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, extended execution challenges in AI and foundry, along with potential margin pressure from low priced contracts, could quickly undercut today’s upbeat recovery expectations.

Find out about the key risks to this Intel narrative.

Another Angle on Valuation

Our SWS DCF model paints a very different picture, suggesting Intel is trading well above an intrinsic value closer to $14.91 per share, which would make the stock look meaningfully overvalued. If the cash flows do not ramp as fast as hoped, how much downside are investors really carrying?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Intel Narrative

If this perspective does not fully reflect your own thinking, or you would rather dig into the data yourself, you can build a custom view in just a few minutes by starting with Do it your way.

A great starting point for your Intel research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next move?

Before the market runs ahead of you, put Intel in context by scanning other opportunities on Simply Wall Street that could sharpen or balance your portfolio.

- Target potential bargains trading below their cash flow value by focusing on these 908 undervalued stocks based on cash flows that could offer more upside than Intel.

- Ride powerful secular trends by zeroing in on these 26 AI penny stocks positioned to benefit from the surge in artificial intelligence demand.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3% that may offer more attractive and sustainable payouts than many headline tech names.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報