AIA Group (SEHK:1299): Reassessing Valuation After China Partnerships, Asian Expansion and Shifting Regulatory Landscape

AIA Group (SEHK:1299) is back in the spotlight as investors weigh its latest push into high growth Asian markets and fresh partnerships in mainland China, against shifting regulation and interest rate expectations shaping the stock’s recent swings.

See our latest analysis for AIA Group.

Despite a 6.1% slide in the 1 month share price return, AIA’s 42.9% year to date share price return and 43.7% 1 year total shareholder return suggest momentum is still broadly constructive as China partnerships and regulatory shifts reset risk expectations.

If AIA’s renewed momentum has your attention, this could be a good moment to explore fast growing stocks with high insider ownership for other fast moving ideas with committed insider backers.

With double digit earnings growth, a sizeable discount to analyst targets and an implied intrinsic discount, has AIA’s strong run still left room for upside, or is the market already pricing in its next phase of growth?

Most Popular Narrative: 17% Undervalued

With AIA Group last closing at HK$79, the most followed narrative pegs fair value closer to HK$95, implying the market may be underestimating its cash generation and capital discipline.

The company's focus on high value protection and low guarantee fee based products (now nearly 90% of new business) has resulted in resilient, predictable cash flows and strong margins, supporting sustainable earnings and embedded value growth. This positions AIA defensively against interest rate volatility and market cycles, underpinning profitability.

Curious how modest top line expectations still justify a higher valuation? The narrative leans on richer margins, shrinking share count, and a premium earnings multiple normally reserved for market darlings. Want to see which forward profit profile makes that price target add up?

Result: Fair Value of $95.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat case could be derailed if growth in key markets like Mainland China slows, or regulatory tightening compresses margins and raises capital demands.

Find out about the key risks to this AIA Group narrative.

Another Take on Valuation

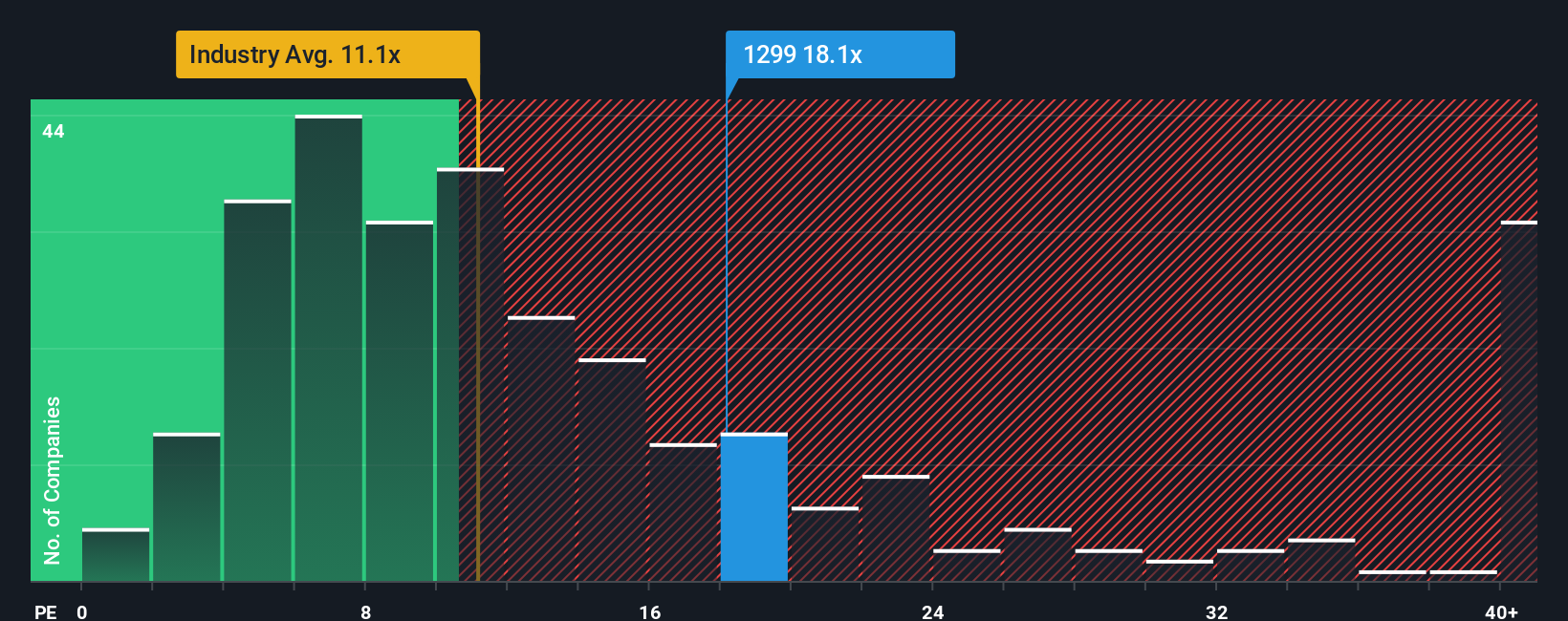

Looked at through earnings ratios, AIA looks far less of a bargain. It trades on a P/E of 17.6x versus a fair ratio of 9.6x and an Asian insurance average of 11.3x, suggesting meaningful rerating risk if sentiment cools. Which signal do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AIA Group Narrative

If this perspective does not fully resonate or you prefer to dive into the numbers yourself, you can build a custom view in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding AIA Group.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by scanning focused stock ideas built from the numbers, not the noise, so your research keeps compounding.

- Capture early growth stories by reviewing these 3612 penny stocks with strong financials that already show strengthening financial foundations and room for upside re rating.

- Position yourself for the next productivity wave by assessing these 26 AI penny stocks that pair real revenue traction with scalable technology advantages.

- Lock in quality at a discount by filtering these 13 dividend stocks with yields > 3% that combine robust cash flows with income potential above market averages.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報