Constellation Brands (STZ): Reassessing Valuation After a Recent Share Price Rebound

Constellation Brands (STZ) has quietly climbed about 14% over the past month even as its year to date return remains sharply negative, a setup that has investors rethinking whether the recent rebound has room to run.

See our latest analysis for Constellation Brands.

That rebound sits against a much tougher backdrop, with the year to date share price return still deeply negative and the one year total shareholder return also in the red. This suggests sentiment is stabilizing but not yet convincingly bullish.

If Constellation’s recent swing has you reconsidering your watchlist, this could be a good moment to explore fast growing stocks with high insider ownership as potential new ideas alongside STZ.

With shares still down sharply this year despite modest growth and trading at a hefty discount to analysts’ targets, is Constellation Brands quietly undervalued, or is the market already pricing in all the growth that lies ahead?

Most Popular Narrative Narrative: 13.9% Undervalued

At a last close of $147.42 versus a narrative fair value of $171.22, Constellation Brands is framed as materially mispriced on the upside.

The company plans to generate approximately $9 billion in operating cash flow and $6 billion in free cash flow from fiscal '26 to fiscal '28. This robust cash flow will support investment in growth initiatives, primarily the modular development of their third brewery in Veracruz and additions to existing facilities in Mexico, potentially enhancing revenue.

Curious how steady revenue, rising margins and shrinking share count add up to this upside case? The narrative leans on bold long range cash flow math. Want to see exactly how those earnings and valuation assumptions stack together?

Result: Fair Value of $171.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weaker than expected beer demand and ongoing tariff or inflation headwinds could pressure margins and undermine the current undervaluation case.

Find out about the key risks to this Constellation Brands narrative.

Another Way to Look at Valuation

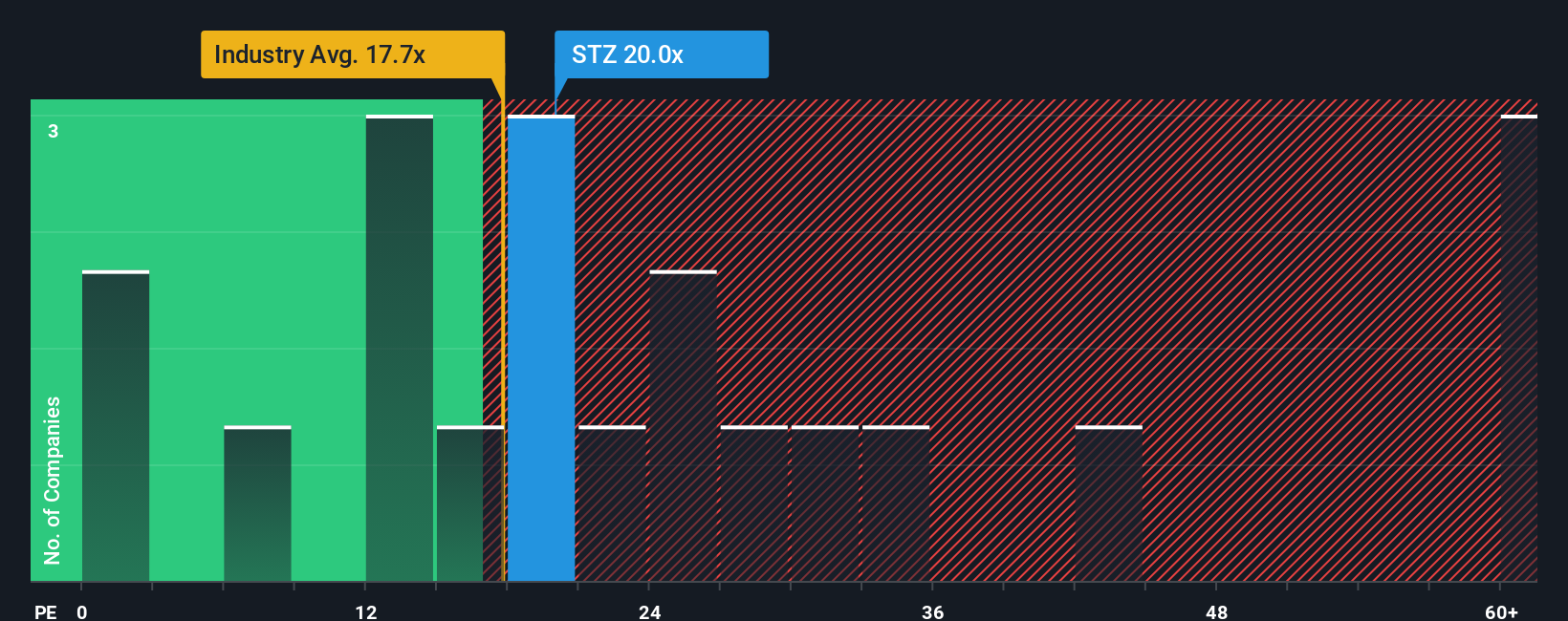

On earnings, Constellation looks far less beaten down. The stock trades on about 21 times earnings, slightly richer than both global beverage peers at 17.6 times and its own fair ratio of 21.9 times. This hints that the market is already paying up for a recovery story. Is that optimism warranted yet?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Constellation Brands Narrative

If you see the story differently or want to stress test the assumptions with your own numbers, you can build a custom view in minutes: Do it your way.

A great starting point for your Constellation Brands research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, use our powerful screeners to help identify your next potential winners, so you are not leaving compelling, data backed opportunities on the table.

- Target reliable cash returns by reviewing these 13 dividend stocks with yields > 3% that combine attractive yields with balance sheet strength and the potential for steady long term income.

- Explore structural growth trends through these 26 AI penny stocks that may benefit from the adoption of automation, machine learning, and data heavy software solutions worldwide.

- Position yourself early in evolving markets with these 80 cryptocurrency and blockchain stocks that harness blockchain innovation, token based ecosystems, and emerging digital asset infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報