Neurocrine Biosciences (NBIX): Revisiting Valuation After a Year of Double-Digit Shareholder Returns

Neurocrine Biosciences (NBIX) has quietly kept shareholders rewarded this year, with the stock up about 11% year to date and roughly 21% over the past year despite recent minor pullbacks.

See our latest analysis for Neurocrine Biosciences.

That pattern of a modest 1 day share price pullback against a solid 30 day share price return of 5.48 percent and a 1 year total shareholder return above 20 percent suggests positive momentum is still broadly intact, as investors reassess growth and risk in the story at around 152.8 dollars per share.

If Neurocrine’s steady gains have you thinking about where else defensiveness and innovation might overlap, it is worth scanning other healthcare stocks that could be setting up for similar multi year compounding.

With double digit earnings growth, a sizable apparent intrinsic discount, and analyst targets sitting comfortably above the current price, is Neurocrine still an underappreciated compounder, or is the market already discounting years of future growth?

Most Popular Narrative: 38% Undervalued

With Neurocrine Biosciences closing at 152.8 dollars versus a narrative fair value near 244.8 dollars, the valuation case leans heavily on future growth and earnings power.

📌 Earnings Expectations (Preliminary) for Neurocrine Biosciences' Q2 2025 earnings

• Consensus EPS Estimate: Around $0.97 per share.

• Expected Revenue: Approximately $653.09 million. Neurocrine continues to focus on treatments for neurological, neuroendocrine, and neuropsychiatric disorders. Their portfolio includes FDA-approved drugs like Ingrezza® and Orilissa®, and they are advancing multiple compounds in mid- to late-stage clinical trials.

Want to see how double digit growth, rising profit margins, and a premium future earnings multiple combine to justify this ambitious upside case? The narrative leans on a long runway of revenue expansion, operating leverage, and a valuation usually reserved for market darlings. Curious which assumptions really drive that gap to fair value, and how sensitive the story is if they slip? Dive in to unpack the full playbook behind this projected upside.

Result: Fair Value of $244.8 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, even compelling upside depends on flawless execution, with regulatory setbacks or slower than expected trial progress both capable of quickly compressing that lofty valuation gap.

Find out about the key risks to this Neurocrine Biosciences narrative.

Another View on Valuation

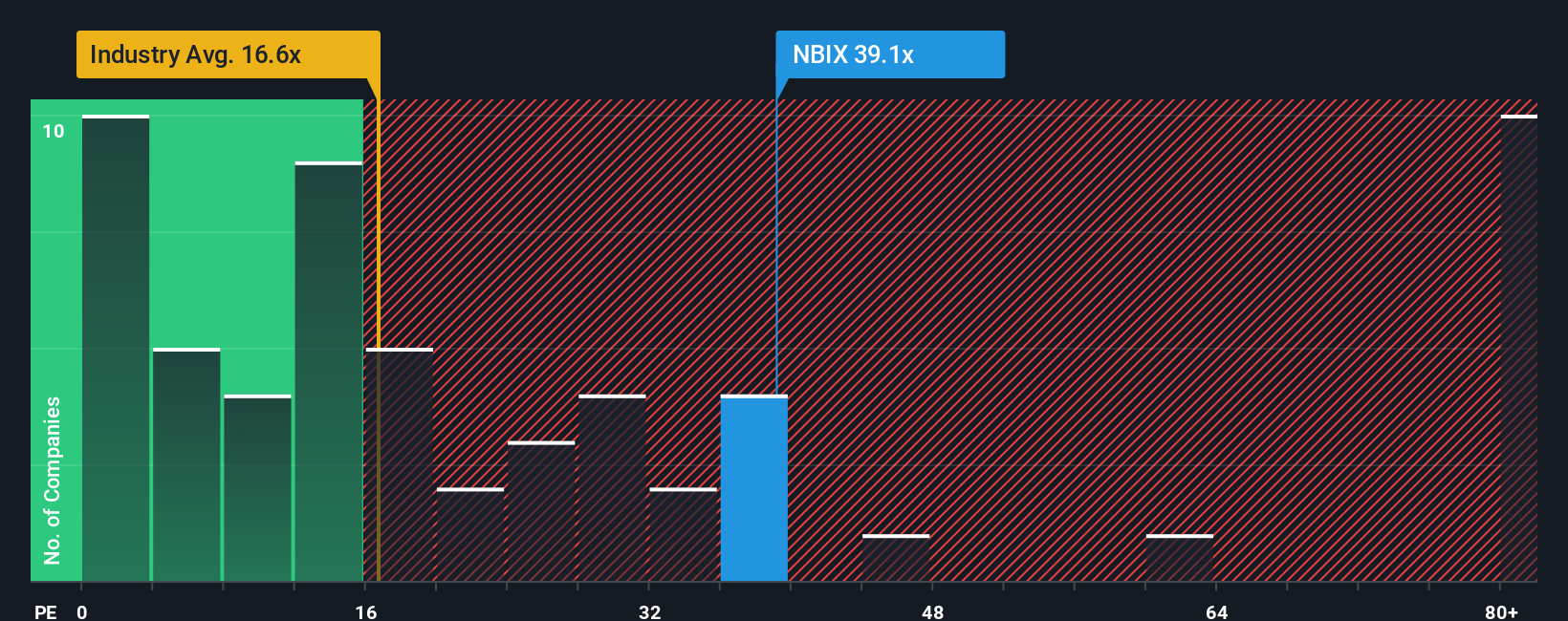

On earnings multiples, Neurocrine looks far less forgiving. The stock trades at about 35.6 times earnings, versus a fair ratio of 25.8 times, a 19 times industry average, and 17.1 times for peers. This suggests investors are already paying up for execution risk. Is that premium really secure?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Neurocrine Biosciences Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Neurocrine Biosciences.

Ready for your next investing move?

Put your research momentum to work by lining up your next opportunities now, so you are not scrambling after the market has already moved without you.

- Capitalize on mispriced potential by targeting these 908 undervalued stocks based on cash flows that may offer strong upside before the crowd catches on.

- Ride structural tailwinds in machine learning and automation through these 26 AI penny stocks tapping into long term, data driven growth themes.

- Strengthen your income stream with these 13 dividend stocks with yields > 3% that can keep cash flowing even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報