Royal Gold (RGLD): Valuation Check After Record Q3 2025 Results, New Assets and a Higher Dividend

Royal Gold (RGLD) just delivered record third quarter 2025 revenue and cash flow, fueled by the Mount Milligan mine life extension, Fourmile exploration progress, and newly closed Sandstorm Gold and Horizon Copper acquisitions.

See our latest analysis for Royal Gold.

The market seems to be buying into that growth story, with Royal Gold’s share price up 17.72% over the past month and a strong year to date share price return of 62.59 percent. Longer term total shareholder returns above 100 percent suggest momentum is still firmly intact despite the recent director sale and earnings miss.

If these record results have you rethinking your exposure to metals and mining, it could be worth exploring fast growing stocks with high insider ownership as a way to uncover other potential long term compounders.

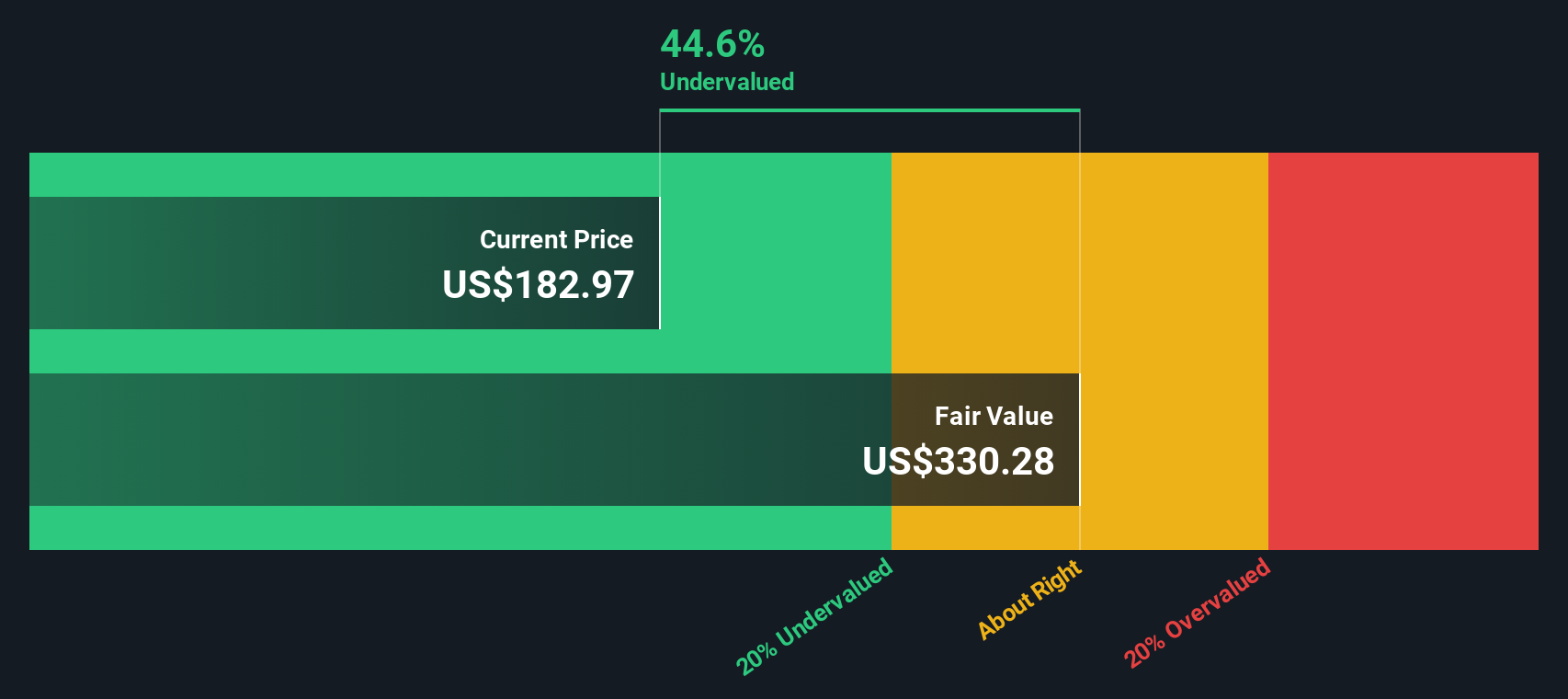

With the stock up sharply and still trading at a discount to analyst targets and some intrinsic value estimates, the key question now is simple: Is Royal Gold still undervalued, or is the market already pricing in future growth?

Most Popular Narrative: 12% Undervalued

Based on the most widely followed narrative, Royal Gold’s fair value sits above the recent 218.75 dollar close, framing today’s rally as only a partial re rating.

The strategic acquisitions of Sandstorm Gold and Horizon Copper will significantly diversify Royal Gold's asset base, reducing single asset risk and increasing exposure to long term growth projects, which should drive more stable and growing revenue streams and improve net margins.

Curious how this acquisition driven reshaping of Royal Gold turns into a higher valuation today, not years from now? The narrative quietly stacks aggressive growth, fatter margins, and a future earnings multiple that rivals sector leaders into one cohesive case. Want to see the precise assumptions powering that upside gap between market price and fair value? Read on to uncover the full playbook behind this 12 percent undervaluation call.

Result: Fair Value of $248.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the bullish case could unravel if gold prices weaken persistently or key mines continue underperforming, which would undermine assumptions about revenue growth and margin expansion.

Find out about the key risks to this Royal Gold narrative.

Another Angle on Valuation

Our SWS DCF model paints a slightly different picture, suggesting Royal Gold is trading about 19 percent below an estimated fair value of 269.98 dollars. If cash flows really do grow as forecast, is this a cushion against downside or a sign expectations are already stretched?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Royal Gold Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized Royal Gold story in minutes: Do it your way.

A great starting point for your Royal Gold research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Do not stop with one idea when the market is full of opportunities. Use the Simply Wall Street Screener to spot your next potential winner today.

- Target steady income by scanning these 13 dividend stocks with yields > 3% that may offer resilient payouts in different market conditions.

- Position yourself for structural growth by reviewing these 30 healthcare AI stocks driving change across diagnostics, treatment, and hospital efficiency.

- Capture high potential volatility by tracking these 80 cryptocurrency and blockchain stocks shaping the evolution of digital finance and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報