Does Fitch’s Stable BBB- Rating Reshape the Risk Narrative Around Omega Healthcare Investors’ (OHI) Leverage?

- Earlier this week, Fitch Ratings affirmed Omega Healthcare Investors’ Long-Term Issuer Default Rating at ‘BBB-’ with a Stable Outlook, highlighting its improving operations, low leverage, and ongoing access to capital despite lingering uncertainty in the skilled nursing sector.

- The affirmation underscores how demographic support and portfolio improvements are helping Omega maintain credit stability even as sector-level risks persist.

- We’ll now examine how Fitch’s reaffirmed ‘BBB-’ rating and Stable Outlook may influence Omega Healthcare Investors’ broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Omega Healthcare Investors Investment Narrative Recap

To own Omega Healthcare Investors, you need to believe that aging demographics and a stabilized regulatory backdrop can offset the skilled nursing sector’s ongoing uncertainties. Fitch’s reaffirmed BBB minus rating with a Stable Outlook reinforces the balance sheet strength behind that thesis and modestly supports the near term catalyst of continued capital access, but it does not change the key risk that sector level stress or tenant issues, such as the Genesis bankruptcy process, could still weigh on rental income.

Among recent developments, Omega’s US$2.3 billion unsecured credit facility stands out as most relevant to Fitch’s rating decision, as it illustrates the company’s ability to refinance debt and fund acquisitions without sharply increasing leverage. That, in turn, ties directly into the catalyst of disciplined balance sheet management and potential portfolio growth, while still leaving investors to weigh the ongoing reimbursement and operator headwinds that could test rent coverage if conditions tighten.

Yet beneath the comfort of an investment grade rating, investors should be aware of how a drawn out Genesis bankruptcy could still...

Read the full narrative on Omega Healthcare Investors (it's free!)

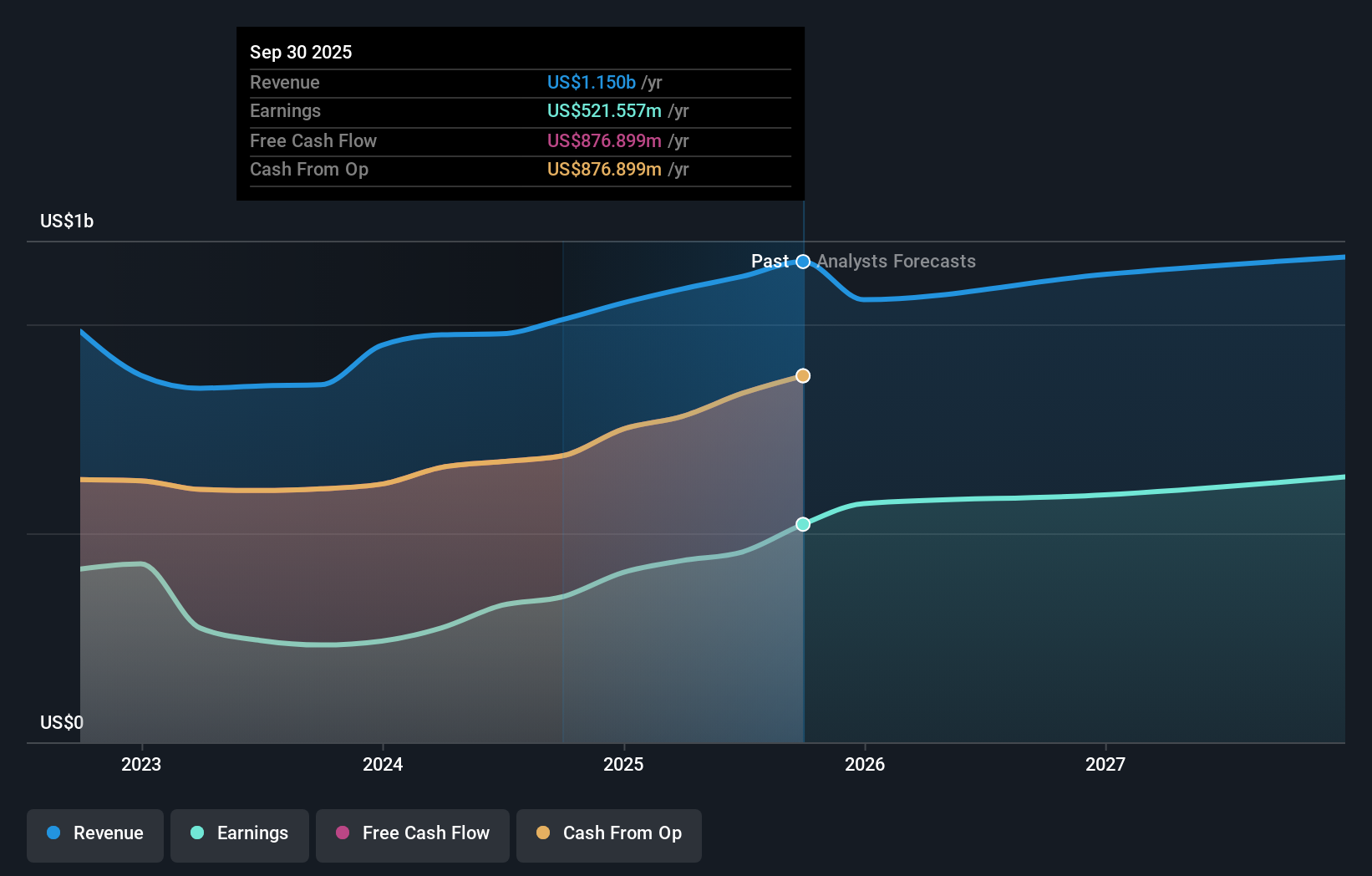

Omega Healthcare Investors' narrative projects $1.1 billion revenue and $617.6 million earnings by 2028. This implies a 0.1% yearly revenue decline and an earnings increase of about $162 million from $455.5 million today.

Uncover how Omega Healthcare Investors' forecasts yield a $46.56 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community currently place Omega’s fair value between US$46.56 and US$86.54, reflecting very different expectations. Against that backdrop, Fitch’s Stable Outlook and focus on leverage and access to capital may matter more for the company’s ability to sustain growth and dividends than any single valuation point, so it makes sense to compare several viewpoints before deciding where you stand.

Explore 3 other fair value estimates on Omega Healthcare Investors - why the stock might be worth as much as 97% more than the current price!

Build Your Own Omega Healthcare Investors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Omega Healthcare Investors research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Omega Healthcare Investors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Omega Healthcare Investors' overall financial health at a glance.

No Opportunity In Omega Healthcare Investors?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報