Will IMCD’s Internal CFO Succession Plan Strengthen Management Continuity and Credibility (ENXTAM:IMCD)?

- IMCD N.V. has announced that its Supervisory Board nominated long-time internal executive Floris Lagerwerf to become Chief Financial Officer in January 2027, succeeding retiring CFO Hans Kooijmans after a year-long transition period starting in 2026.

- This early and internally focused succession plan, alongside proposed Supervisory Board reappointments, underscores IMCD’s emphasis on continuity in financial oversight and governance.

- Next, we’ll explore how appointing an internal successor as future CFO could influence IMCD’s investment narrative and long‑term execution.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

IMCD Investment Narrative Recap

To own IMCD, you need to believe its specialist distribution model can compound value as manufacturers outsource more and niche end‑markets deepen, despite softer recent earnings and FX pressures. The CFO succession news itself does not materially change the near term drivers, which still hinge on demand recovery, working capital normalisation and the company’s ability to offset cost inflation and M&A driven balance sheet strain.

The most directly connected development is the Supervisory Board’s plan to reappoint key members in 2026, alongside expanding the board to six members, which ties into the CFO transition. For investors watching execution on digitalisation and outsourcing related growth, this continuity in oversight may help support consistency in capital allocation and integration decisions at a time when M&A intensity and macro uncertainty remain central to the story.

But set against this leadership continuity, investors should still be aware of how elevated acquisition activity could compound if...

Read the full narrative on IMCD (it's free!)

IMCD's narrative projects €5.7 billion revenue and €345.6 million earnings by 2028.

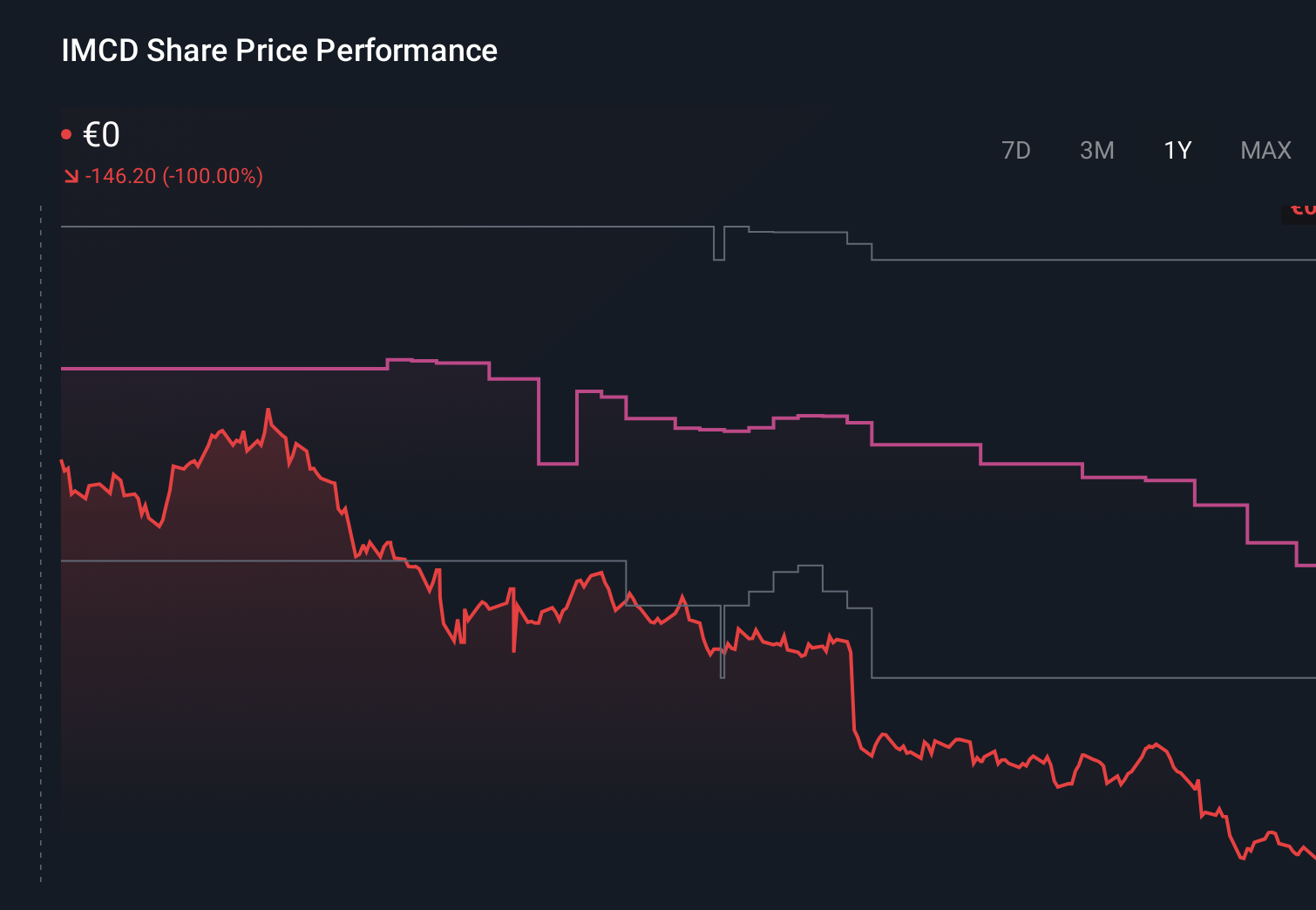

Uncover how IMCD's forecasts yield a €127.18 fair value, a 65% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community currently see IMCD’s fair value between €85 and €167.02 per share, highlighting wide dispersion in individual models. Against this backdrop, concerns about modest organic growth and cost inflation effects on margins give you clear context for why opinions differ and why it can be useful to weigh several alternative viewpoints before forming your own.

Explore 5 other fair value estimates on IMCD - why the stock might be worth just €85.00!

Build Your Own IMCD Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IMCD research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free IMCD research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IMCD's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報