Assessing Celestica’s (TSX:CLS) Valuation After Its Strong Run and Recent Pullback

Celestica (TSX:CLS) has been on many radar screens after its powerful run this year, but the last month’s pullback has some investors wondering whether the market is finally catching its breath.

See our latest analysis for Celestica.

Despite the sharp 1 day share price pullback and a softer 7 day share price return, Celestica’s 90 day share price gain and multi year total shareholder returns suggest momentum is pausing rather than breaking.

If Celestica’s run has you rethinking your tech exposure, this could be a moment to explore high growth tech and AI stocks that might be setting up for their next leg higher.

With revenue and earnings still climbing and the share price now off recent highs, the key question is whether Celestica’s surge still understates its earnings power or if markets are already pricing in years of future growth.

Most Popular Narrative Narrative: 26% Undervalued

Compared to Celestica’s last close at CA$421.77, the most popular narrative anchors on a materially higher fair value estimate, framing a bullish long term earnings story.

Shifting mix toward high margin end markets (A&D, industrial, healthtech) and value added services (full rack integration, after market, design, and services) is expected to drive net margin expansion and enhance earnings quality, particularly from 2026 onward.

Curious how this margin upgrade, aggressive top line expansion, and a richer future earnings multiple all intersect to justify the upside? The narrative’s assumptions are anything but conservative, and the full breakdown reveals which growth lever really carries the valuation. Want to see which financial swing matters most for that higher fair value call? Dive in to unpack the numbers behind the optimism.

Result: Fair Value of $569.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated hyperscaler exposure and execution risk around major AI and networking ramps could quickly challenge today’s upbeat margin and valuation assumptions.

Find out about the key risks to this Celestica narrative.

Another Way to Look at Value

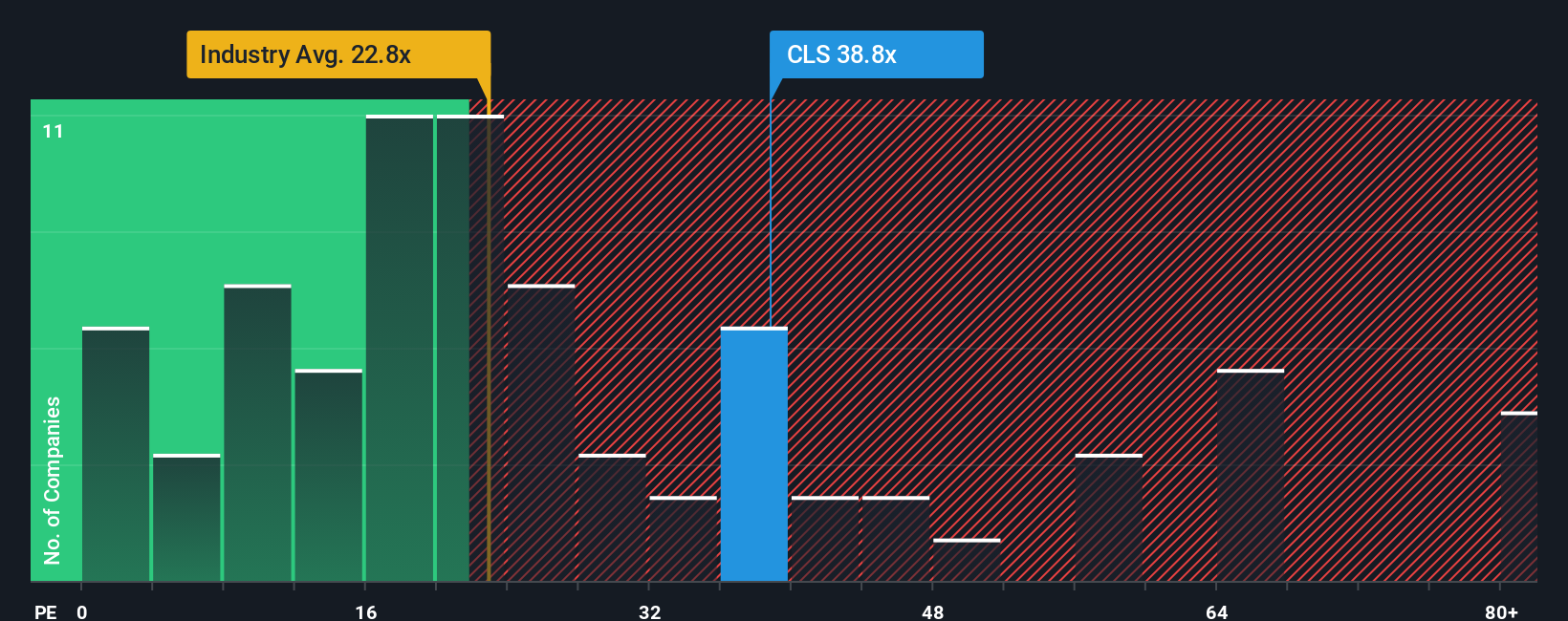

While the narrative leans on long term earnings power to argue Celestica is 26% undervalued, a simple price to earnings lens tells a different story. At 49.2 times earnings versus 24.8 times for the industry, 33.4 times for peers, and a 48 times fair ratio, the stock screens expensive. This raises the risk that any stumble in growth could hit the share price hard. Which version of value do you trust when momentum cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Celestica Narrative

If you see Celestica’s story differently or want to stress test the assumptions with your own inputs, you can build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Celestica.

Looking for more investment ideas?

Before you move on, consider using the Simply Wall Street Screener to uncover candidates that match your goals and risk profile.

- Capture early momentum by targeting these 3612 penny stocks with strong financials that already show real financial strength instead of relying on hype alone.

- Position yourself ahead of the next earnings wave by focusing on these 908 undervalued stocks based on cash flows that markets have not fully appreciated yet.

- Strengthen your portfolio’s income stream by zeroing in on these 13 dividend stocks with yields > 3% that combine current yields with payout characteristics that align with your strategy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報