Is NXP Semiconductors (NXPI) Still Undervalued After Its Recent 16% Share Price Climb?

NXP Semiconductors (NXPI) has quietly climbed about 16% over the past month, even without a clear headline catalyst, putting fresh attention on whether the recent move fairly reflects its growth profile.

See our latest analysis for NXP Semiconductors.

That 15.8% 1 month share price return has shifted sentiment after a quieter quarter, and while the 1 year total shareholder return of 7.2% looks modest, the 5 year total shareholder return of 60.1% signals steady long term compounding rather than a sudden, hype driven spike.

If NXP’s move has you thinking about where else momentum could build, this is a good moment to explore high growth tech and AI stocks for other potential semiconductor and chip adjacent ideas.

With earnings still growing faster than sales and the share price sitting below the average analyst target, the key question now is simple: is NXP still undervalued, or is the market already pricing in its future growth?

Most Popular Narrative: 11.6% Undervalued

With NXP Semiconductors last closing at $228.16 versus a narrative fair value near $258, the current share price sits below those growth driven expectations.

The analysts have a consensus price target of $258.19 for NXP Semiconductors based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $289.0, and the most bearish reporting a price target of just $210.0.

Want to see what kind of revenue climb, margin rebuild, and earnings expansion could back that gap to fair value? The playbook may surprise you.

Result: Fair Value of $258.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that playbook depends on a smooth recovery, and renewed automotive softness or aggressive China pricing could quickly compress margins and derail those upside assumptions.

Find out about the key risks to this NXP Semiconductors narrative.

Another Lens on Value

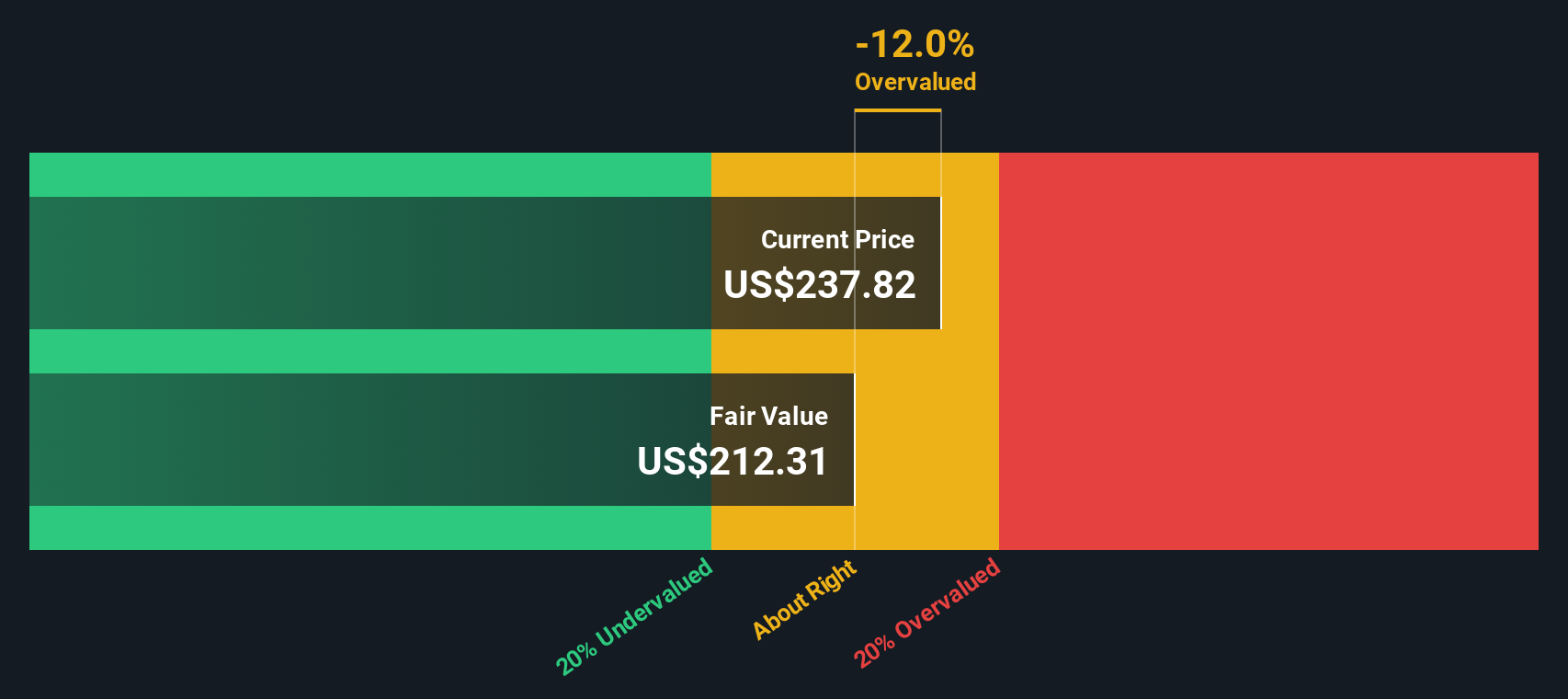

Our SWS DCF model paints a cooler picture, with fair value closer to $218.58, implying NXP is trading slightly above intrinsic value rather than at a big discount. If cash flows are right and the narrative is too optimistic, potential upside could be thinner than it appears.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NXP Semiconductors for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NXP Semiconductors Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom view in just minutes with Do it your way.

A great starting point for your NXP Semiconductors research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next high conviction idea?

Before you move on, lock in your advantage by scanning fresh opportunities on Simply Wall St’s Screener, where data and narrative meet to sharpen your decisions.

- Capture asymmetric upside with carefully filtered small caps via these 3612 penny stocks with strong financials that balance higher risk with strong underlying fundamentals.

- Ride structural growth in automation and intelligent software by targeting companies powering innovation through these 26 AI penny stocks.

- Strengthen your margin of safety by zeroing in on companies trading below intrinsic value using these 908 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報