Synchrony Financial (SYF): Reassessing Valuation After Strong Recent Share Price Performance

Synchrony Financial (SYF) has quietly turned into one of the stronger performers in consumer finance, with the stock up around 29% this year and roughly 26% over the past year.

See our latest analysis for Synchrony Financial.

That steady climb to an $84.22 share price, with a 1 month share price return of just over 15% and a standout 5 year total shareholder return approaching 192%, suggests momentum is building as investors reassess Synchrony’s growth and risk profile.

If Synchrony’s run has you thinking about what else might be gaining traction, this could be a good moment to explore fast growing stocks with high insider ownership.

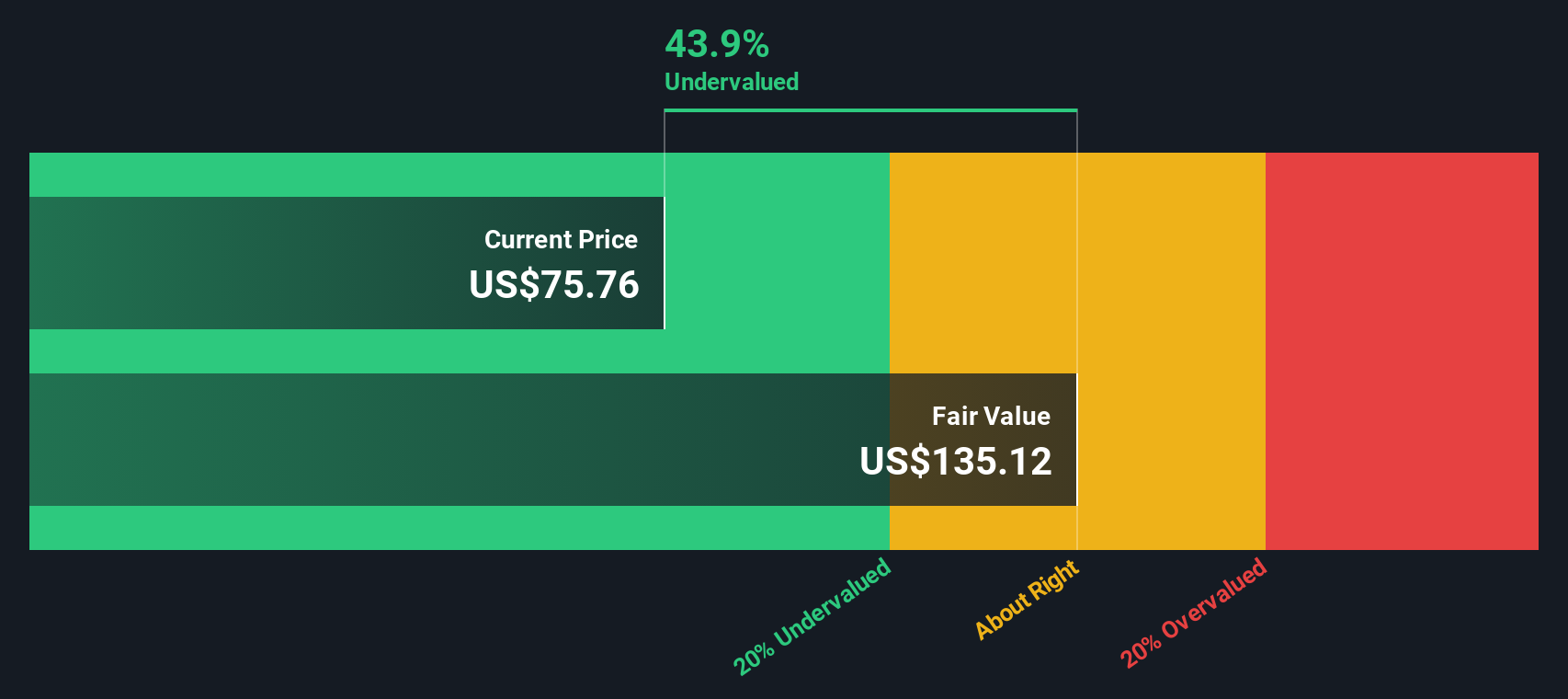

With shares hovering near analysts’ targets but still trading at a hefty intrinsic discount, the key question now is whether Synchrony remains undervalued or if the market is already pricing in its next leg of growth?

Most Popular Narrative Narrative: 1.8% Overvalued

Compared with Synchrony’s last close at $84.22, the most followed narrative pegs fair value slightly lower, suggesting only a modest premium in today’s price.

The company's expansion in high growth verticals like health, wellness, and pet financing where it is resuming growth after recent credit tightening broadens the consumer base and diversifies revenue streams, contributing to more sustainable earnings growth and risk mitigation over the long run.

Curious how a relatively small gap between price and fair value can still hinge on bold calls about growth, margins, and buybacks? Want to see exactly which long run financial bets are doing the heavy lifting in this valuation story, and how they stack up against today’s earnings power and revenue base?

Result: Fair Value of $82.74 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated payment rates and intense fintech competition could blunt loan growth, pressure margins, and test confidence in Synchrony’s long term earnings power.

Find out about the key risks to this Synchrony Financial narrative.

Another Lens On Value

Our SWS DCF model paints a very different picture, suggesting Synchrony might actually be worth around $145.54 per share, which is about 42% above today’s price. When one model calls modest overvaluation and another deep undervaluation, which story do you lean toward?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Synchrony Financial Narrative

If you see things differently or simply want to dig into the numbers yourself, you can build a complete view in just minutes: Do it your way.

A great starting point for your Synchrony Financial research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before the market moves again, put your watchlist to work with fresh ideas from the Simply Wall St Screener, so you are not stuck reacting later.

- Capitalize on mispriced opportunities by targeting these 908 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Ride powerful secular trends by zeroing in on these 26 AI penny stocks that could reshape how businesses operate worldwide.

- Lock in dependable income streams by focusing on these 13 dividend stocks with yields > 3% that can support long term wealth building.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報