Does Lucid (LCID) Still Have a Credible Path to Breakeven Amid Dilution Concerns?

- Earlier this month, Lucid Group participated in investor conferences in Florida and London, where its interim CEO and CFO outlined production plans, capital needs, and progress on scaling the new Gravity SUV.

- At the same time, a cautious analyst downgrade highlighting extended losses and potential equity dilution contrasted with a more supportive backdrop from lower interest rates, sharpening investor focus on Lucid’s path to breakeven and funding.

- We’ll now examine how Morgan Stanley’s cautious outlook on losses and dilution risks reshapes Lucid Group’s existing investment narrative.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Lucid Group Investment Narrative Recap

To own Lucid Group today, you need to believe that Gravity’s production ramp, broader model lineup and technology can eventually support scale and a path to breakeven, despite current heavy losses. The recent conferences and Morgan Stanley downgrade sharpen attention on two near term swing factors: execution on the Gravity SUV ramp as the key catalyst, and funding and dilution risk as the biggest overhang. The rate cut helps financing conditions but does not materially change these fundamentals.

Among recent announcements, Lucid’s plan to roughly double output to about 18,000 vehicles in 2025, while targeting breakeven around 72,000 units annually, ties directly into this debate. The investor presentations in Florida and London effectively put those production and capital markers in front of the market at the same time as the downgrade, making the credibility of Lucid’s scale up plans central to how investors weigh the upside from Gravity against the risk of further equity issuance.

Yet, while Gravity’s ramp is central to the story, investors also need to be aware of the potential impact of a sizeable equity raise and...

Read the full narrative on Lucid Group (it's free!)

Lucid Group's narrative projects $5.6 billion revenue and $285.8 million earnings by 2028.

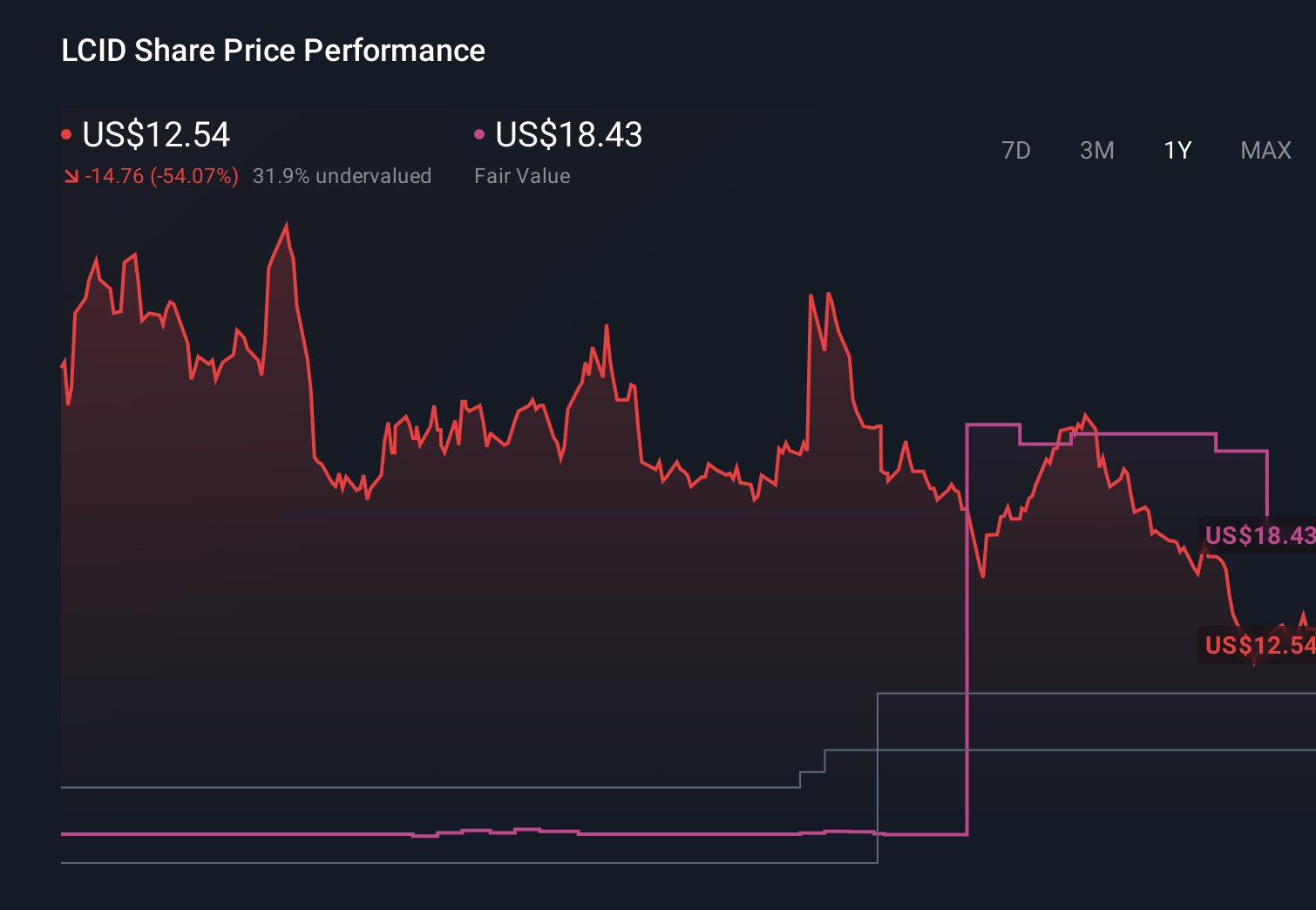

Uncover how Lucid Group's forecasts yield a $18.43 fair value, a 47% upside to its current price.

Exploring Other Perspectives

Eighteen Simply Wall St Community fair value estimates span roughly US$0.50 to US$54.80 per share, highlighting very different expectations. Set against concerns about continued losses and dilution risk, it is worth weighing several of these views before deciding how Lucid might fit in your portfolio.

Explore 18 other fair value estimates on Lucid Group - why the stock might be worth less than half the current price!

Build Your Own Lucid Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lucid Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Lucid Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lucid Group's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報