Sizing Up LiveRamp (RAMP): Is the Recent 90-Day Rebound Enough to Justify Its Valuation?

LiveRamp Holdings (RAMP) has been quietly grinding higher over the past quarter, and that move looks more interesting once you line it up against the company’s improving revenue and faster growing profits.

See our latest analysis for LiveRamp Holdings.

At around $30.21, the recent 90 day share price return of 14.69% contrasts with a softer 1 year total shareholder return of negative 5.15%. This suggests improving sentiment but a still recovering long term story.

If you like the mix of growth and data driven business models, it could be worth scanning other high growth tech names through high growth tech and AI stocks to see what else stands out.

With earnings rising faster than revenue and the shares still trading at a hefty discount to analyst targets and intrinsic value estimates, the key question now is whether LiveRamp remains mispriced or if the market is already factoring in that growth.

Most Popular Narrative: 23.8% Undervalued

With LiveRamp last closing at $30.21 against a most popular narrative fair value of $39.63, the story frames current pricing as meaningfully behind fundamentals.

Ongoing operational efficiencies from offshoring, automation, and disciplined stock-based compensation, combined with positive momentum in high-margin product lines, are driving significant improvement in operating and free cash flow margins, enabling increased share buybacks and potential EPS upside.

It may be surprising that modest top line growth can still support such a rich upside case. The explanation focuses on margin expansion, earnings momentum, and a potential future valuation reset. Want to see exactly how these moving parts add up to that fair value projection, and which assumptions carry the most weight? Dive into the full narrative to unpack the numbers behind this perspective.

Result: Fair Value of $39.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained revenue concentration among large clients and intensifying competition in AI driven data connectivity could quickly challenge this upside-focused narrative.

Find out about the key risks to this LiveRamp Holdings narrative.

Another View: Rich Multiples Cloud the Picture

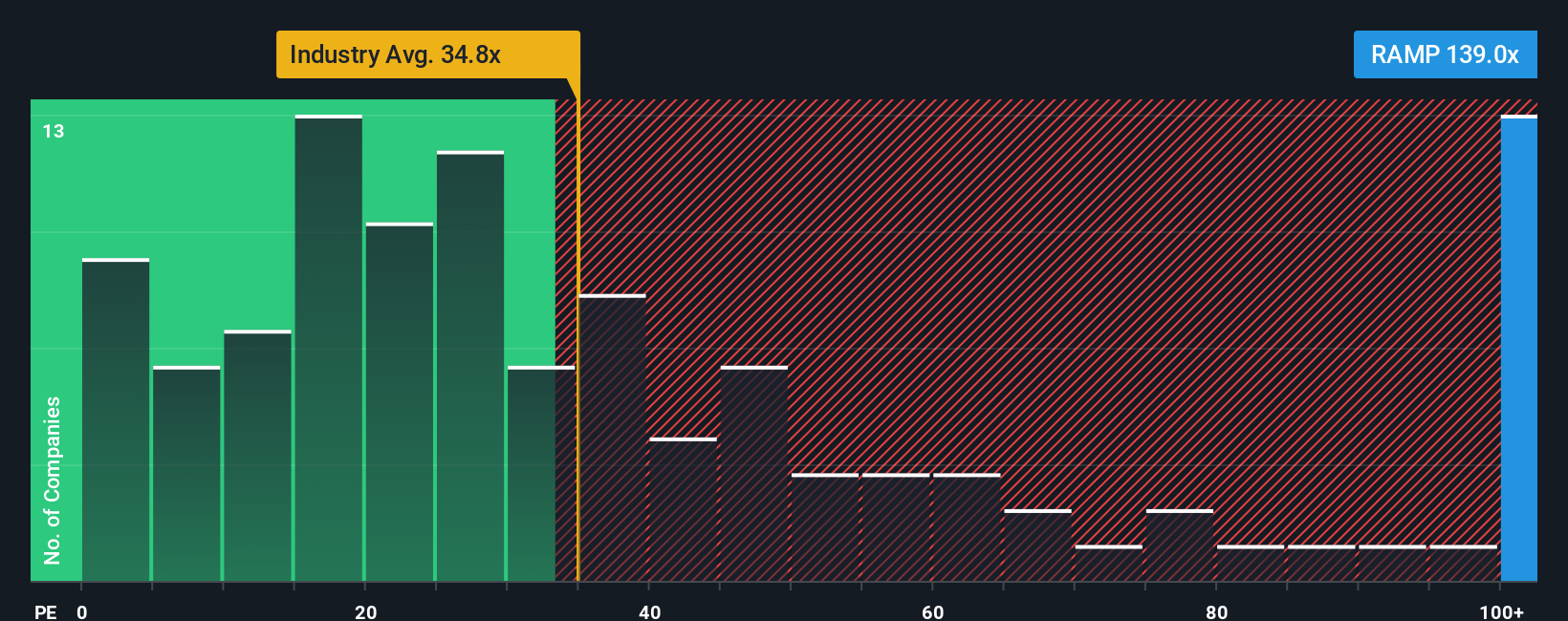

Look past narratives and cash flow models, and the market is already paying up for LiveRamp. Its price to earnings ratio sits near 50 times, far above US software peers at 32.9 times and a fair ratio of 30 times. This raises real downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LiveRamp Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding LiveRamp Holdings.

Ready for more high conviction ideas?

Before you move on, put Simply Wall Street’s Screener to work so you do not miss stocks quietly setting up the next leg of your portfolio’s growth.

- Capitalize on potential market mispricings by hunting through these 908 undervalued stocks based on cash flows that show strong cash flow support for their valuations.

- Ride the next wave of innovation by targeting these 26 AI penny stocks positioned at the intersection of software, automation, and intelligent data.

- Strengthen your income stream with these 13 dividend stocks with yields > 3% that combine robust yields with the potential for long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報