Deutsche Post (XTRA:DHL): Reviewing Valuation After a Strong Three-Month Share Price Rally

Deutsche Post (XTRA:DHL) has quietly delivered solid returns this year, and with shares up about 23% over the past 3 months, investors are starting to recheck what they are actually paying for.

See our latest analysis for Deutsche Post.

Zooming out, Deutsche Post has been in a clear upswing, with a roughly 38.5% year to date share price return and a 3 year total shareholder return above 50%. This suggests momentum is building as investors reassess its earnings resilience and valuation.

If Deutsche Post's steady climb has you rethinking your portfolio, this is a good moment to widen the lens and explore fast growing stocks with high insider ownership.

Yet with the share price now edging above the average analyst target, but our intrinsic value model still implying a sizeable discount, investors face a key question: is Deutsche Post still a buy, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 5.2% Overvalued

With Deutsche Post closing at €46.98 versus a narrative fair value of €44.66, the current rally is being weighed against a more tempered long term outlook.

Strategic structural cost initiatives under the Fit for Growth program are already delivering net positive effects, ahead of plan, and are expected to contribute over €1 billion in annual run rate savings by 2026, which is expected to drive higher net margins and earnings quality.

Want to see what kind of slow but steady revenue expansion, margin lift and future earnings multiple have to come together to justify that valuation path?

Result: Fair Value of $44.66 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks like tighter de minimis rules and prolonged trade weakness could further pressure Express volumes and delay the earnings recovery that underpins this narrative.

Find out about the key risks to this Deutsche Post narrative.

Another Angle on Value

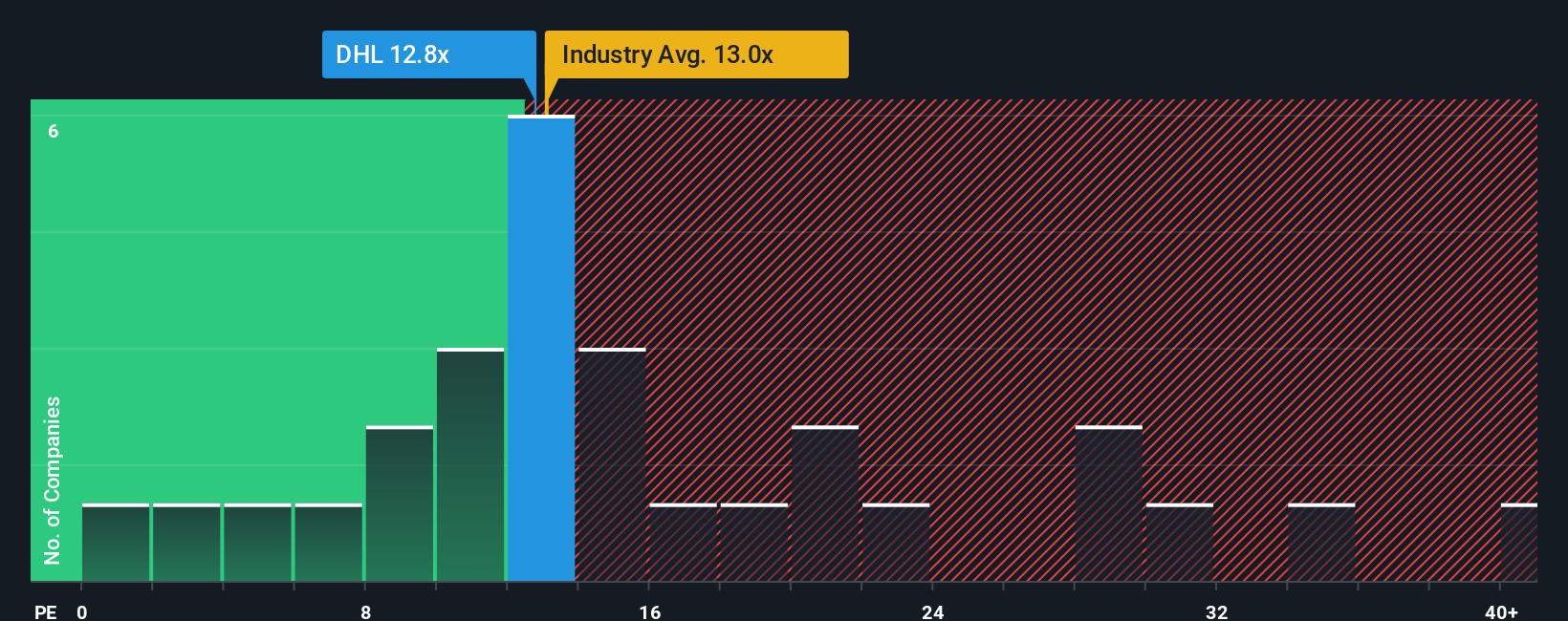

While the most popular narrative says Deutsche Post looks about 5% overvalued versus its €44.66 fair value, the earnings multiple story is more forgiving. At 14.9 times earnings, the shares sit well below peers at 20.5 times and even under a 16 times fair ratio, which hints at upside if sentiment keeps improving.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Deutsche Post Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes, Do it your way.

A great starting point for your Deutsche Post research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall Street Screener to surface fresh, data driven ideas beyond Deutsche Post.

- Capture early stage potential by reviewing these 3612 penny stocks with strong financials that already back up their stories with solid financials and disciplined execution.

- Target powerful secular themes by focusing on these 26 AI penny stocks positioned at the intersection of scalable business models and real world AI adoption.

- Strengthen your income stream by scanning these 13 dividend stocks with yields > 3% that balance attractive yields with sustainable payout ratios and resilient cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報