Is Estée Lauder’s 2025 Rebound Justified After a 40.7% Year to Date Surge?

- If you have been wondering whether Estée Lauder Companies at around $104 is a comeback story or a value trap, you are not alone. The numbers give us some clues worth unpacking.

- The stock is up 18.1% over the last month and 40.7% year to date, yet it is still down sharply over 3 and 5 years. This suggests that sentiment has shifted, but the long term scars have not fully healed.

- Investors have been watching Estée Lauder navigate a slow recovery in key beauty markets and ongoing efforts to streamline its product and supply chain footprint, moves that are meant to rebuild both growth and margins. At the same time, the company has been leaning on its strong brand portfolio and travel retail exposure. This helps explain why the market has started to revisit the story even as some macro clouds linger.

- Despite the recent rebound, Estée Lauder only scores 1 out of 6 on our undervaluation checks. Below we look at what different valuation approaches are seeing in the stock, then finish with a framework that can give you an even clearer view of what it is really worth.

Estée Lauder Companies scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Estée Lauder Companies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes the cash Estée Lauder is expected to generate in the future, then discounts those projections back to today to estimate what the business is worth now.

Estée Lauder is currently generating roughly $816.6 million in free cash flow, and analyst and internal projections used in this 2 Stage Free Cash Flow to Equity model see that figure rising to about $2.0 billion by 2030. The path between now and then includes a ramp up in annual free cash flow over the coming decade, with earlier years guided mainly by analyst estimates and the later years extrapolated to reflect a maturing, slower growth phase.

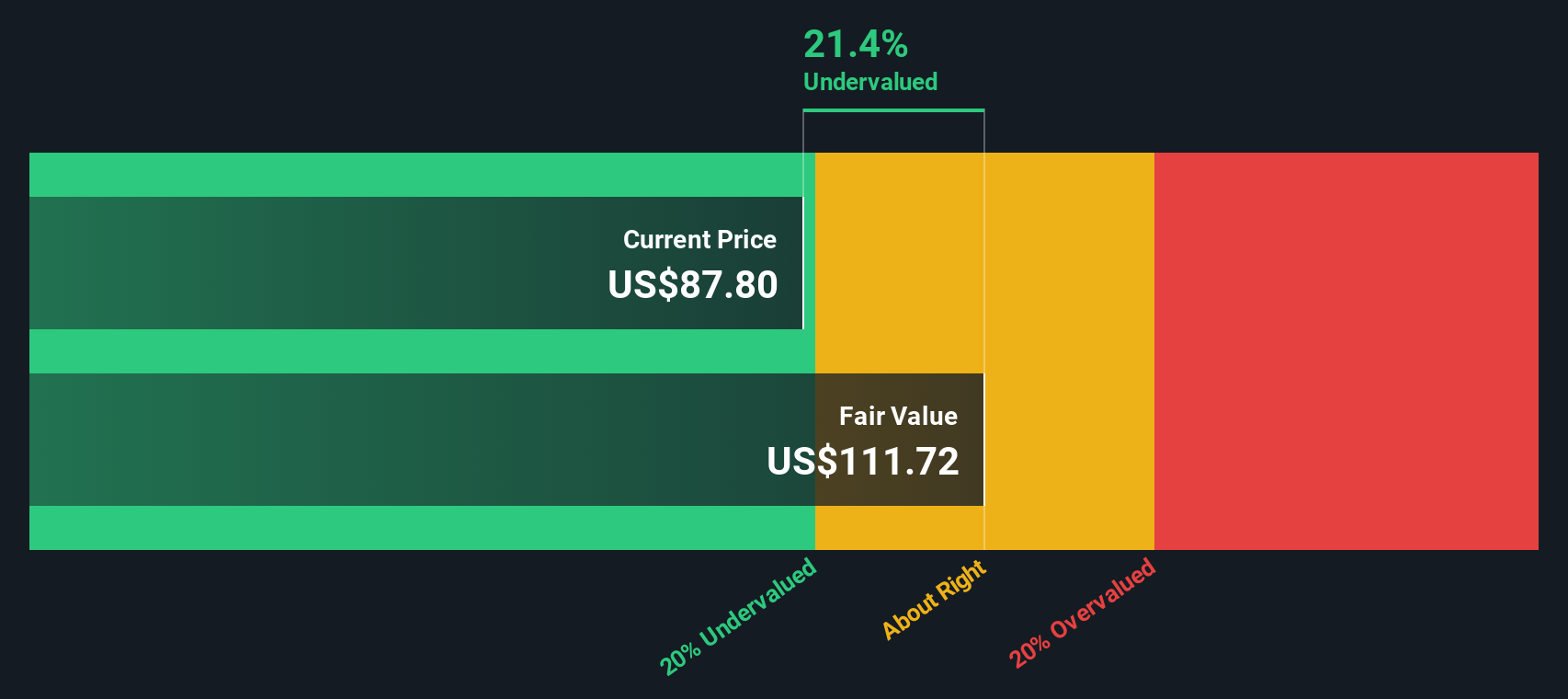

When all those future cash flows are discounted back, the intrinsic value from the DCF comes out at about $107 per share. With the stock trading close to $104, the model implies it is roughly 2.7% undervalued, indicating a modest potential upside rather than a deep discount.

Result: ABOUT RIGHT

Estée Lauder Companies is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Estée Lauder Companies Price vs Sales

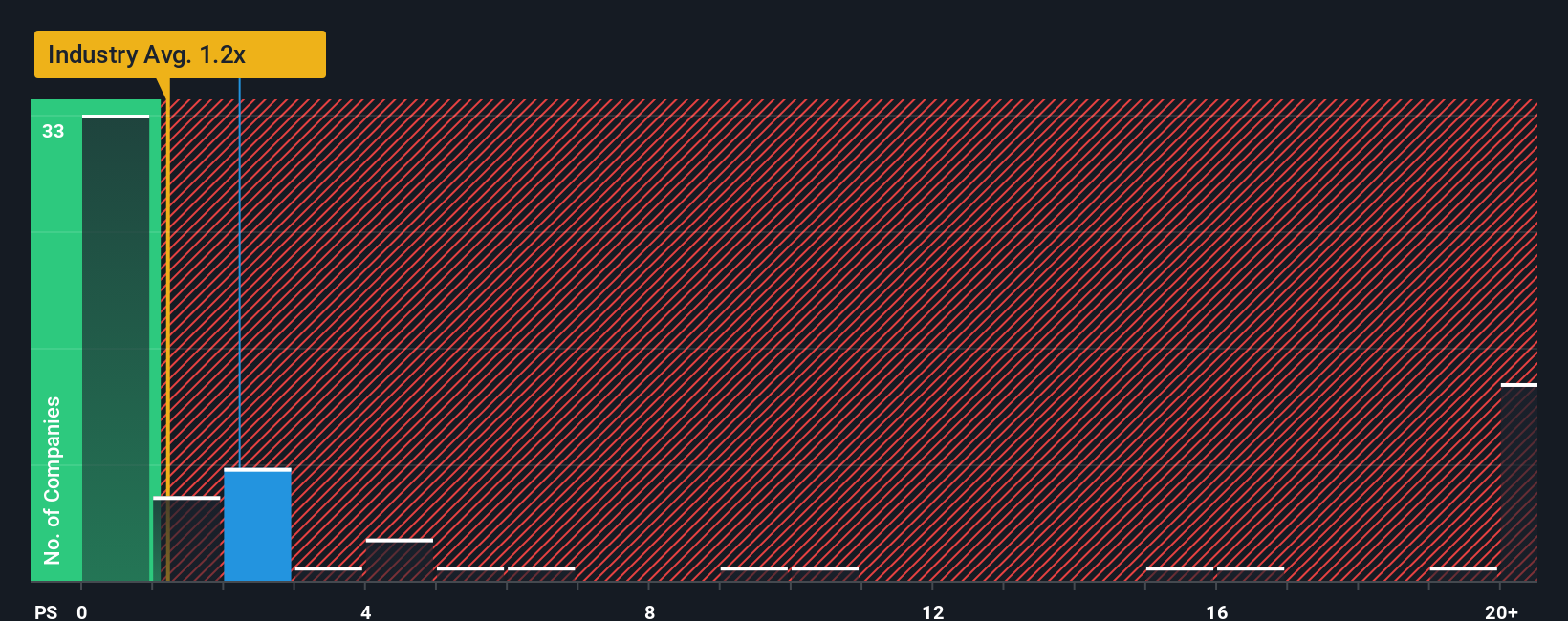

For consumer brands like Estée Lauder, revenue is often a more stable guide than earnings, so the Price to Sales ratio is a useful way to gauge what investors are willing to pay for each dollar of sales. In general, higher growth and lower risk can justify a richer multiple, while slower growth or bumpier cash flows typically call for a lower, more conservative ratio.

Estée Lauder currently trades at about 2.60x sales, which is well above the broader Personal Products industry average of roughly 0.84x and also ahead of the peer group average of around 1.55x. On the surface, that premium suggests the market is already pricing in a meaningful amount of quality and recovery.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what a reasonable Price to Sales multiple should be, given Estée Lauder’s growth outlook, margins, size, industry positioning and risk profile. On that basis, the Fair Ratio sits at about 2.26x. Because this is below the current 2.60x, the shares look somewhat expensive on a sales basis rather than mispriced against peers.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Estée Lauder Companies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story about a company, where you spell out what you think will happen to its revenue, earnings and margins, and then connect that view to a fair value estimate and a buy or sell decision. On Simply Wall St’s Community page, used by millions of investors, Narratives turn a loose thesis like “Estée Lauder will benefit from digital expansion and luxury fragrances” into a concrete forecast and fair value that can be compared directly with today’s share price to decide if the stock looks attractive or stretched. These Narratives are dynamic, automatically updating when new information such as earnings, news or guidance comes in, so your fair value evolves as the facts change. For example, one Estée Lauder Narrative on the platform might assume strong execution and set fair value near $120 per share, while another, more cautious view might focus on travel retail and China risks and land closer to $61, showing how different perspectives translate into different target prices you can weigh against the current market price.

Do you think there's more to the story for Estée Lauder Companies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報