Lineage (LINE): Reassessing Valuation After Q3 2025 Results and Ongoing Strategic Growth Investments

Lineage (LINE) just reported third quarter 2025 results, showing higher warehouse occupancy and ongoing investments in its network. A special call on operational excellence and digital strategy put future efficiency and growth in sharper focus.

See our latest analysis for Lineage.

Even with the operational improvements and digital push in focus, the share price tells a more cautious story. A 1 month share price return of 10.21% contrasts with a sharply negative year to date share price return, suggesting recent momentum is tentative rather than firmly established.

If this kind of execution story has you thinking about where else capital might work harder, it could be worth exploring fast growing stocks with high insider ownership as a source of fresh ideas.

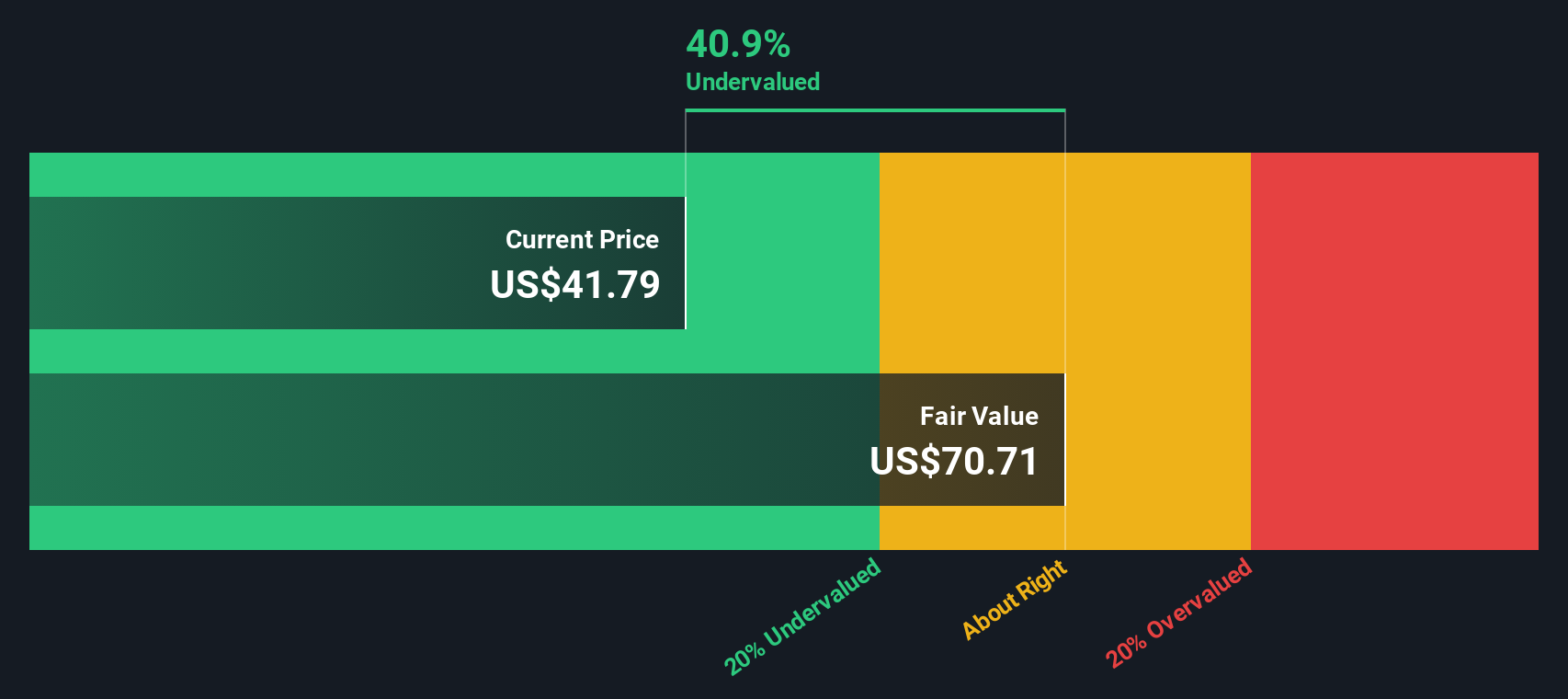

With shares still down sharply this year despite improving occupancy and a sizable intrinsic value gap, the real question is whether Lineage is now trading below its true potential or if markets are already pricing in future growth.

Price-to-Sales of 1.6x, Is it justified?

Lineage closed at $36.82, and on a price-to-sales ratio of 1.6x it looks meaningfully undervalued when set against both peers and intrinsic value estimates.

The price-to-sales multiple compares the value investors place on each dollar of Lineage's revenue to the value placed on revenue at similar companies. For a capital intensive, still unprofitable industrial REIT, revenue based valuation can be a useful yardstick when earnings are negative and traditional profit multiples are less meaningful.

What stands out is how compressed Lineage's multiple is relative to its context. It trades at 1.6x sales versus an estimated fair price-to-sales ratio of 2.3x, a level our models suggest the market could eventually gravitate toward if execution and growth continue. Against the broader Global Industrial REITs industry average of 8.6x and a peer average of 10.7x, the discount is stark, signaling that investors are pricing in a combination of continued losses and execution risk rather than paying up for its scale and network effects.

Explore the SWS fair ratio for Lineage

Result: Price-to-Sales of 1.6x (UNDERVALUED)

However, persistent losses and execution missteps on its digital and operational initiatives could quickly erode confidence and keep the valuation discount in place.

Find out about the key risks to this Lineage narrative.

Another View: What Does Our DCF Suggest?

Our DCF model indicates a fair value of approximately $63.09 per share, which is roughly 42% above the current price of $36.82. If both sales-based multiples and cash flow estimates are pointing to potential upside, is the market being overly skeptical or pricing in risks that others are overlooking?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lineage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lineage Narrative

If you see the numbers differently, or want to dig into the details yourself, you can build a personalised view in minutes using Do it your way.

A great starting point for your Lineage research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investable ideas?

Lineage might be compelling, but you may miss additional opportunities if you stop here. Let the Simply Wall Street Screener surface your next idea.

- Capture potential mispriced opportunities by scanning these 908 undervalued stocks based on cash flows that markets may be overlooking despite strong fundamentals and attractive cash flow profiles.

- Explore innovation by targeting these 26 AI penny stocks that are positioned to benefit from demand for automation, data intelligence, and next generation software solutions.

- Seek to enhance your income potential by focusing on these 13 dividend stocks with yields > 3% that combine regular payouts with balance sheets built to handle changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報