Camden Property Trust (CPT): Reassessing Valuation After Q3 Earnings Beat and Upgraded Funds From Operations Guidance

Camden Property Trust (CPT) just delivered an earnings update that cleared the bar, lifting its full year funds from operations guidance and prompting a fresh round of analyst opinion shifts across the REIT space.

See our latest analysis for Camden Property Trust.

Those stronger Q3 numbers and the recent dividend affirmation have not yet flipped the trend, with the year to date share price return still negative and the one year total shareholder return also in the red. This suggests sentiment is stabilising rather than surging.

If Camden’s steady REIT profile has you thinking about diversification, this could be a good moment to explore fast growing stocks with high insider ownership for more dynamic ideas with skin in the game.

With earnings beating expectations, guidance moving higher and the shares still down over the past year, investors face a key question: is Camden quietly undervalued here, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 11% Undervalued

With Camden Property Trust closing at $104.23 versus a narrative fair value near the mid teens, the gap reflects confidence in a multi year earnings rebuild.

Record high apartment demand, improving affordability (wages outpacing rent growth for 31 months), and strong resident retention due to high homeownership costs are strengthening Camden's occupancy and ability to grow revenues, laying the groundwork for outsized rent growth as supply moderates in 2026 and 2027.

Curious how steady top line growth, fatter margins, and a rich future earnings multiple all combine into that upside case? The full narrative reveals the exact roadmap.

Result: Fair Value of $116.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if Sun Belt demand cools or new apartment supply lingers longer than expected, Camden’s rent growth and margin expansion narrative could quickly lose momentum.

Find out about the key risks to this Camden Property Trust narrative.

Another View: Rich Multiples Cloud the Picture

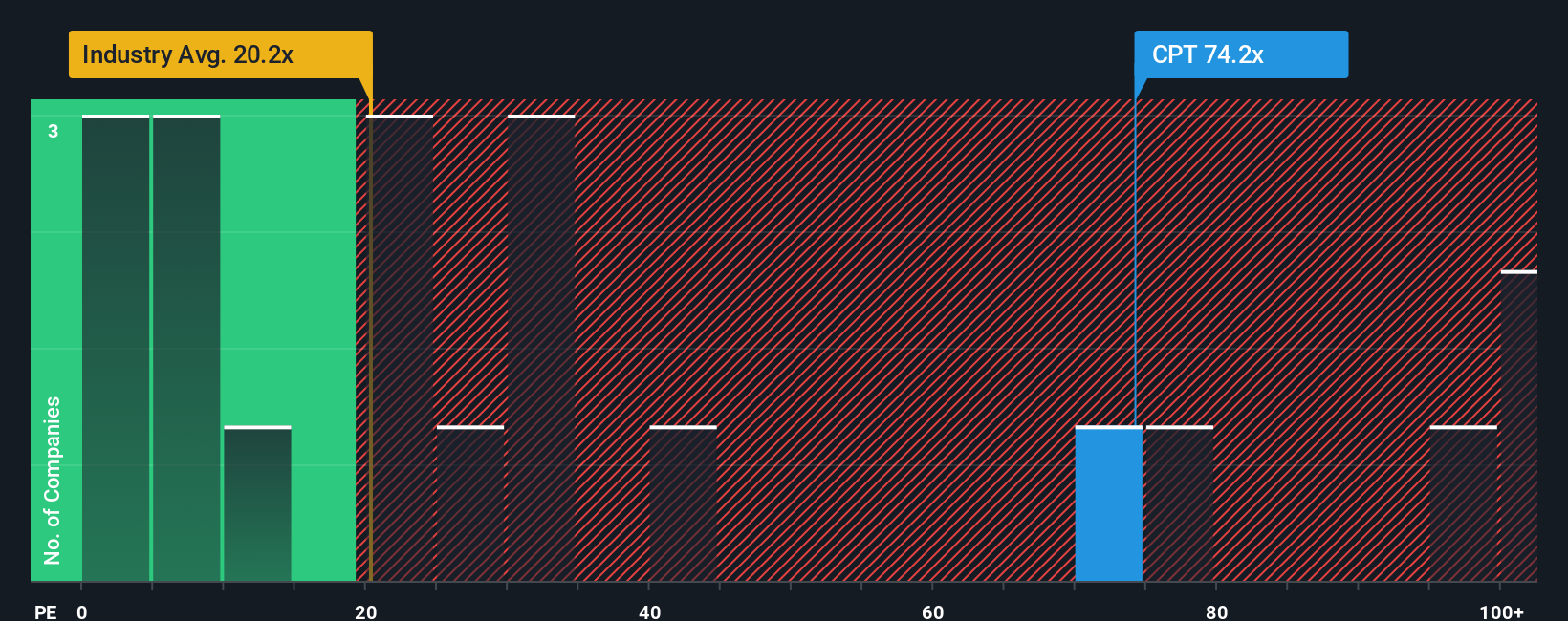

Step away from narratives and Camden looks pricey on simple valuation. Its price to earnings ratio sits at 41.3 times, well above Residential REIT peers at 24.9 times and a fair ratio of 24.5 times. This suggests limited margin for disappointment if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Camden Property Trust Narrative

If you see things differently or simply prefer to dive into the numbers yourself, you can spin up a custom narrative in just minutes: Do it your way.

A great starting point for your Camden Property Trust research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next opportunity by scanning targeted stock ideas built from real numbers, not hype, using the Simply Wall St Screener.

- Explore mispriced opportunities by reviewing these 908 undervalued stocks based on cash flows that the market may be overlooking despite strong underlying cash flows.

- Consider structural trends in medical innovation by assessing these 30 healthcare AI stocks that are transforming diagnostics, treatment, and patient outcomes.

- Review income-focused ideas by targeting these 13 dividend stocks with yields > 3% that may help strengthen your portfolio’s cash generation as rates and inflation change.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報