Sinopharm Group (SEHK:1099): Valuation Check After Renewing Shanghai Henlius Distribution Partnership

Sinopharm Group (SEHK:1099) is back in focus after Shanghai Henlius Biotech moved to renew their long running distribution framework, extending Sinopharm’s role in distributing Henlius products from 2026 through 2028.

See our latest analysis for Sinopharm Group.

The renewed Henlius deal lands while Sinopharm’s HK$20.36 share price has seen a modest 1 day share price return of 1.09% but a softer 30 day share price return of 4.77%, with a more reassuring 5 year total shareholder return of 32.69% suggesting that longer term momentum remains intact.

If this kind of healthcare partnership catches your eye, it could be worth scanning healthcare stocks to spot other names building solid positions in the sector.

With earnings still growing, a renewed Henlius pipeline relationship in place, and the share price trading below analyst targets, should investors see Sinopharm as undervalued? Or has the market already priced in its next leg of growth?

Price-to-Earnings of 8.1x: Is it justified?

Sinopharm’s last close at HK$20.36 equates to a price-to-earnings ratio of 8.1x, which screens as undervalued against both peers and the broader Hong Kong market.

The price-to-earnings multiple compares what investors are paying for each unit of current earnings, a key yardstick for large, established healthcare distributors where profits rather than assets or sales typically drive valuation.

At 8.1x earnings, the market appears to be pricing Sinopharm’s profit stream at a clear discount. Earnings are forecast to keep growing rather than shrink, which suggests investors may be underpaying for a steady, if unspectacular, growth profile.

The discount looks even starker when set against the Hong Kong Healthcare industry average of 12.3x, the wider market at 12.1x, and an estimated fair price-to-earnings ratio of 19.1x that the shares could theoretically gravitate toward if sentiment normalises.

Explore the SWS fair ratio for Sinopharm Group

Result: Price-to-Earnings of 8.1x (UNDERVALUED)

However, risks remain, including policy tightening on drug pricing and slower hospital procurement growth that could compress margins and delay any re-rating.

Find out about the key risks to this Sinopharm Group narrative.

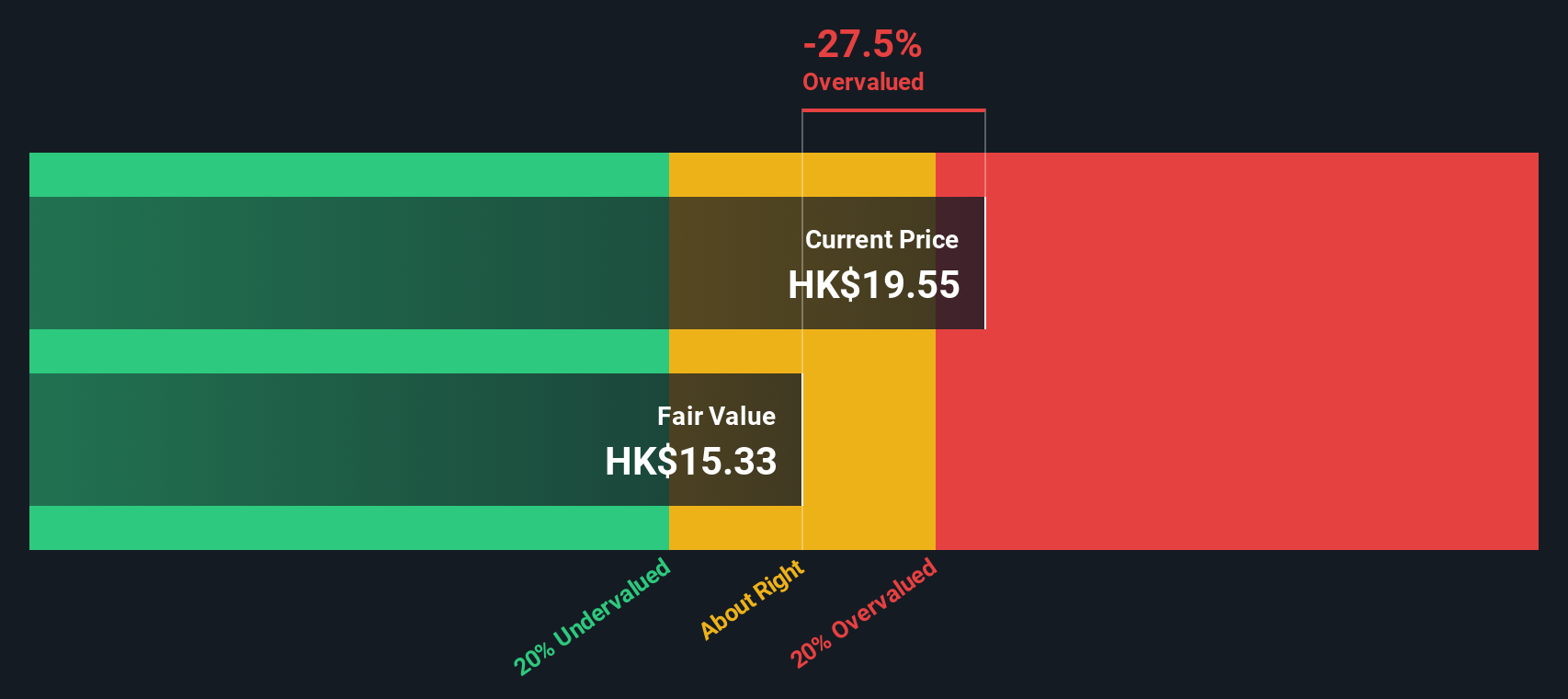

Another View: Our DCF Model Paints a Tougher Picture

While the 8.1x earnings multiple hints at value, our DCF model is more cautious and puts fair value closer to HK$15.36, which makes the current HK$20.36 price look overvalued. Is the market banking on steadier growth than the cash flows currently support?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sinopharm Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sinopharm Group Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a complete view in just minutes: Do it your way.

A great starting point for your Sinopharm Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in a few fresh opportunities by scanning targeted stock lists now so you are not chasing them after they break out.

- Capitalize on potential mispricing by reviewing these 908 undervalued stocks based on cash flows that may offer stronger upside relative to current market expectations.

- Position yourself for the next wave of disruption by assessing these 26 AI penny stocks harnessing artificial intelligence to transform entire industries.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that can help support more reliable long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報