RealReal (REAL) Valuation Check After Insider Sale and Ongoing Optimism Following Strong Q3 Results

RealReal (REAL) has been in the spotlight after Chief Accounting Officer Steve Ming Lo sold 62,355 shares, just as investors were still digesting upbeat Q3 results with record growth and improved profitability metrics.

See our latest analysis for RealReal.

At a share price of $14.34, RealReal’s recent 90 day share price return of 43.4 percent and 1 year total shareholder return of 63.14 percent suggest momentum is still building off the upbeat Q3 narrative, even as insider selling injects a note of caution.

If this kind of recovery story has your attention, it could be worth broadening your search and exploring fast growing stocks with high insider ownership next.

With shares now hovering just below consensus targets after a rapid rebound and profitability still a work in progress, the key question is simple: Is RealReal a mispriced turnaround, or is the market already banking on future growth?

Most Popular Narrative: 5.2% Undervalued

With RealReal last closing at $14.34 versus a most popular narrative fair value of $15.13, the story leans toward modest upside grounded in steady progress.

The analysts have a consensus price target of $10.0 for RealReal based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $8.0.

Curious how a business still in loss territory can justify a richer future earnings multiple than many mature retailers? The narrative leans on compounding revenue, margin catch up and a bold profitability bridge that could reshape how investors frame this resale platform’s ceiling.

Result: Fair Value of $15.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slower ramp in AI driven efficiencies or weaker luxury resale supply could quickly challenge assumptions about sustained margin expansion and revenue growth.

Find out about the key risks to this RealReal narrative.

Another Angle on Valuation

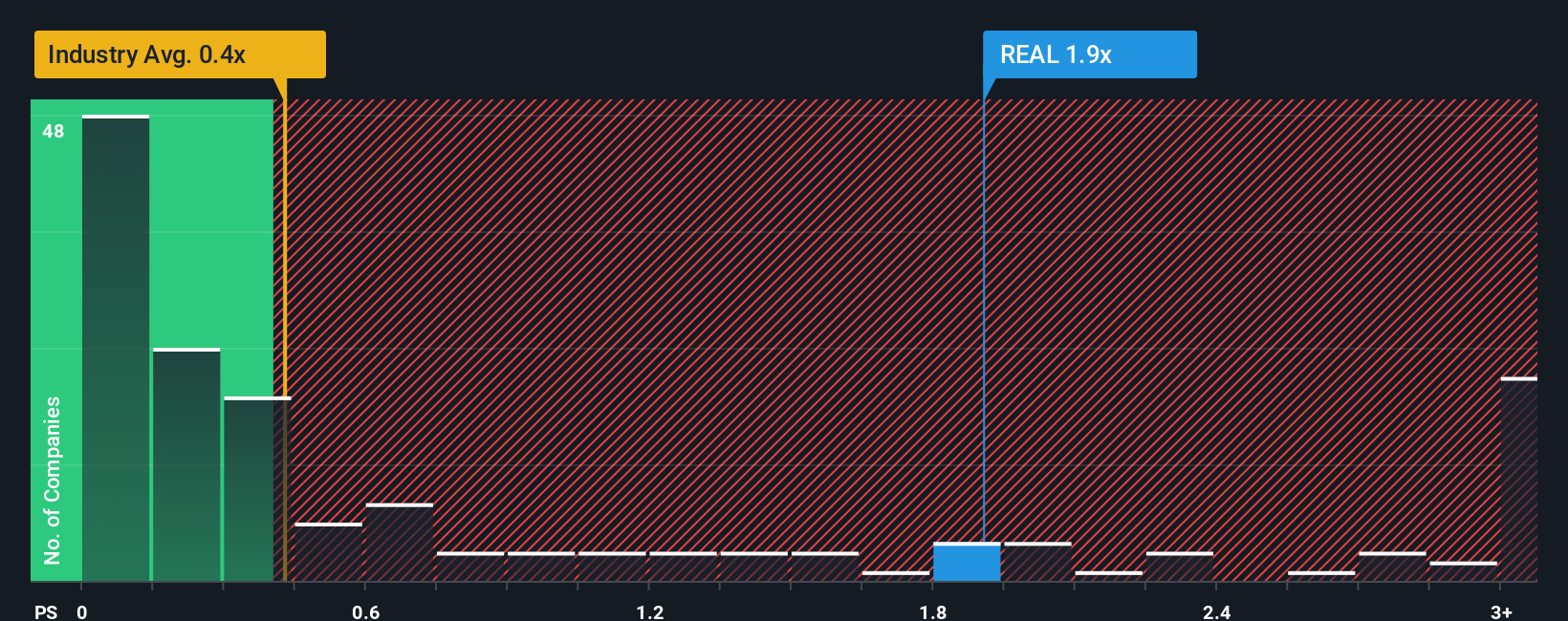

While the narrative fair value points to modest upside, our look at the price to sales ratio paints a tougher picture. At 2.5 times sales, RealReal trades well above the US Specialty Retail average of 0.5 times and peer average of 2 times, and even above its own fair ratio of 1.7 times. This suggests valuation risk if growth or margin gains slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RealReal Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in minutes with Do it your way.

A great starting point for your RealReal research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before momentum moves elsewhere, use the Simply Wall Street Screener to uncover fresh opportunities aligned with your strategy, instead of waiting for the next headline.

- Capture early growth by targeting these 26 AI penny stocks positioned at the heart of rapid advances in automation, machine learning, and data driven business models.

- Lock in dependable cash flow potential through these 13 dividend stocks with yields > 3% that may support income focused portfolios even when markets stay volatile.

- Ride structural shifts in finance by reviewing these 80 cryptocurrency and blockchain stocks shaping payments, digital assets, and blockchain infrastructure worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報