Is Mitsubishi Electric (TSE:6503) Quietly Redefining Its AI and Sustainability Edge With Recent Innovations?

- In recent days, Mitsubishi Electric announced a physics-embedded AI for equipment degradation, microbubble-driven microchannel cooling technology, and new high-isolation HVIGBT power modules, while also earning CDP’s top “A List” rankings for Climate Change and Water Security.

- Together, these innovations and ESG accolades highlight Mitsubishi Electric’s push to fuse advanced AI, power electronics, and sustainability to support industrial reliability, decarbonization, and lifecycle cost reductions.

- Next, we’ll examine how Mitsubishi Electric’s physics-embedded AI for predictive maintenance could reshape its broader investment narrative and long-term positioning.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Mitsubishi Electric Investment Narrative Recap

To own Mitsubishi Electric, you need to believe it can translate its hardware, power electronics and factory automation strengths into higher value digital and AI-enabled solutions, while managing rising competition and cyclical end markets. The latest AI, cooling and HVIGBT announcements support its innovation story but do not materially change the near term focus on execution in digital transformation or the pricing pressure risk from lower cost Asian rivals.

The new physics embedded AI for equipment degradation is especially relevant, as it directly addresses the shift toward AI driven automation in factories. If Mitsubishi Electric can embed this capability into its existing installed base and service offerings, it could help defend margins in factory automation and counter some concerns about demand moving away from traditional hardware.

Yet, against this backdrop, investors should be aware that growing AI automation could just as easily intensify competitive pressures and...

Read the full narrative on Mitsubishi Electric (it's free!)

Mitsubishi Electric’s narrative projects ¥6,044.2 billion revenue and ¥423.4 billion earnings by 2028. This requires 2.9% yearly revenue growth and about a ¥57.5 billion earnings increase from ¥365.9 billion today.

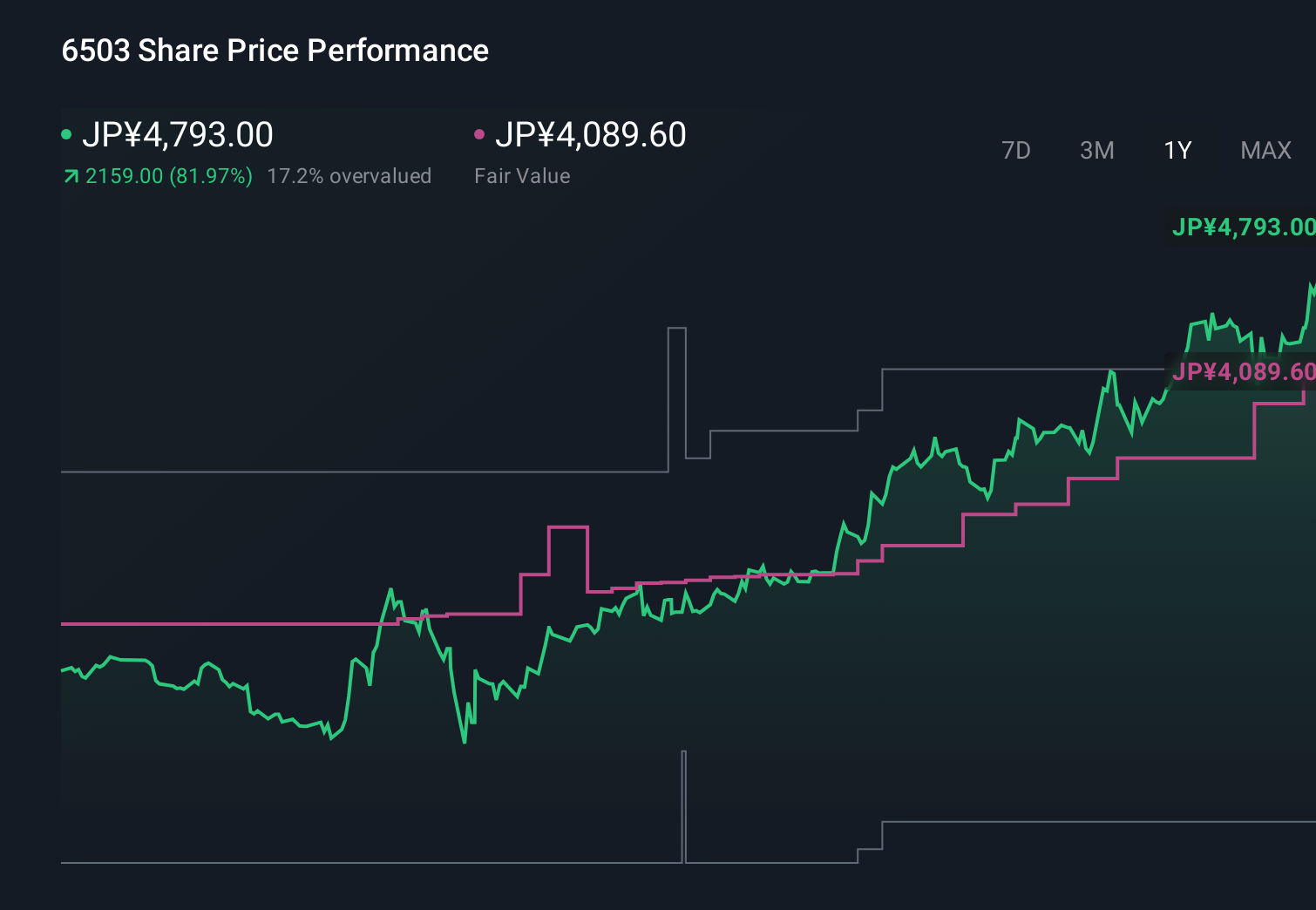

Uncover how Mitsubishi Electric's forecasts yield a ¥4090 fair value, a 15% downside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span roughly ¥2,114 to ¥4,090, underlining how far apart individual views on Mitsubishi Electric can sit. Set against this spread, the company’s push into physics based AI for predictive maintenance raises important questions about whether it can truly offset hardware margin pressure and support more resilient long term earnings growth.

Explore 4 other fair value estimates on Mitsubishi Electric - why the stock might be worth less than half the current price!

Build Your Own Mitsubishi Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsubishi Electric research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Mitsubishi Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsubishi Electric's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報