3SBio (SEHK:1530): Reassessing Valuation After Share Placement and Hair-Loss Business Spin-Off

3SBio (SEHK:1530) has just raised about HK$3.1 billion through a follow on share offering, while spinning off its hair loss business. This double move sharpens its focus on next generation drugs.

See our latest analysis for 3SBio.

Despite a choppy few weeks, with a 30 day share price return of minus 19.08 percent and some volatility around the placement news, 3SBio still boasts a powerful long term total shareholder return profile. This suggests momentum has cooled in the near term, but the broader thesis remains very much intact.

If this capital raise has you thinking about where the next healthcare winner might come from, it could be worth exploring healthcare stocks as a way to spot other potential compounders in the sector.

With the stock trading at a sizeable discount to analyst targets despite modest long term gains and profits under pressure, is 3SBio quietly undervalued after its strategic reset, or are investors already pricing in its next wave of growth?

Price-to-Earnings of 26.7x: Is it justified?

Based on our DCF work, 3SBio looks meaningfully undervalued, trading at HK$27.82 versus an estimated fair value of about HK$43.18.

Our DCF model projects the company’s future cash flows and discounts them back to today, using assumptions about growth, profitability and required returns. For a profitable biotech with established products and positive earnings momentum, this framework helps look past short term noise and focus on long term cash generation.

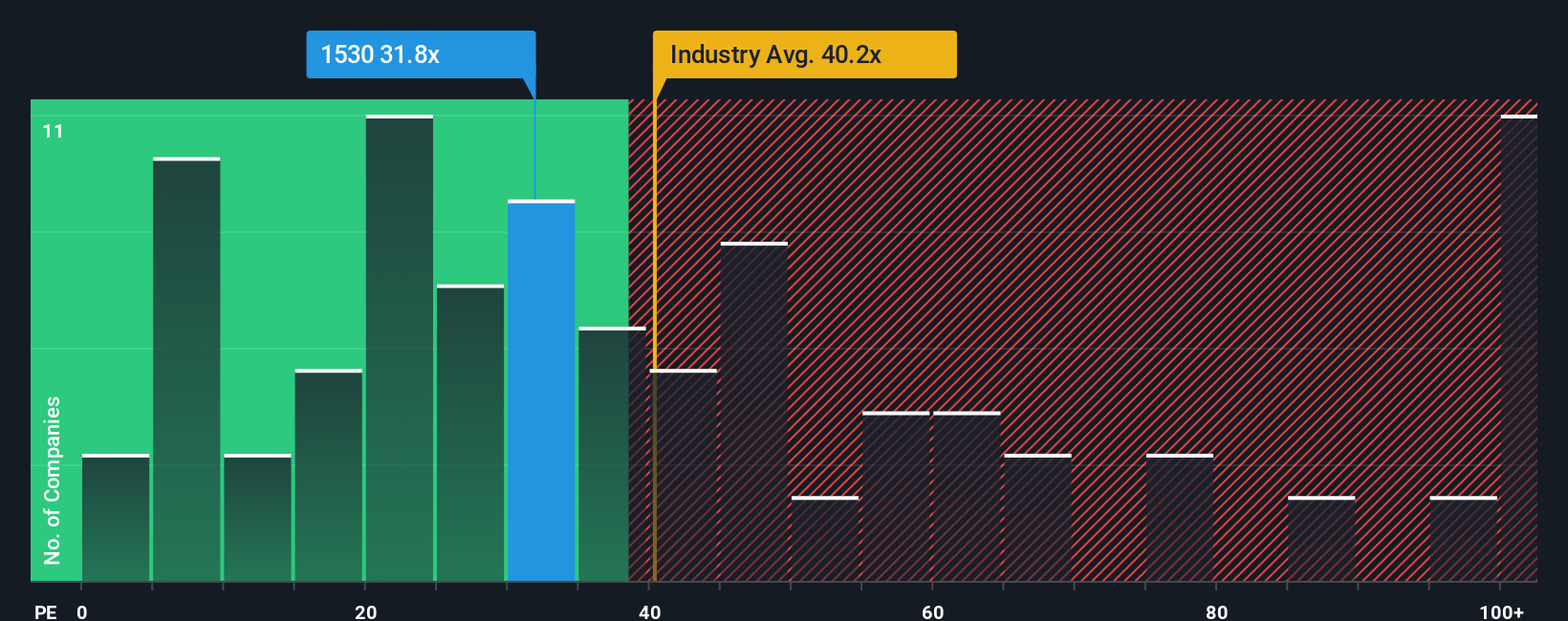

The current price to earnings ratio of 26.7 times sits well below both the sector and peer averages, which hints that the market may be underpricing 3SBio’s earnings power. Even so, it trades above an estimated fair price to earnings ratio of 19.7 times. This is a level the market could gravitate towards if sentiment normalises and expectations reset.

Compared with other Asian biotech names on roughly 38.7 times earnings and its own peer group on about 64.1 times, 3SBio’s multiple looks materially lower. This suggests investors are applying a noticeable discount despite recent profit growth and margin improvement.

Explore the SWS fair ratio for 3SBio

Result: Price-to-Earnings of 26.7x (UNDERVALUED)

However, sustained revenue softness and double digit profit declines, alongside biotech sector volatility, could quickly erode that apparent valuation discount.

Find out about the key risks to this 3SBio narrative.

Another View on Valuation

On the flip side, the fair ratio suggests 3SBio looks expensive at 26.7 times earnings versus a fair ratio of 19.7 times. In practice, that means today’s discount to peers could narrow very quickly if sentiment turns, leaving less margin for error than it first appears.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out 3SBio for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own 3SBio Narrative

If you see the numbers differently or want to dig into the details yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your 3SBio research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunities by putting the Simply Wall Street Screener to work so you do not miss tomorrow’s standouts.

- Target steady cash returns by using these 13 dividend stocks with yields > 3% to uncover companies that pay meaningful income while still leaving room for capital growth.

- Position yourself for the next wave of innovation by scanning these 26 AI penny stocks and zeroing in on businesses building real products, not just hype.

- Capitalize on market mispricing with these 908 undervalued stocks based on cash flows, filtering for quality companies whose cash flows suggest far more upside than their current share prices reflect.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報