Live Nation (LYV): Valuation Check as It Expands Global Footprint with Thailand’s Impact Arena Deal

Live Nation Entertainment (LYV) is extending its global footprint by taking over operations of Thailand's Impact Arena, committing to modernize the venue and deepen its presence in Asia's fast growing live entertainment market.

See our latest analysis for Live Nation Entertainment.

The Impact Arena deal lands at a time when sentiment around Live Nation is steady rather than euphoric. The share price is at $143.14, with a solid year to date share price return of 10.76 percent but a softer 90 day share price return of negative 16.96 percent. The three year total shareholder return of 106.34 percent shows that, over a longer horizon, investors who stayed on board have still been well rewarded, and current momentum looks more like a consolidation phase than a trend break.

If this kind of expansion story has you thinking more broadly about the live events and entertainment space, it could be a good moment to scan fast growing stocks with high insider ownership as potential next candidates for your watchlist.

With growth steady but not spectacular, and the share price sitting below analyst targets yet close to estimated intrinsic value, is Live Nation quietly undervalued here, or is the market already factoring in its next leg of expansion?

Most Popular Narrative Narrative: 15.3% Undervalued

With Live Nation closing at $143.14 against a narrative fair value near $169, the gap reflects bold expectations for multi year earnings expansion.

Increased adoption of advanced ticketing technologies (dynamic pricing, platform upgrades, and AI driven operational efficiency) enables improved yield management and cost structure for Ticketmaster, which should support ongoing net margin improvement and better earnings conversion.

To see the assumptions behind this valuation, the growth story leans on accelerating earnings, slowly rising margins, and a future multiple that assumes serious staying power.

Result: Fair Value of $169.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory scrutiny and potential ticketing reforms could pressure margins and constrain growth expectations, which may challenge the underappreciated expansion story underpinning this valuation.

Find out about the key risks to this Live Nation Entertainment narrative.

Another View: Rich on Earnings

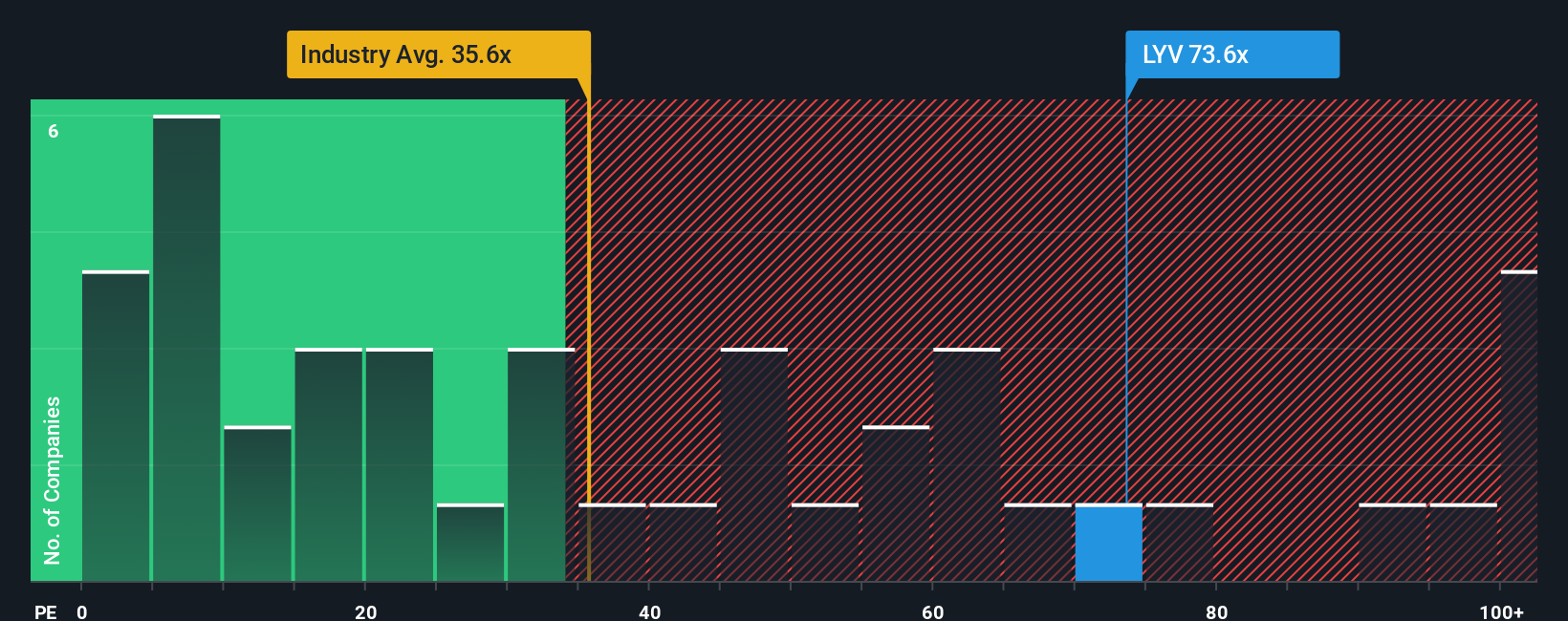

Viewed through earnings, Live Nation looks far less cheap. Its current P/E of 103.2 times dwarfs both the US Entertainment industry at 20.3 times and peers at 59.1 times. It also sits well above a fair ratio of 37.4 times, raising the risk of a painful de rating if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Live Nation Entertainment Narrative

If you see things differently or prefer to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Live Nation Entertainment research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself the edge by scanning focused stock lists built from hard data, not hype, so you never miss your next opportunity.

- Capture potential mispricings by reviewing these 908 undervalued stocks based on cash flows where current market pessimism may not reflect long term cash flow strength.

- Capitalize on innovation tailwinds by targeting these 26 AI penny stocks that could benefit most as artificial intelligence moves from concept to real earnings power.

- Lock in reliable income streams by evaluating these 13 dividend stocks with yields > 3% that aim to balance yield with sustainable payout ratios and resilient cash generation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報