Holcim (SWX:HOLN) Valuation Check After CDP A-List Recognition and Deutsche Bank ‘Top Pick’ Call

Holcim (SWX:HOLN) is back in the spotlight after landing yet another spot on CDP’s A List for climate and water, while also being tagged a top pick by Deutsche Bank.

See our latest analysis for Holcim.

Against that backdrop, Holcim’s 9.73% 90 day share price return and 70.34% one year total shareholder return suggest momentum is building again, even after a weaker year to date share price.

If Holcim’s circular construction push has you thinking about the broader opportunity set, this could be a smart moment to explore fast growing stocks with high insider ownership.

Yet despite the accolades and a soaring multi year return, the shares now trade close to analyst fair value, raising the key question for investors: Is this a fresh buying opportunity, or is future growth already priced in?

Most Popular Narrative: 1% Overvalued

With Holcim closing at CHF 75.54 against a narrative fair value of about CHF 74.92, expectations sit finely balanced around today’s price.

Sustained investments and leadership in decarbonization, circular construction, and innovation (including net-zero cement initiatives and supplementary cementitious materials) position Holcim ahead of industry regulatory trends. This enables the company to secure new revenue streams, access premium markets, and defend margins amid tightening climate rules.

Curious how a shrinking top line can still support richer profit margins and a higher future earnings multiple than today? Want to see the full playbook behind that balancing act? Read on to uncover the assumptions powering this fair value call.

Result: Fair Value of $74.92 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer construction demand or integration hiccups from Holcim’s recycling and solutions acquisitions could quickly puncture the margin and valuation story presented here.

Find out about the key risks to this Holcim narrative.

Another Angle on Value

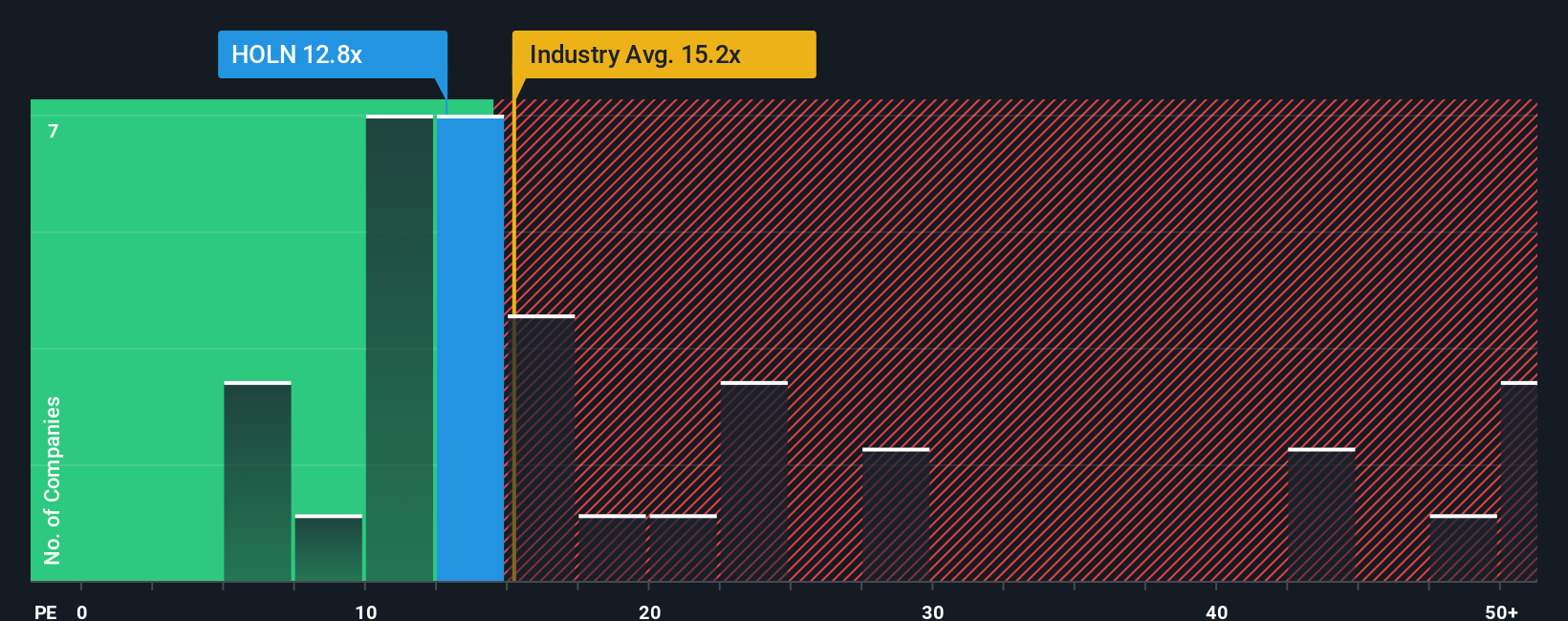

While the narrative fair value puts Holcim roughly in line with today’s price, its 12.9x earnings multiple looks modest beside a 17.3x fair ratio, 15.7x for the European Basic Materials group, and 25.3x for peers. Is the market mispricing risk, or overlooking a margin story in transition?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Holcim Narrative

If you would rather challenge these assumptions or dig into the numbers yourself, you can craft a personalized view in minutes with Do it your way.

A great starting point for your Holcim research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

If you stop with Holcim, you could miss other powerful setups. Use the Simply Wall St Screener to uncover your next edge before the crowd.

- Capture potential price gaps by targeting mispriced cash generators with these 908 undervalued stocks based on cash flows that screen for strong fundamentals against discounted valuations.

- Ride structural growth trends by scanning these 30 healthcare AI stocks focused on companies using AI to transform diagnostics, treatment pathways, and healthcare efficiency.

- Turn volatility into opportunity by reviewing these 80 cryptocurrency and blockchain stocks where listed businesses are building real world value around digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報